Oil and Energy Again

–

It’s been a busy few days. I have been busy with work and other family commitments. But I have been actively trading. I just haven’t had time to write articles but I did post my recommendations for a few Stocks that made Awesome gains on a private WhatsApp group.

As part of investing the key concept to remember is to be disciplined, Cut your losses early, learn every day and give small incentives to yourself and the family if you make good gains.

I had a good month of investing الحمدلله and wanted to reward myself and the family so I recently took a trip to Calgary to visit some family members and also visited some Ice glaciers, Beautiful lakes, and national parks. I am grateful for their hospitality and I am humbled by the beautiful creations of our lord on this planet. It’s breathtaking

Most of our picks from last month made good gains.

Specially SBLK, EQT, and AMR, and I sold them on Profits and so did some of the members of the group.

I was a little disappointed that I did not hold on to EQT. When I alerted it on the what’s Up Group it was at 43.52 And that is when I entered the stocks. I sold them a few days later for 44.52. Still made profits. But now the same stock is 48.43. Kinda lost out on big gains but إن شاء الله we will get plenty of more opportunities. But remember the market rewards the disciplined. I had a specific profit target for this stock and I got my worth. Now we move on to the next.

I also traded RBLX for a good 8% profit last week. It was just too oversold. And I knew that It was a good stock for Swing. ROBLOX in my opinion is a 100 Dollars stock I have them in my 401k Portfolio. I traded AMR for a quick 6% Swing. I missed trading MRK when it was about to break out even though I alerted it on the group.

If you need access to this group (It’s Free by the way) Send me an email at halalfinanceinvesting@gmail.com. I will send you a link.

Collectively now most of the picks recommended have made gains for us since we started trading together on this website.

Namely, CRK, NFE, GOGL, and MNRL ( All hit 52 weeks high ) And generated about 10-15 % Profits from the time I recommend on my website.

I spent some time tracking the positions. I sold them early because I need capital for swing trades but if you had bought them when I alerted on this site and sold them at peak. This is how much you would have gained.

$CVE ➡️ $18.12 ➡️ $24.20 💸 33% gain! 📈

$MNRL ➡️ $26.43 ➡️ $32.58 💸 23% gain! 📈

$MPLX ➡️ $33.83 ➡️ $35.58 💸 5% gain! 📈

$MTDR ➡️ $54.99 ➡️ $64.17 💸 16.69% gain! 📈

$NFE ➡️ $41.96 ➡️ $49.60 💸 18.21% gain! 📈

$GOGL ➡️ $12.52 ➡️ $16.43 💸 31.23% gain! 📈

$SSRM ➡️ $20.21 ➡️ $23.67 💸 17% gain! 📈

$EQT ➡️ $43.52 ➡️ $ 48.43 💸 11.28% gain! 📈. ( Alerted on Whatsup App)

$SBLK ➡️ $29.99 ➡️ $33.84💸 12.84% gain! 📈 ( Alerted on Whatsup App)

$AMR ➡️ $147.49 ➡️ $181.62 💸 23% gain! 📈 ( Alerted on Whatsup App)

$RBLX ➡️ $29.72 ➡️ $33.95 💸 14.23% gain! 📈 ( Alerted on Whatsup App)

$MRK ➡️ $89. 42 ➡️ $94.78 💸 5.99% gain! 📈 ( Alerted on Whatsup App)

Come back to OIL and Energy stock :

I wrote comprehensively about MidStream energy players. Here is the link to the article https://www.halalfinanceinvesting.com/good-stocks-to-buy-energy-mplx/

So I will be taking a position in another Midstream energy company ( I already have some positions).

AM –Antero Midstream Corp

Antero Midstream Corp is a midstream company that owns, operates, and develops midstream energy infrastructure services and production activity in the Appalachian Basin’s Marcellus Shale and Utica Shale located in West Virginia and Ohio. Its assets consist of gathering pipelines, compressor stations, interests in processing and fractionation plants, and water handling and treatment assets. The company, through its wholly-owned subsidiary Antero Midstream Partners and its affiliates, provides midstream services to Antero Resources Corp under long-term contracts

So why are we bullish on AM?

-

Cash flow performance saw a solid start to 2022 with its operating cash flow climbing to $184.7m during the first quarter versus its previous result of $165.7m during the first quarter of 2021, thereby representing a solid increase of 11.44% year-on-year.

-

The Russia-Ukraine war and its resulting sanctions against the former represent a seismic shift in the global gas market that stands to benefit United States-based producers.

- OIL and Gas have still some legs to run before we see a downtrend.

Fundamental Analysis

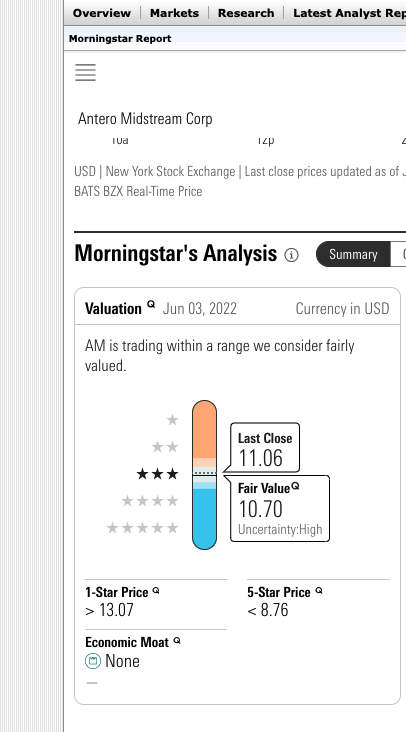

Morning Star Rating :

I ran the Stock in Morning Star and the Fair value evaluation came below the current price. But I believe that the stock will move in the coming months.

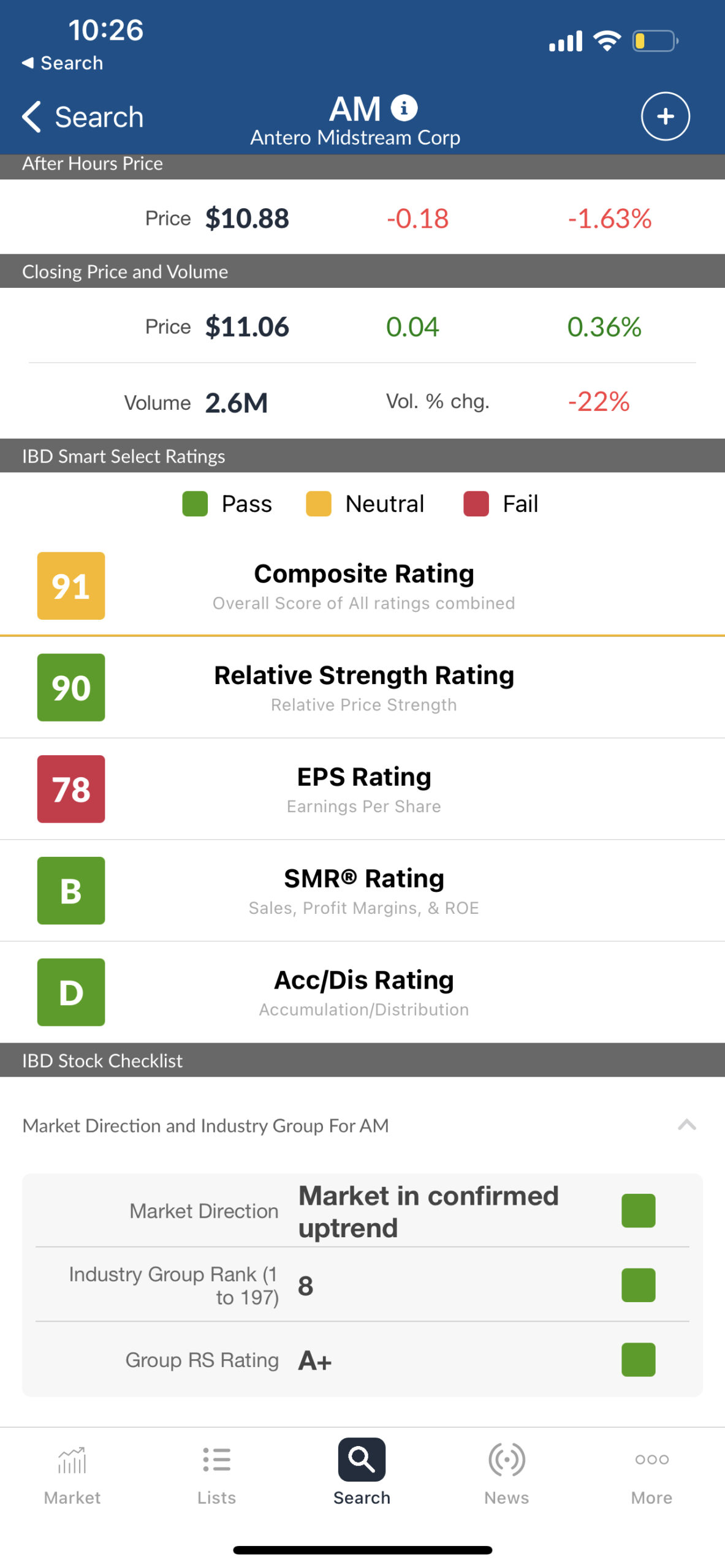

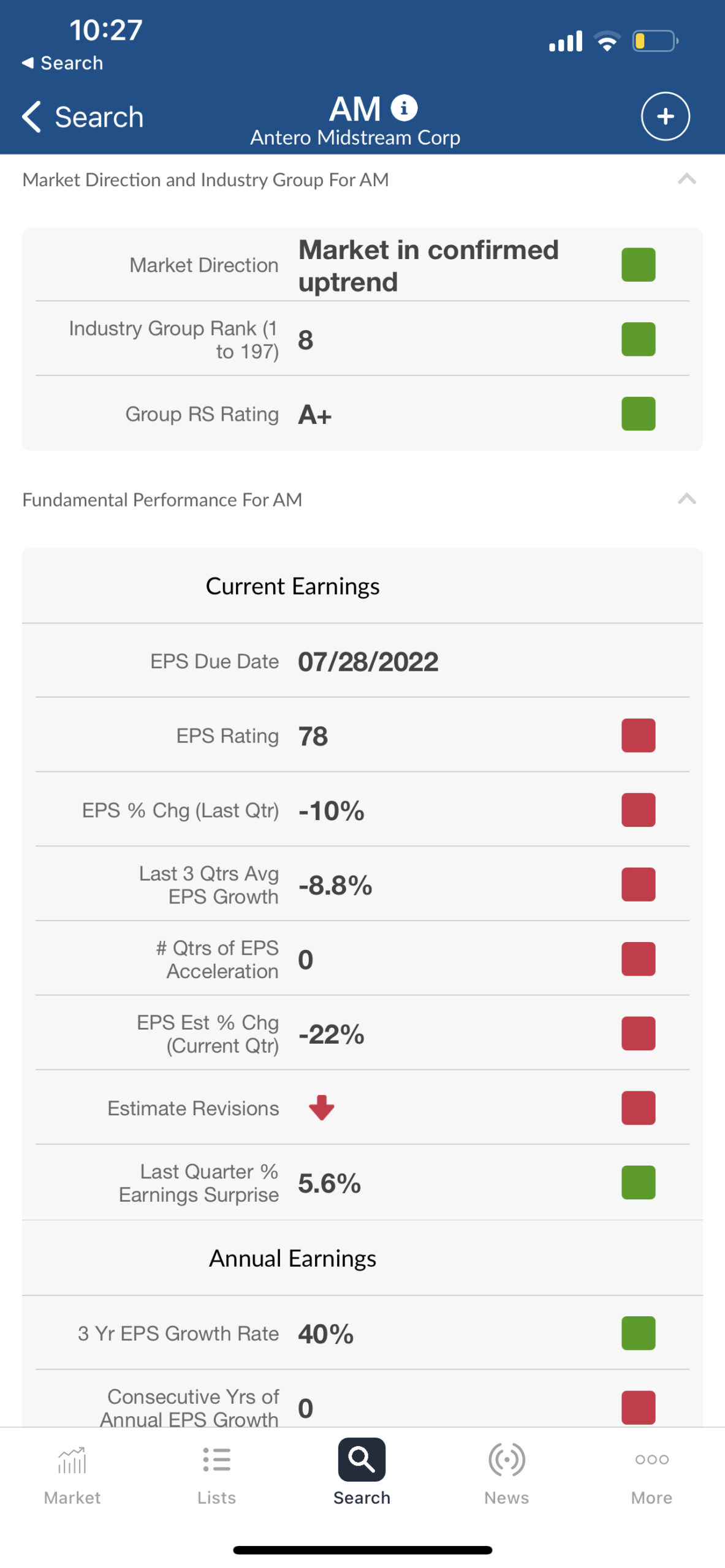

IBD Rating :

I ran the stock in IBD to check its Ratings. Currently, the stock is ranked number 20 in that specific industry group. (EQT is number one and we already are into this stock) . The composite rating is around 91 Highly impressive. EPS ( Earnings per share ) is lagging. But I believe that numbers should improve in the next few months. I am planning to hold this stock for a few months at least.

EPS

Technical Analysis

Current chart :

My chart Analysis

I did a quick One Day chart analysis.

A support zone ranges from 9.54 to 9.84.

A resistance zone ranges from 11.45 to 11.69.

My SL (Stop Loss) is around $ 9.50. I will maintain the Strict SL for most of my stocks.

As usual, my target is to get 10-15% profits on this swing.

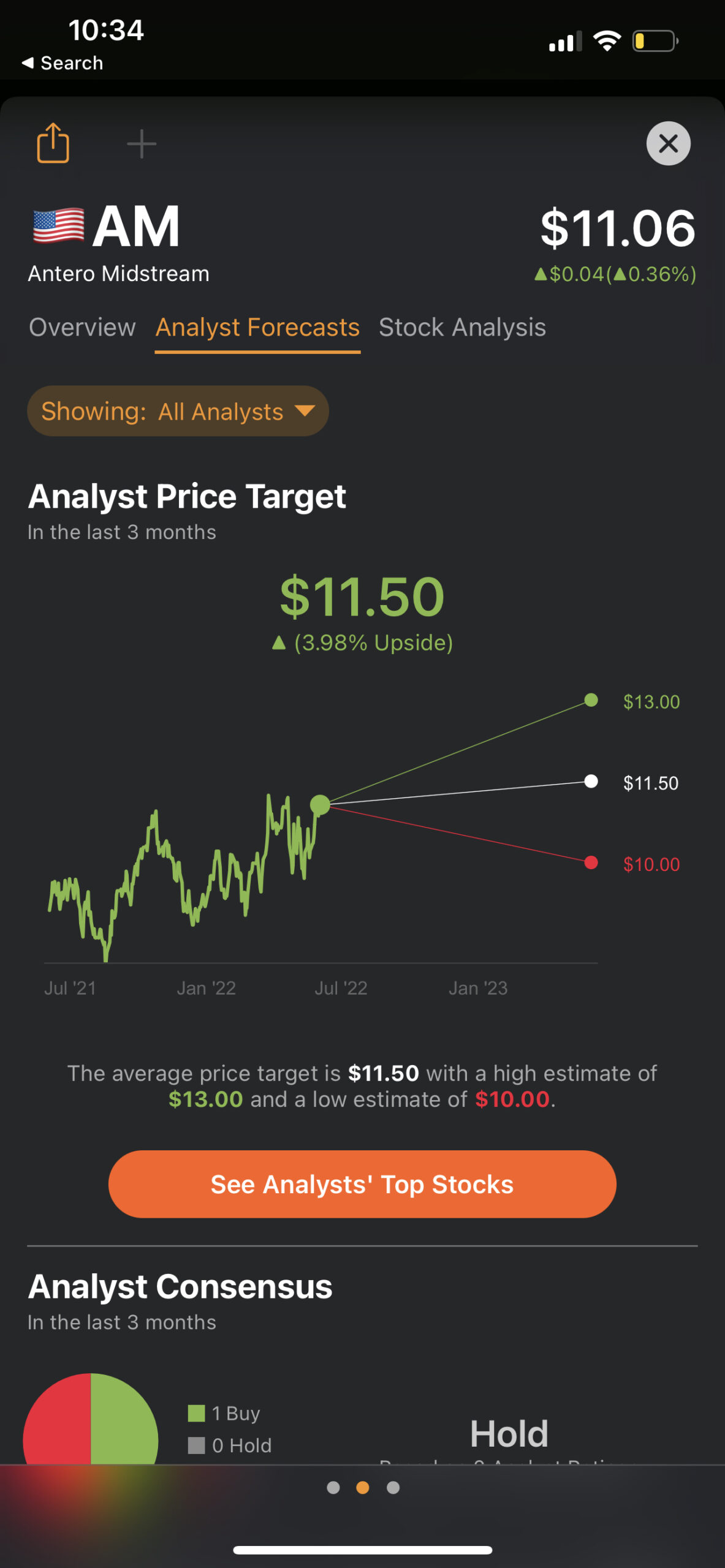

Analyst Rating :

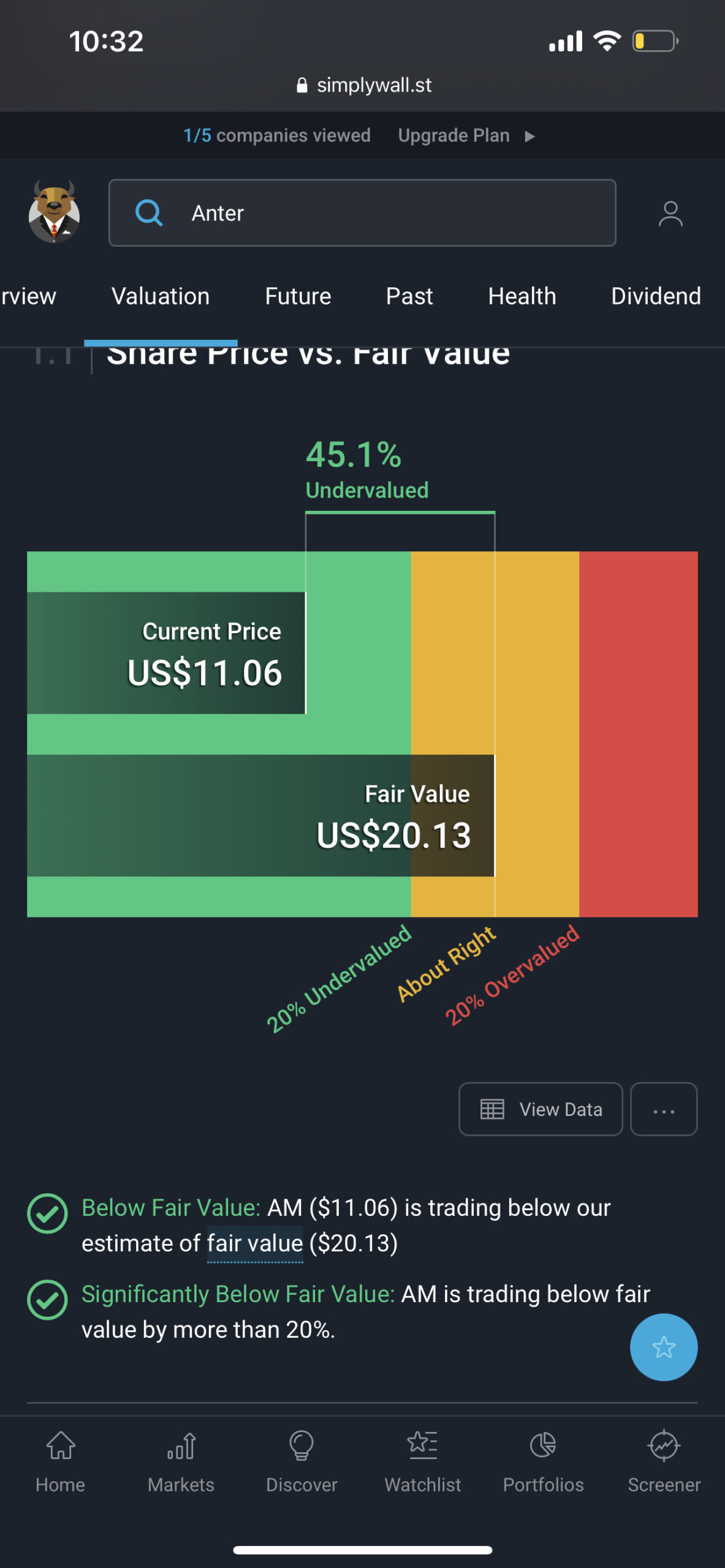

Simply wall St Rating :

I ran the stock on Simply wall St RANKS. And the suggested pricing upside is around $20.13 and it is currently 45% undervalued.

Tip Ranks Rating :

I ran the stock on Tip ranks and the suggested pricing upside is around $13 with about 4 % upside.

Zacks Rating :

Zacks’s Rating currently has a Hold rating.

Disclosure: At the time of writing I have a small position in AM stock. I have plans to initiate new positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. I am not a financial adviser. Please do your own due diligence.