5G –

If you had invested just $5,000 at that price to pick up 5,000 shares of Netflix around 2002 that modest investment would now be worth more than $2.6 million – a mind-numbing return of more than 50,000%! But before that happened did you know that Reed Hastings the founder of Neflix went to BlockBuster and asked them to purchase his model ( Allow people to rent movies through mail). The executives at blockbusters laughed him out of the executive room.

BlockBusters valuation around that time was close to $4b billion dollars. Reed Hastings was wanting to sell Netflix for $50 Million dollars. In less that 10 years, Blockbusters valuation was “$0”

The moral of the story is that we are at the phase where technology and creative ideas every year are leading to reshape entire industries (UBER , AIRBNB, TSLA).

As Uber soared to a $1 billion valuation, the old taxi industry was crushed.

As Apple’s iPhone dominated the smartphone market, the losing competitor, BlackBerry Ltd. (BB), saw its share price plummet more than 90%.

We want to be on the right side of this technological advancement to ride the wave. We need to be with companies that have exponential progress.

The destruction of seemingly strong and dominant businesses by innovative technology-focused upstarts is a story we are starting to see over and over and over in America…

In order to capture some of the stock market’s biggest investment gains over the next few years, focus only on the fastest-growing, most disruptive companies.Companies that fail to adapt die a slow but certain death.

So what is the next fastest growing and disruptive sector ?

5G – 10,000 times faster than 4g LTE

Every technological advancements in future will require 5G

- EV

- Healthcare

- IOT ( Internet of things)

It is just not about faster download speeds there is more to 5g than what catches the eye.

A few years ago Chinese company Huawei was a leading horse in the race to deploy 5G technology worldwide. It still is but the US government distrusts Huawei because of their alleged spying activities on behalf of Chinese government. Europe followed suit and so did other overseas governments. While Huawei is losing contracts This company is gaining it.

So I decided to take a small stake ( I will keep adding) in the company that I believe will have a major role to play in this disruptions. (This will also go in my black box investments)

ERIC – Telefonaktiebolaget LM Ericsson (publ)

together with its subsidiaries, provides communication infrastructure, services, and software solutions to the telecom and other sectors. It operates through four segments: Networks, Digital Services, Managed Services, and Emerging Business and Other. The Networks segment offers radio access network solutions for various network spectrum bands, including integrated high-performing hardware and software. This segment also provides integrated antenna and transport solutions; and a range of service portfolio covering network deployment and support. The Digital Services segment offers software-based solutions for business support systems, operational support systems, communication services, core networks, and cloud infrastructure. The Managed Services segment provides networks and IT managed, network design and optimization, and application development and maintenance services to telecom operators. The Emerging Business and Other segment includes emerging businesses comprising Internet of Things; iconectiv; Cradlepoint that offers wireless edge WAN 4G and 5G enterprise solutions; and Red Bee Media, MediaKind, and other new businesses. It operates in North America, Europe and Latin America, the Middle East and Africa, South East Asia, Oceania, India, North East Asia, and internationally. Telefonaktiebolaget LM Ericsson (publ) was founded in 1876 and is headquartered in Stockholm, Sweden.

So why are we bullish on ERIC ?

- Ericsson is in the right place at the right time… with the right products. It is a 5G powerhouse that provides a broad range of 5G hardware, solutions, and services.

- It powers more than half of the 169 live 5G networks worldwide.

- The revenue is increasing and earnings are excellent. the company recently announced its largest-ever contract – an $8.3 billion agreement with Verizon to provide 5G solutions that enable the telecom giant to roll out its next-generation wireless network.

- The EPS could easily grow to $1 by next year.

Fundamental Analysis

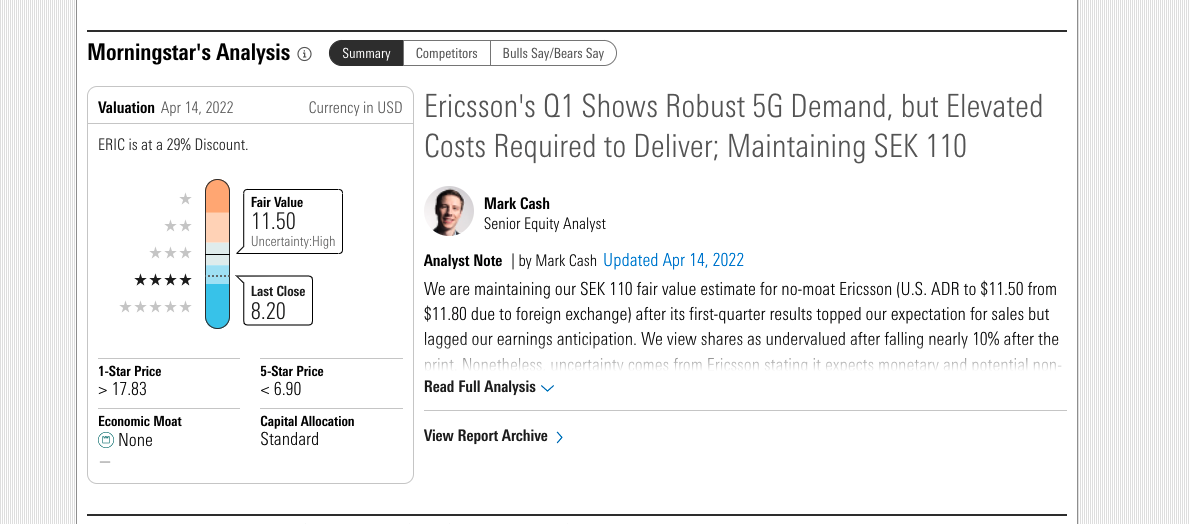

Morning Star Rating :

I ran the Stock in Morning Star, The Fair value evaluation came up greater than the current price.

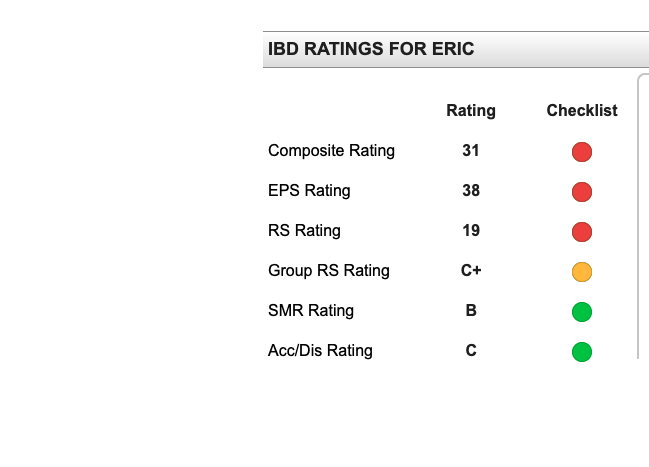

IBD Rating :

I ran the stock in IBD to check its Ratings. Not very impressive but those numbers should start improving in the next few years.

Technical Analysis

Current Chart

Support and resistance

N/A

Analyst Rating :

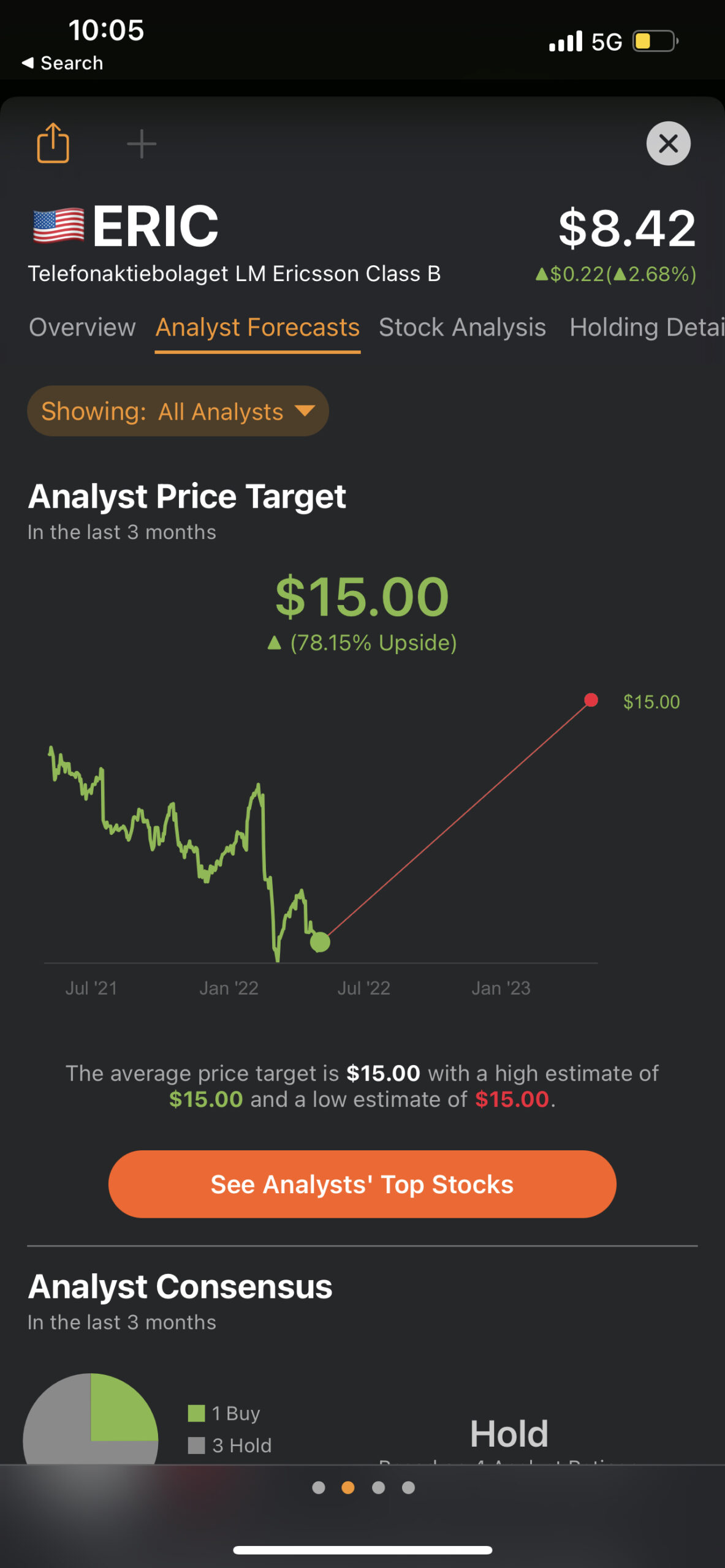

Tip rank Rating :

I ran the stock on Tip RANKS. The most conservative upside is at $ 15.00 at 78 % return on investment. We will hold this stock for 5 years. So my advise is to not sell when it hits $ 15.

Zacks Rating :

Zacks Rating :

N/A

Disclosure: At the time of writing I hold a position in ERIC stock. I have no plans to initiate any new positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. I am not a financial adviser. Please do your own due diligence.