Social

media is the new norm. Whether we like it or not our smartphones are a gateway to the outside world.

Social media is an internet-based form of communication. Social media platforms allow users to have conversations, share information, and create web content.

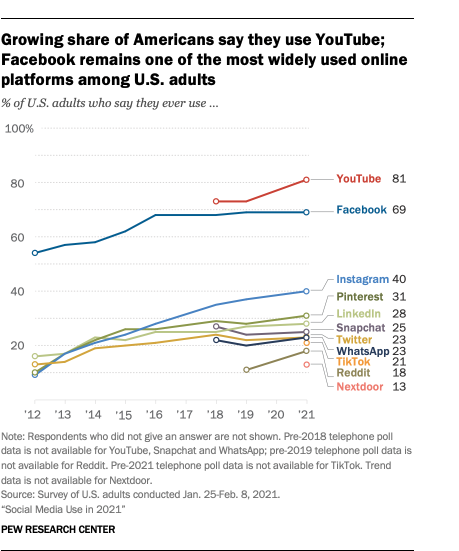

Look at the chart below of the percentage of users for Social media.

YouTube and Facebook continue to dominate the online landscape, with 81% and 69%, respectively, reporting ever using these sites. And YouTube and Reddit were the only two platforms measured that saw statistically significant growth since 2019.

So in reality majority of the users from across the world are directly or indirectly using some kind of social platform in their day-to-day lives.

So we decided to deep dive into one company that is not doing so well. But still is in a good reward to risk Ratio category.

This company does not need an introduction.

FB- Meta Platforms, Inc.

The company is currently trading at close to -25% discounts from the highs of last years And close to -34% discounts from the highs of the last six months.

So what went wrong with FaceBook?

- Meta Platforms’ Q4 2021 diluted earnings per share of $3.67 as disclosed in its financial results media release came in -4% below the Wall Street analysts’ consensus bottom-line forecast of $3.82 per share. ( Not that bad really if you ask my opinion).

- Its operating metric Daily active users (DAUs) declined from 1,930 million in the third quarter of 2021 to 1,929 million in the most recent quarter. ( 1 million less) But the actually predicted DAUs were supposed to be 1,950 million.

- So in summary the Meta platforms disappointed the markets on their two key metrics, Financial (Earnings per share) and operating (DAU).

- Apple IOS privacy changes might have also contributed to their earnings ( ad targetings).

So why are we bullish on FaceBook?

- FB bets on Metaverse and its aggressive spending on this sector can drive exponential returns on investments in the near future.

- Their ad revenue projections sound very positive.

- Meta is taking steps to further monetize its various apps, such as providing interactive video ads and tapping into e-commerce.

- It is also applying artificial intelligence and virtual and augmented reality technologies to various products, which may increase Meta user engagement even further, helping to further generate attractive revenue growth from advertisers in the future.

- With 2.5 Billion monthly active users. FB is not going anywhere. And its Economical Moat. (An economic moat is a distinct advantage a company has over its competitors which allows it to protect its market share and profitability.)

Fundamental Analysis

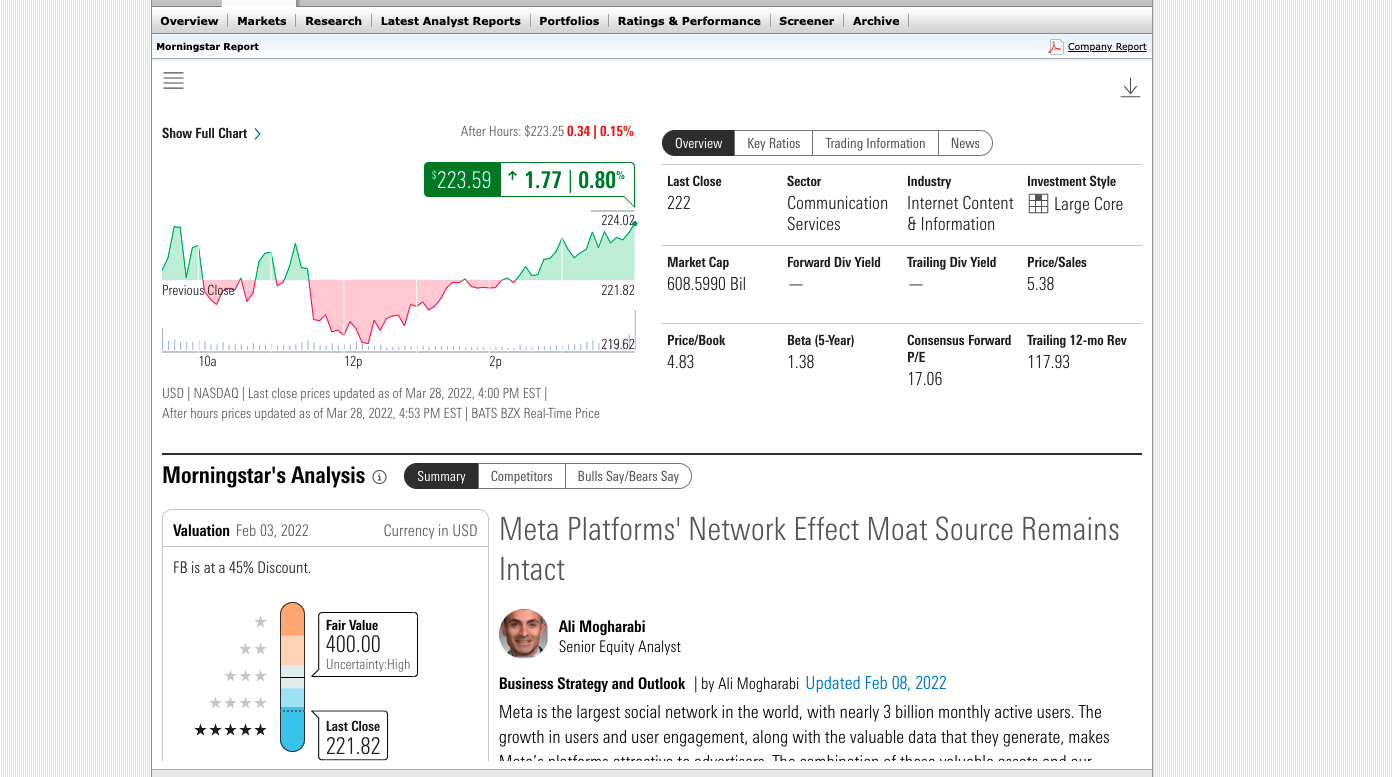

I ran the Stock in Morning Star and here is what came up. The fair valuation of this stock is at $400 ( We do not expect it to hit $400 in at least 12-18 months)

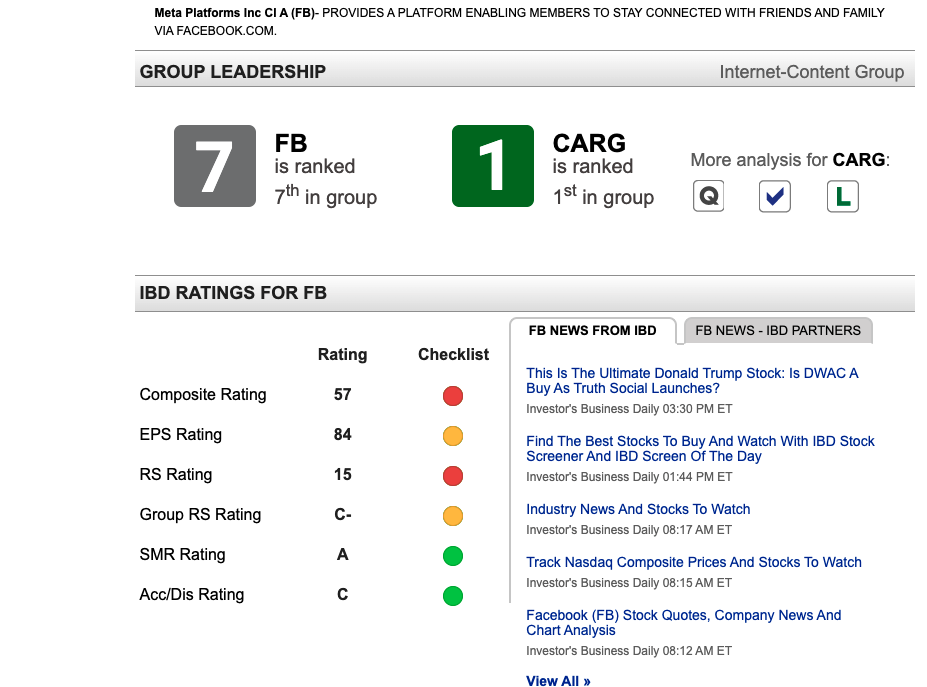

I ran the stock in IBD to check its Ratings. Currently, the stock is ranked number 57th on the Premium List. Check the Chart below. The composite rating is low since it is already beaten down.

A composite rating of 57 is not attractive to enter any stock position but Facebook is still a market leader. So we will ignore this for now.

Technical Analysis

I am not looking for Support and resistance for FB to enter. This is a long-term investment for us. So we will keep this stock for at least a 12-18 months period. I do however recommend a 25% Support Loss for managing risk.

But I did a quick One Day chart analysis. The current Support is at $ 186.71. And the resistance can be the last time we say at Gap down at 246.31. You can either wait for it to break 246.31 to add the position Or you can do a small starter position right now.

Analyst Rating :

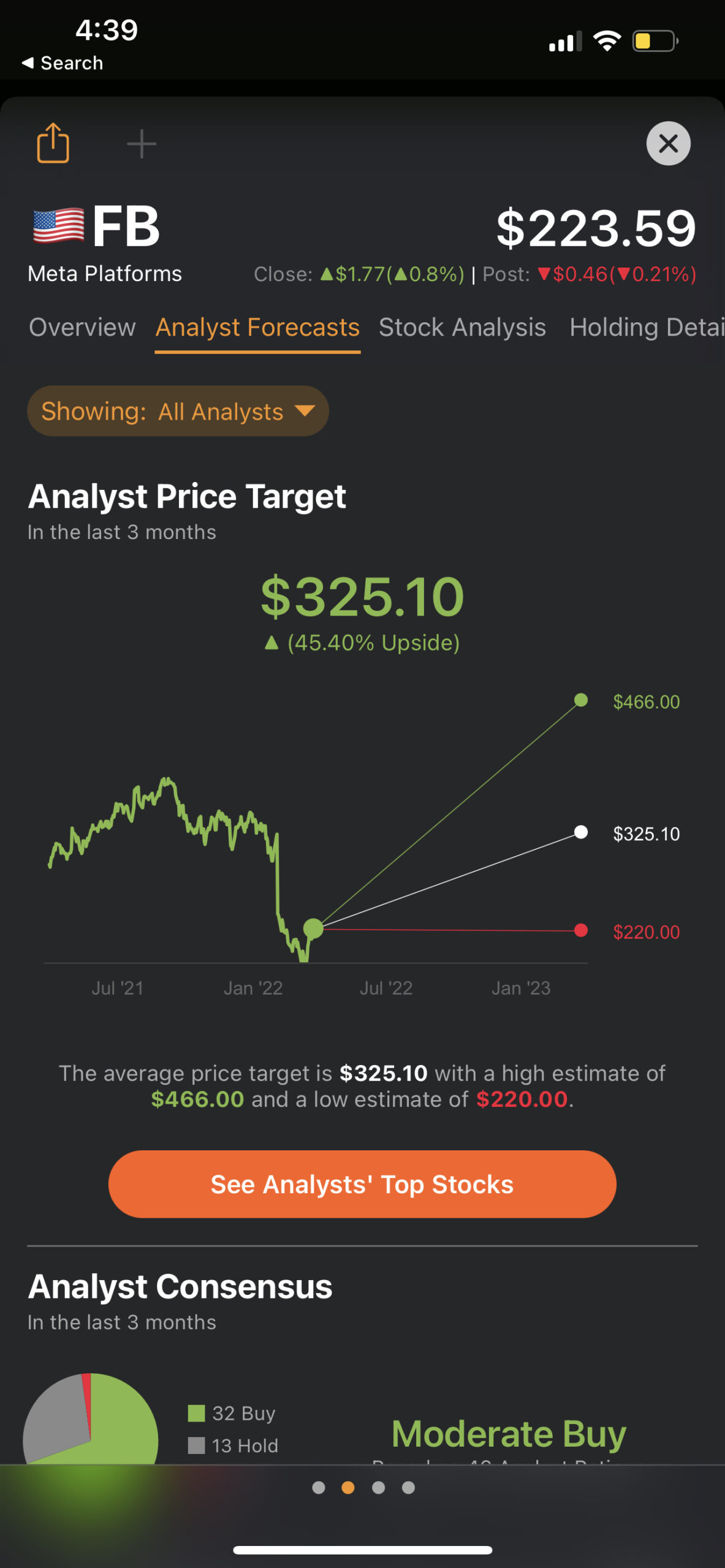

Tip rank Rating :

I ran the stock on Tip RANKS. And the suggested pricing upside is around $325 with a high estimate of $466 and a low of $220.

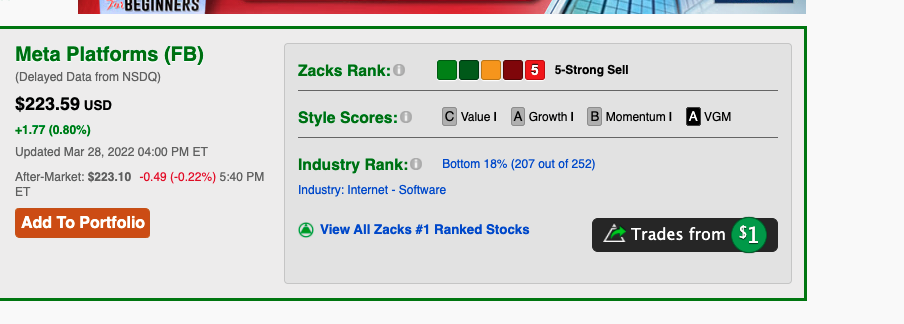

Zacks Rating :

Zacks’s Rating currently has it as a strong sell. ( I will ignore this as well)

Disclosure: At the time of writing I already hold a large position in FB stock. I have no plans to initiate any new positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. I am not a financial adviser. Please do your own due diligence.