Shipping Again

– People were asking me in the email why I choose unique industry sectors for my trading. (Most of them invest in tech and EVs). My style of trading is Swing trading and occasionally I do day trading if the time permits.

And my target is to make 10-20% each month on my capital. So we always choose an industry that is generating revenue and has price momentum and currently, transportation, Oil and Gas, Metal, and Industrials are red hot. Our job as swing traders is to find good fundamental companies, Make quick profits and look for other opportunities.

Quick update:

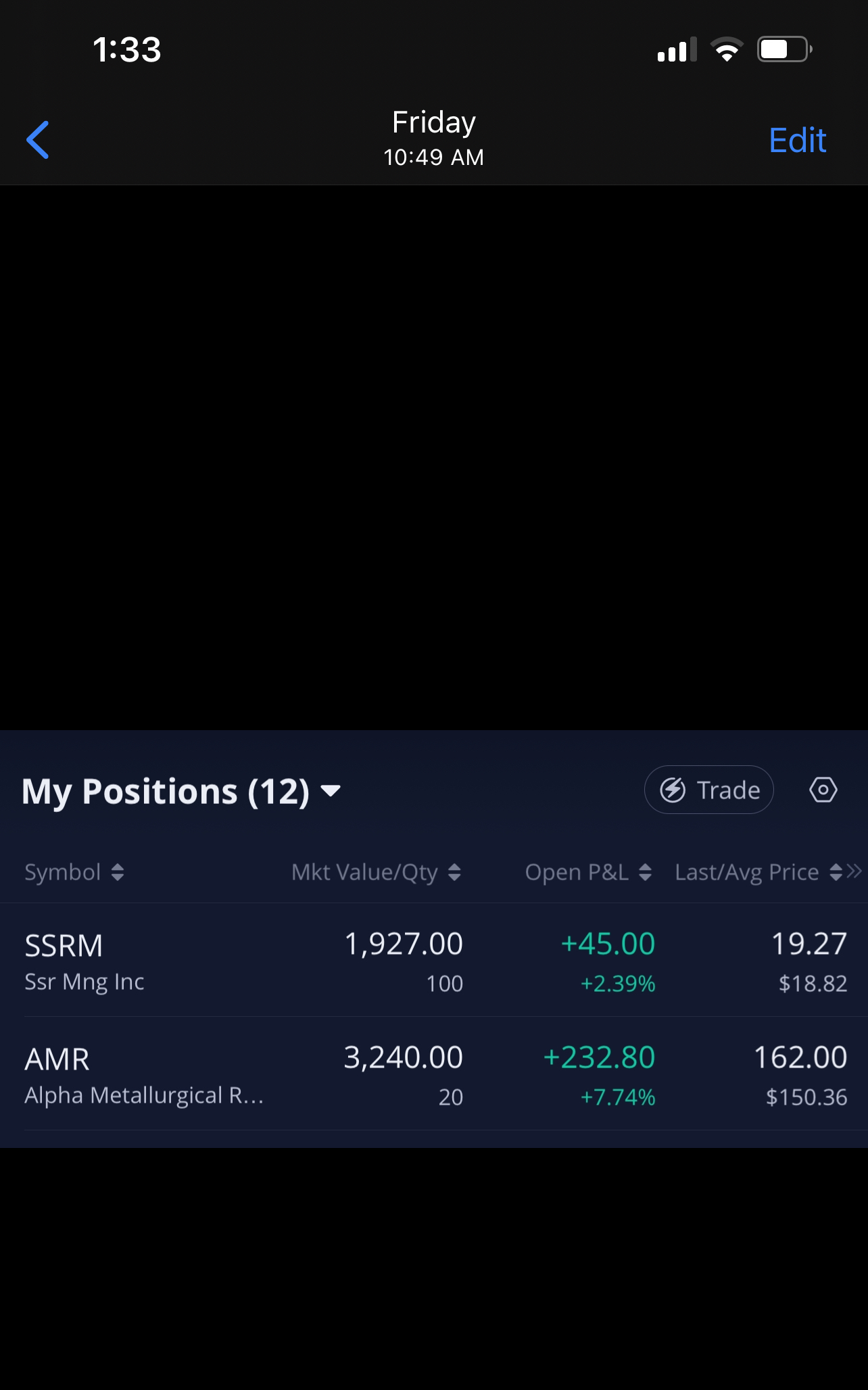

Currently, I have some positions that I opened last week based on technical setups. (Sorry I have been too busy to alert them on the website). I did write in my last article that I will enter SSRM when it goes below $18.94 and it did, so I bought 100 stocks of this company. In less than 1 day I was up close to 3% on this investment.

I was also Up almost 8% on my other entry of AMR which I entered based on charts.

I was also Up almost 8% on my other entry of AMR which I entered based on charts.

Both of which I plan to sell at the market open on Monday.

Collectively I was up almost 11% on my capital in less than 3-4 days of work. If we take these trades 3 times in a month. We can easily up 30 % on our capital. And for all people who are saying that this is a bad market to make money. Any market is a good market to make money if you do your homework and maintain a tight stop loss.

Come back to Shipping stock :

“Same story from the last article”

Shipping stocks have moved higher for much of the past two years after Covid-related disruptions sent shipping costs higher for businesses importing products and customers paying for them.

Add to it “supply chain challenges in China, primarily due to actions to mitigate the spread of Covid-19, as well as continued supply chain constraints and congestion on the U.S. West Coast, elevated consumption trends, and inventory restocking.”

It also said it expected little to change in the supply and demand backdrop.

Russia will halt gas flows to Poland and Bulgaria, as tankers will be needed to ship incremental gas and coal from North America to Europe.

Oil and gas tanker equities have been strong performers since Russia invaded Ukraine, prompting rounds of sanctions on Russian exports. so I am exploring another Stock that I might enter soon.

SBLK – Star Bulk Carriers Corp

Star Bulk Carriers Corp provides seaborne transportation solutions in the dry bulk sector. The company owns and operates dry bulk carrier vessels, which are used to transport major bulks, such as iron ore, coal, grains, bauxite, fertilizers, and steel products. It owns a fleet of vessels that consists of Newcastlemax, Capesize, Post Panamax, Kamsarmax, Panamax, Panamax, and Supramax. It generates revenues through the voyages it carries out.

So why are we bullish on SBLK?

- Star Bulk Carriers are approaching its next earnings report date. This is expected to be May 24, 2022. The company is expected to report EPS of $1.41, up 291.67% from the prior-year quarter.

- Zack’s latest consensus estimate is calling for revenue of $338.57 million, up 68.89% from the prior-year quarter.

Fundamental Analysis

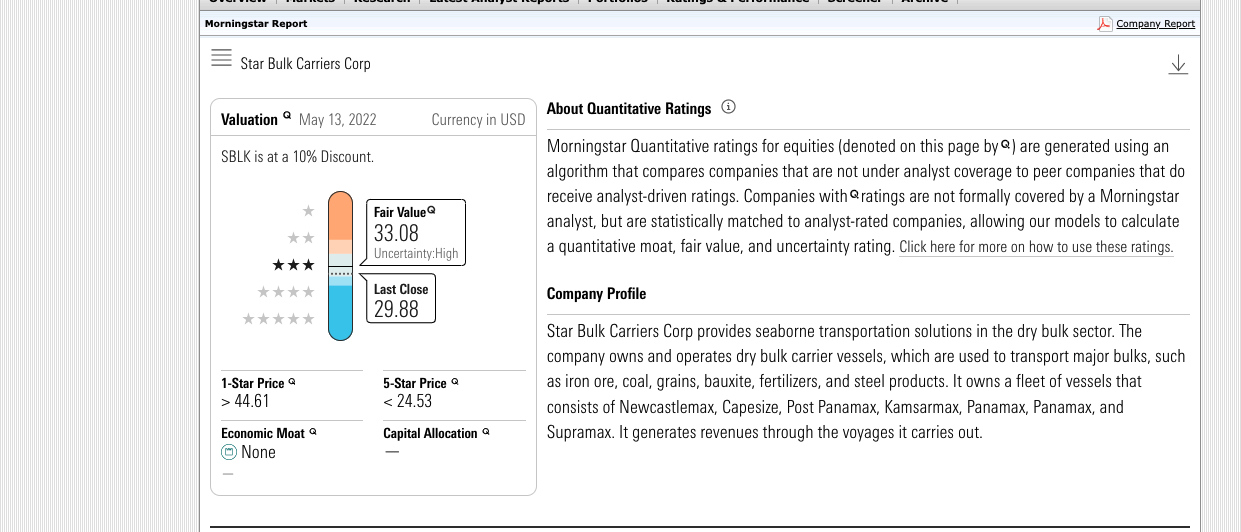

Morning Star Rating :

I ran the Stock in Morning Star and the Fair value evaluation came up above the current price. Which is a good sign

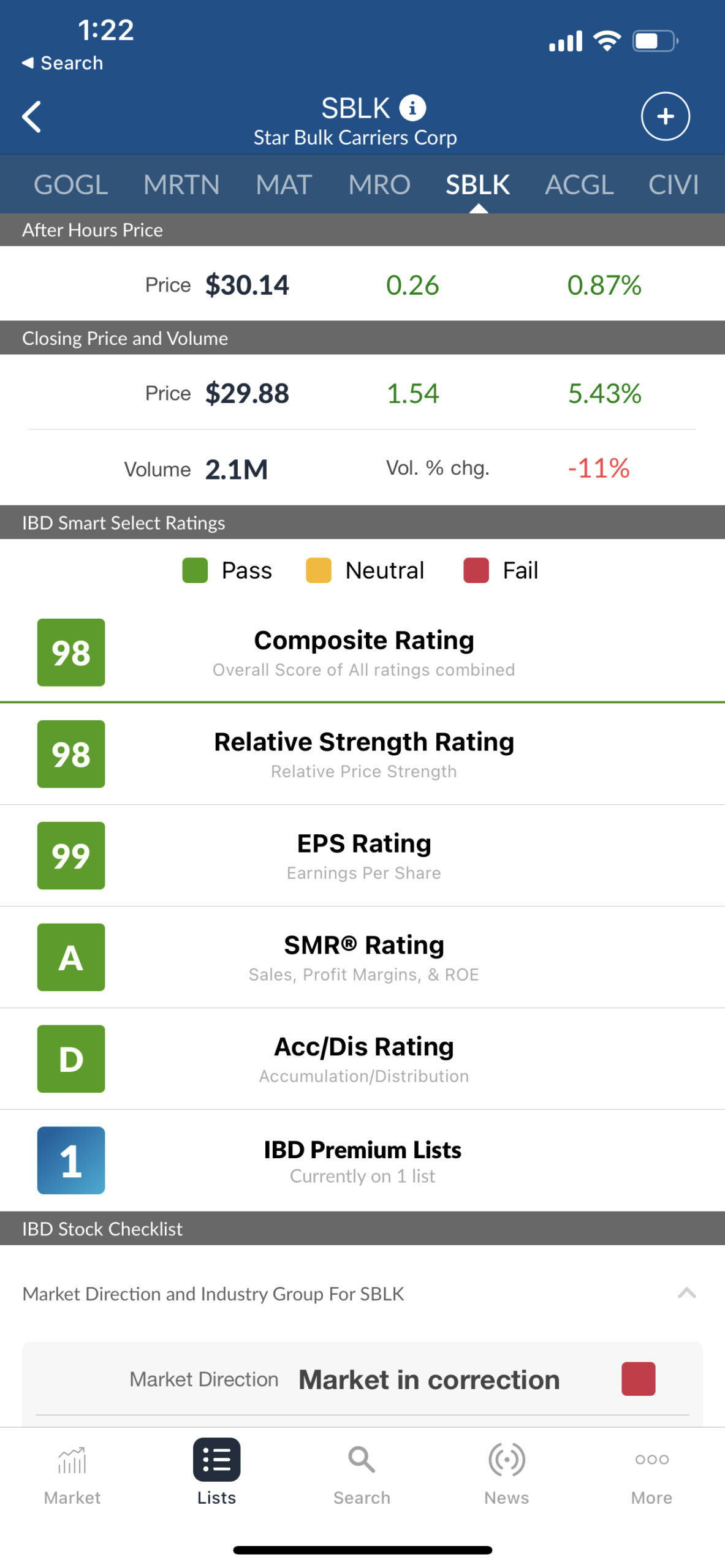

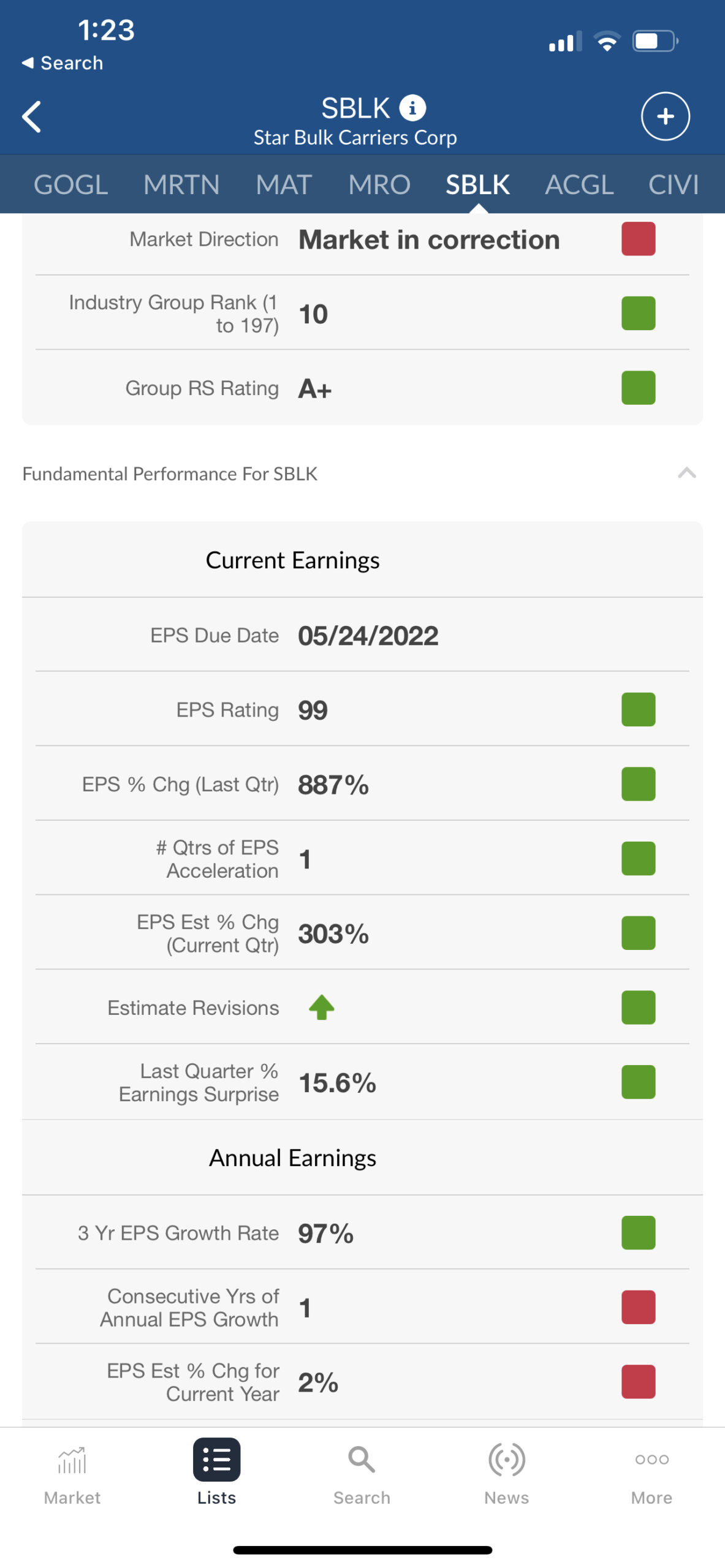

IBD Rating :

I ran the stock in IBD to check its Ratings. Currently, the stock is ranked number 3 in that specific industry group. It is however number one on their premium List. The composite rating is around 98 Highly impressive. EPS ( Earnings per share ) is a highly impressive 887% in the last quarter. That’s a very high momentum EPS. This is a Solid fundamental company ready to breakout.

EPS

Technical Analysis

Current chart :

My chart Analysis

I did a quick One Day chart analysis. The current daily support is $25.84. And the resistance is at $ 32.41. And it is trading right below the 10-day and 20-day moving averages. My entry is at the first 5-minute candle high on the opening. My stop loss would be at $ 25.84. The rectangle is a good consolidation area before it breaks out.

As usual, my target is to get 10-15% profits on this swing.

Analyst Rating :

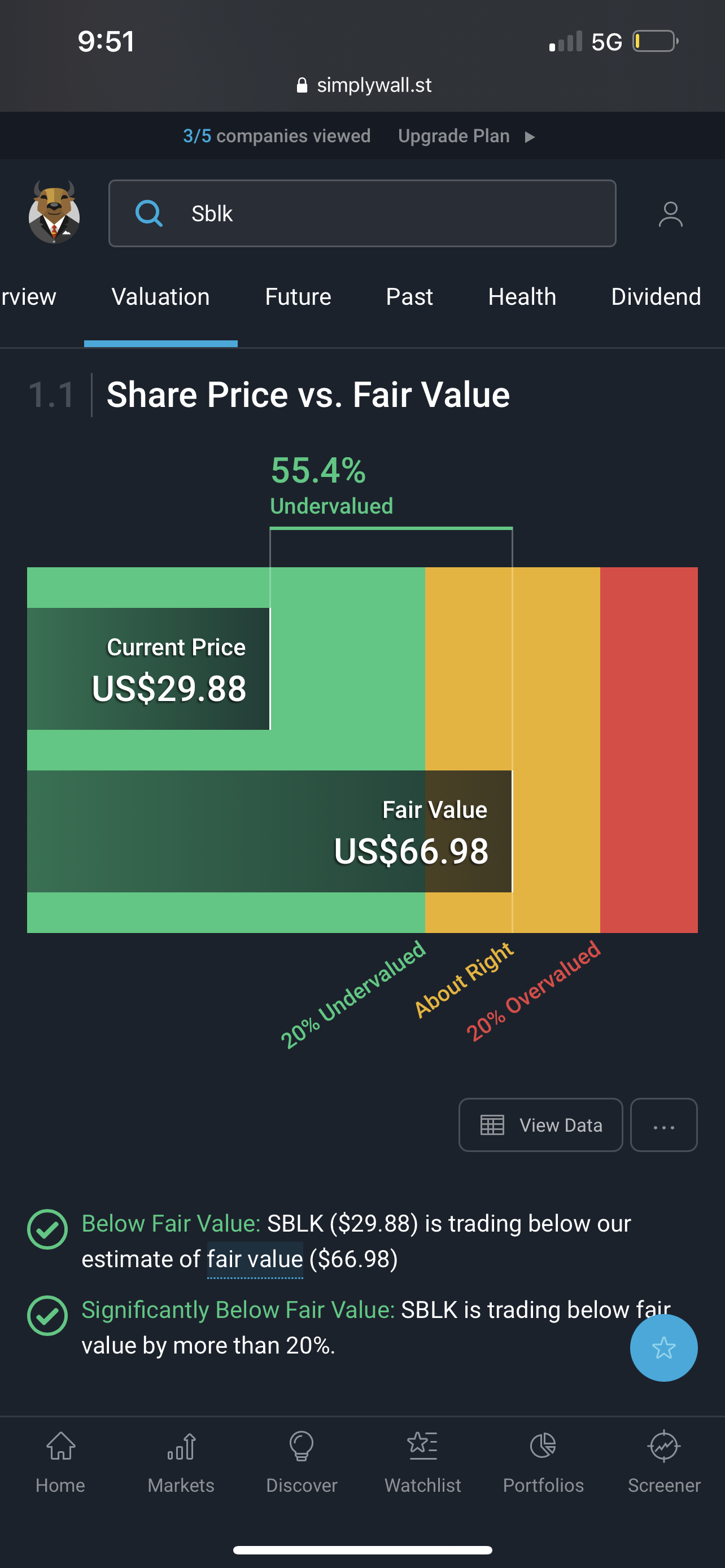

Simply wall St Rating :

I ran the stock on Simply wall St RANKS. And the suggested pricing upside is around $66.98 and it is currently 55% undervalued.

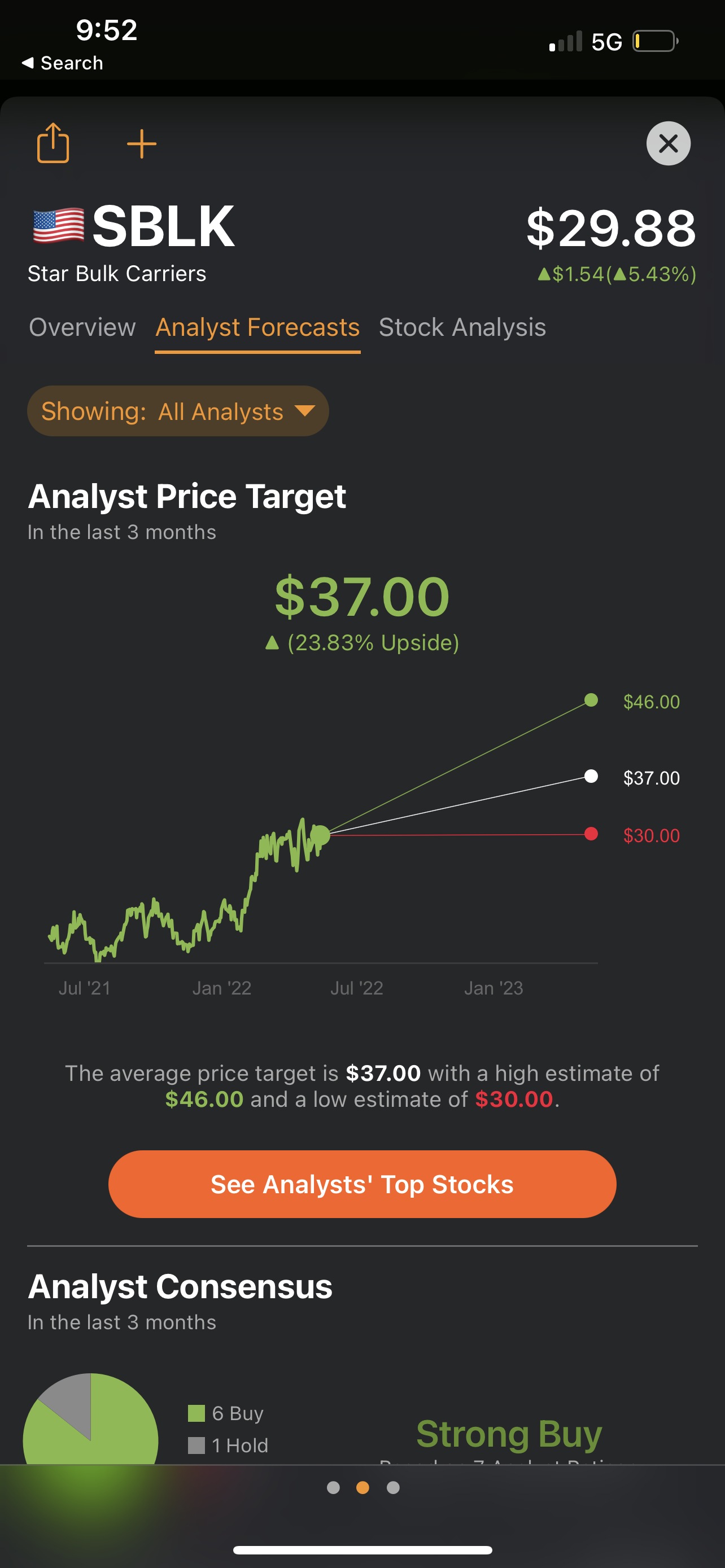

Tip Ranks Rating :

I ran the stock on Tip ranks and the suggested pricing upside is around $37 and the maximum upside is $46.00

Zacks Rating :

Zacks’s Rating currently has a Buy rating.

Disclosure: At the time of writing I DO NOT yet hold a position in SBLK stock. I have plans to initiate new positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. I am not a financial adviser. Please do your own due diligence.