R eal estate sector is currently Hot. Have you tried to buy a house recently? I live in Texas in the Dallas Fort Worth Area and almost every inventory is sold out. Currently, buyers are outbidding each other of their houses. It’s a simple equation of Supply and Demand. The story is the same in almost all parts of the USA.

Check this Graph below

source: tradingeconomics.com

Even though the recent month saw a marginal decline in selling. we believe that with the summer approaching the sales will only increase. The Median home sale price was up 14% last year. We are in the middle of a housing Mania.

Last summer, the National Association of Realtors put out a report on the state of U.S. housing. And its findings reveal a big reason why the market is so crazy right now.

Coming out of the Great Recession, the housing market was left for dead. Homebuilders and developers stopped doing their jobs. They stopped building enough properties to meet future demand… And they built below replacement levels for years.

As a result, the U.S. is short nearly 7 million housing units. That includes single-family homes, apartments, and condos. It’s simple economics. Home sales are jumped Dramatically since the pandemic. The housing mania is here to stay for some time now.

So we decided to deep down into a company that everybody checks out when they want to buy a new home.

Zillow (Z). Yes, the same beaten-down Zillow where the stock is almost 80% down from the highs of last year. So technically Zillow made a lot of bad decisions in the last few years. It took incredible losses for those decisions. But here is a key point. Zillow beat both earnings and revenues estimates. It is just that it did not beat the investor’s expectations. Zillow’s Home flipping model.

In 2018, it got into the home-flipping business – something Richard Barton the CEO of the company had always wanted to do.

The model was to buy houses and flip them for a profit. Zillow would use its vast industry knowledge to buy houses and flip them for a profit. Sellers would get to sell their homes at a fair price, with lower fees, and without stress. It should have been a win-win.

It wasn’t.

Instead, the business went caput. Zillow encountered huge losses. They kept buying houses by offering higher prices. Which caused a shift in the housing-pricing algorithms. It lost close to $250 million in the third quarter of 2021. Approximately $81,000 per home sold.

I wouldn’t bet against Richard Barton. ( He Founded Expedia, GlassDoor – sold it for $1.2 billion in 2018)

Even with the failed home-flipping model of Zillow which it recently shut down. The website still gets around a lot of traffic. (Roughly 60 million people browse homes on zilliow.com and trulia.com). Trulio got acquired by Zillow in 2015.

So real estate agents pay advertising money to Zillow for being a premier agent. So in reality Zillow’s main customers are agents and they pay for advertising.

So Zillow’s core business Zillow’s internet, media & technology ( IMT) Segment is the company’s main advertising business. And the revenue jumped 30 % to $1.9 billion in 2021. Zillow overall will lose money while is it trying to sell off that huge inventory from Zillow offers. But combine that loss with their advertising business their revenue still grew 31 % last year. It made about $2.1 billion in revenues last year after removing Zillow offers. That number can easily reach $5 Billion by the end of 2025. If that happens Zillow’s market cap can hit $45 billion dollars. That is at least 250% upside potential. So in hindsight, the money we put in Zillow could double in 12- 18 months.

So we will follow the advice of the greatest investor that we know

“Buffett always says that you should be fearful when others are greedy and be greedy when others are fearful”

Today investors are fearful of Zillow. So we will be greedy.

Zillow Group, Inc., a digital real estate company, operates real estate brands on mobile applications and Websites in the United States. The company operates through three segments: Homes; Internet, Media & Technology; and Mortgages. The Homes segment is involved in the resale of homes; and title and escrow services to home buyers and sellers, including title search procedures for title insurance policies, escrow, and other closing services. The IMT segment offers premier agents, rentals, new construction marketplaces, display, and other advertising, as well as business software solutions. The Mortgage segment provides home loans; and marketing products including custom quotes and connects services. Its portfolio of brands includes Zillow Rentals, Trulia, StreetEasy, Zillow Closing Services, HotPads, and Out East. The company was incorporated in 2004 and is headquartered in Seattle, Washington.

Courtesy of Yahoo Finance.

Fundamental Analysis

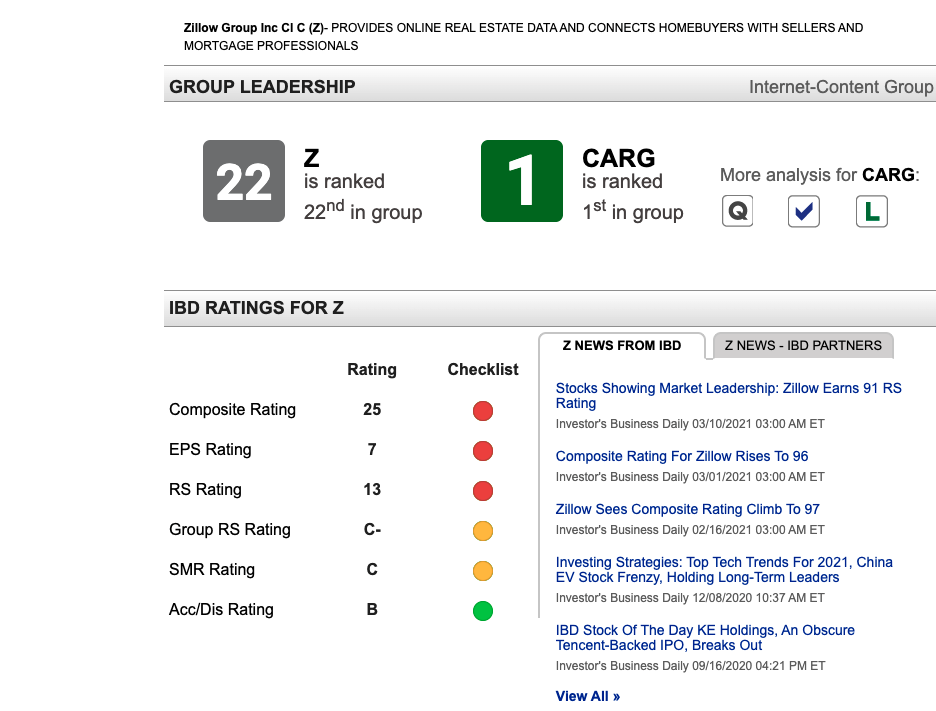

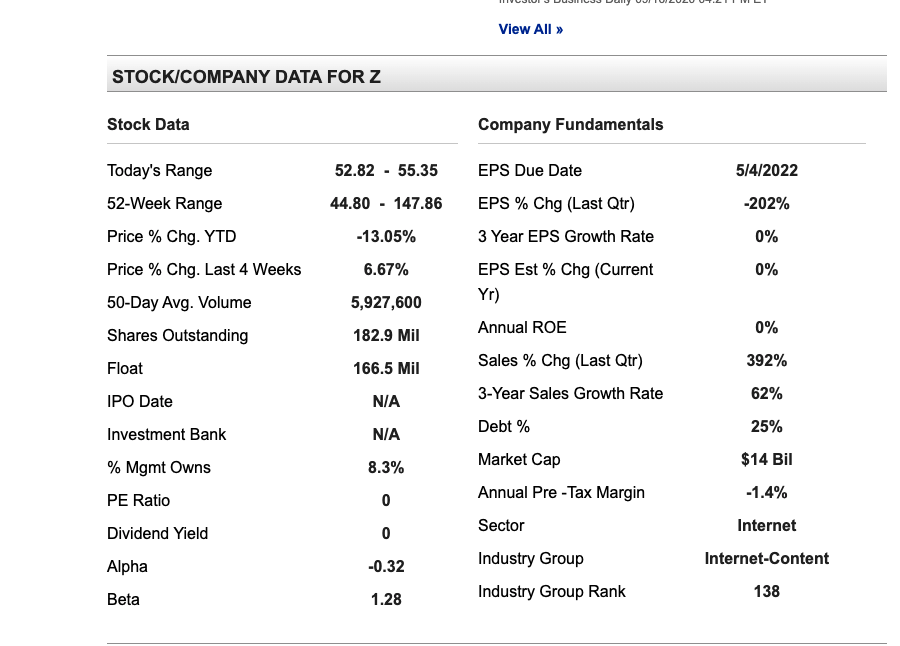

I ran the stock in IBD to check its Ratings. Currently, the stock is ranked number 25th on the Premium List. Check the Chart below. The composite rating is low since it is beaten down.

Technical Analysis

I am not looking for Support and resistance for Zillow. This is a long-term investment for us. So we will keep this stock for at least a 12-18 months period. I do however recommend a 25% Support Loss for managing risk.

Analyst Rating :

I ran the stock on Tip RANKS. And the suggested pricing upside is around $78 with a high estimate of $80 and low of $76. ( Once it reaches that price I will try to book some profits)

Zillow does not have any ranking on Zacks currently.

Disclaimer: I am not a financial advisor. Do not take anything on my website as financial advice, ever. Do your own research. Consult a professional investment advisor before making any investment decisions!