R

ussia is a massive component of the global energy industry. But today it is a Pharoah. The sanctions have hit it hard and almost all global companies dropped Russia.McDonald’s. Starbucks. Coca-Cola. Apple. Netflix, Paypal Etc. The global economy does not suffer so much with the exit of McDonald’s (Contrary I believe the people will become healthier) as it does with the exit of the Big oil companies.

That group of companies includes ExxonMobil, BP, Shell, Halliburton, Schlumberger, and Baker Hughes. Together, these companies make up a group of businesses we call “Big Oil.” With the exit of Big Oil from Russia, the country’s oil and natural gas industry is about to suffer serious harm. This means oil prices are likely to be above $100 per barrel for a long time. Here is a good Oil company that has solid fundamentals.

CVE – Cenovus Energy Inc

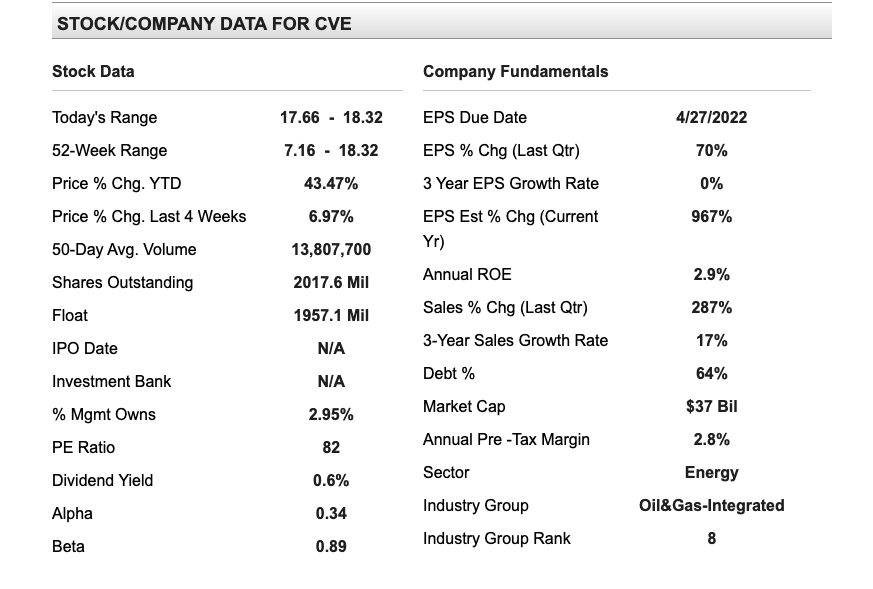

Cenovus Energy, Inc. engages in the provision of gas and oil. Its activities include the development, production, and marketing of crude oil, natural gas liquids (NGLS), and natural gas in Canada. The firm operates through four segments: Oil Sands, Conventional, Refining & Marketing, and Corporate & elimination. The Oil sands segment includes the development and production of bitumen in northeast Alberta including Foster Creek, Christina Lake, and Narrows Lake as well as projects in the early stages of development. The Conventional segment includes land primarily in the Elmworth-Wapiti, Kaybob-Edson, and Clearwater operating areas. The Refining and Marketing segment provides transportation and selling of crude oil, natural gas, and NGLS. The Corporate and Eliminations segment includes unrealized gains and losses recorded on derivative financial instruments, divestiture of assets, as well as other administrative, financing activities, and research costs. The company was founded in 1881 and is headquartered in Calgary, Canada.

- Cenovus Energy’s four analysts are for revenues of CA$74b in 2022.

- If it does succeed it would reflect a major 59% increase in its sales over the past 12 months.

- Earnings per share (EPS) are presumed to jump 1,354% to CA$4.06 in 2022.

Fundamental Analysis

Morning Star Rating :

I ran the Stock in Morning Star and no Fair value evaluation came up.

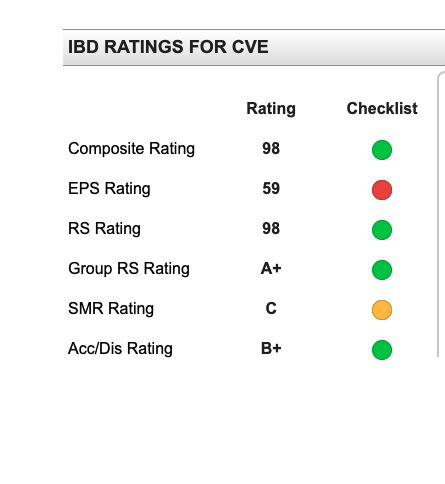

IBD Rating :

I ran the stock in IBD to check its Ratings. Currently, the stock is ranked number 8 in that specific industry group Check the Chart below. The composite rating is around 98 which is highly impressive and the EPS change last quarter was 70 %.

Technical Analysis

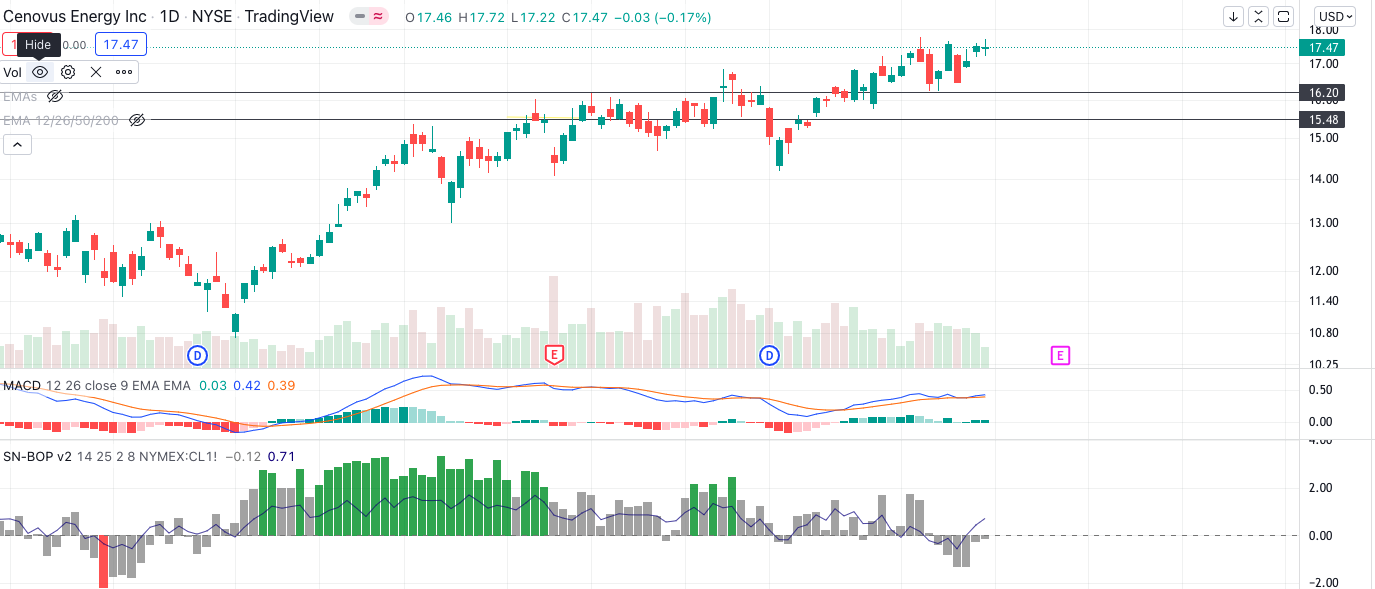

I did a quick One Day chart analysis. The current Support is $15.48. And the resistance is at $ 17.47. My stop loss would be around $15.40.

Note: It currently broke resistance during the time I was writing this article.

I will be looking to ride the stock for at least 20% profits. And I might sell after that. But feel free to hold on to it

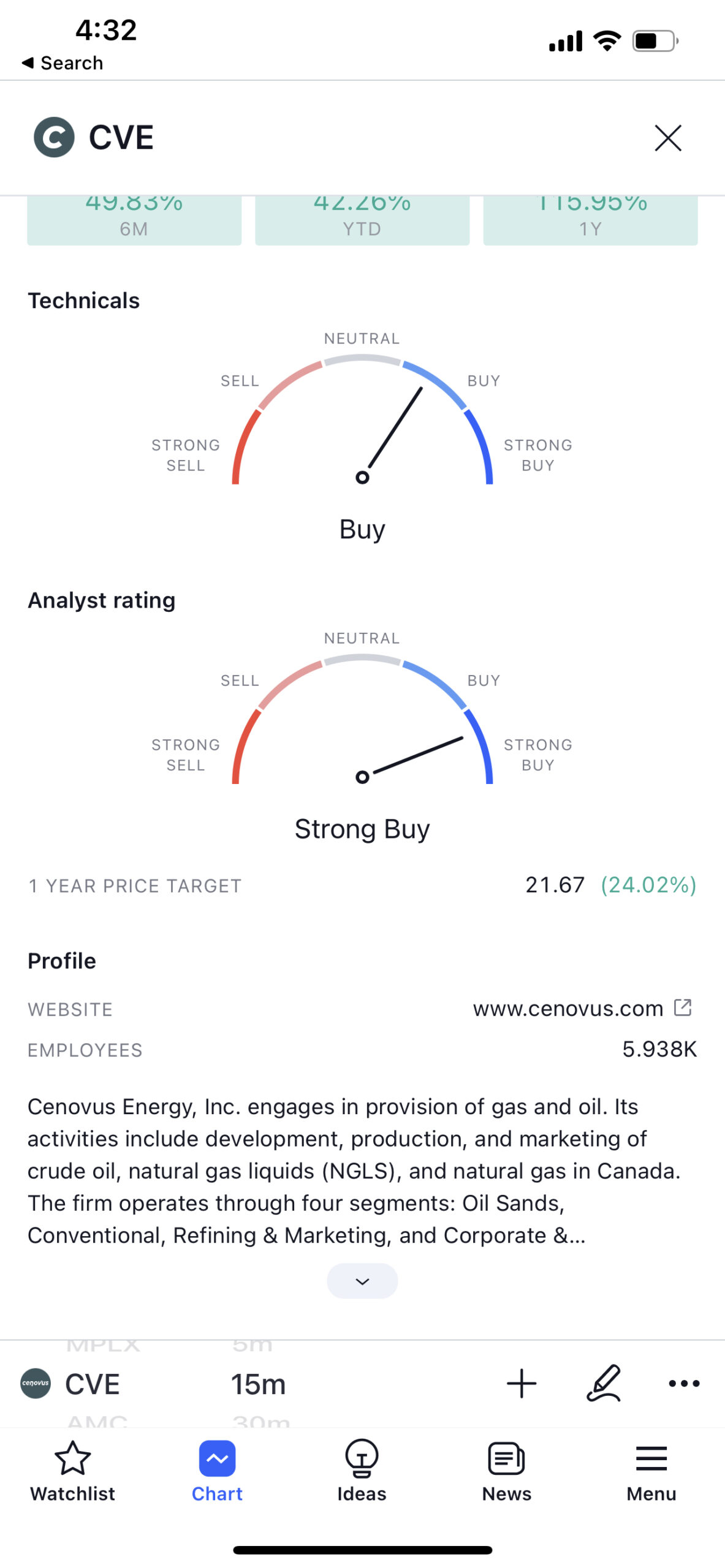

Analyst Rating :

Tip rank Rating :

I ran the stock on Tip RANKS. And the suggested pricing upside is around $21.03 with a high estimate of $ 27.72 and a low of $16.63

Zacks Rating :

Zacks’s Rating currently has a Strong Buy rating.

Disclosure: At the time of writing I hold a position in CVE stock. I have no plans to initiate any new positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. I am not a financial adviser. Please do your own due diligence.