S hipping industry is currently ranked 15th out of IBD’s 197 industries. If you have been following the news then you know that shipping is currently growing at a rapid pace and the global supply chain is dependant on shipping containers.

As per Zion Market Research study, the Shipping Container industry accumulated proceeds worth nearly US$ 6.45 billion in 2020 and is anticipated to accrue returns of approximately US$ 16.01 billion by 2028. Moreover, the Shipping Container market is prognosis to record a CAGR of almost 12.1% in 2021-2028.

Through the primary research, it was established that the Shipping Container Market was valued at approximately USD 6.45 billion in 2020 and is projected to reach roughly USD 16.01 billion by 2028.

Social media is an internet-based form of communication. Social media platforms allow users to have conversations, share information, and create web content.

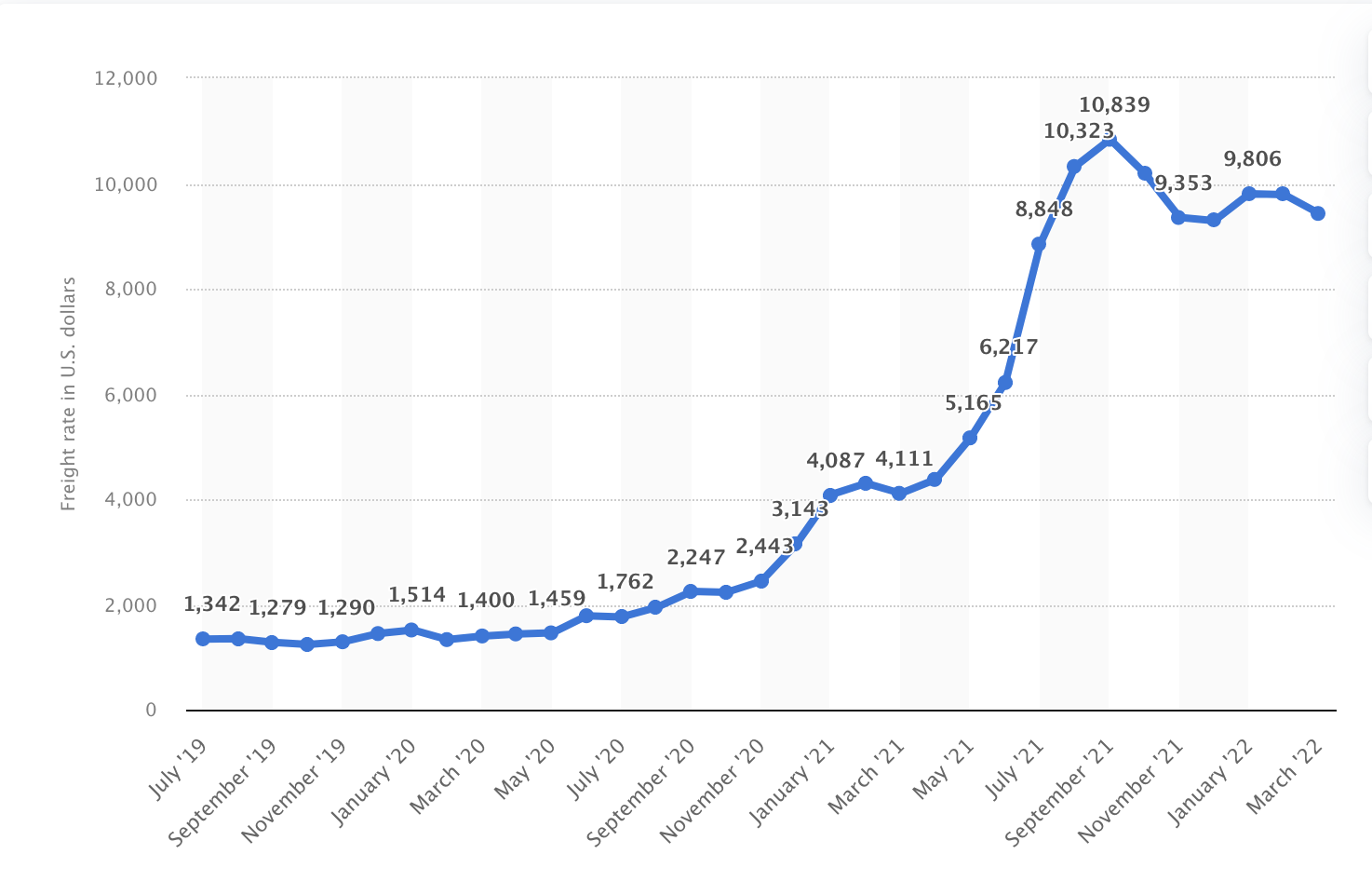

Container freight rates increased dramatically between July 2019 and March 2022. The year 2021 saw an especially steep increase in global freight rates, reaching a record price of over 10,800 U.S. dollars in September 2021. In March 2022, the global freight rate index stood at about 9,400 U.S. dollars.

Look at the Freight rates on a year-to-year comparison below.

So we decided to deep dive into one company that is going to benefit from this surge in shipping industry.

GOGL – Golden Ocean Group.

Golden Ocean Group is a midcap marine shipping stock. The company — headquartered in Bermuda — operates vessels that handle dry bulk goods.

So why are we bullish on GOGL ?

- GOGL recently posted an EPS ( Earnings per share) of $2.73 last year.

- Their revenue projections sound very positive.

- We Supply chain snags and shipping congestion will continue to surge the price of this stock higher.

- The firm boasts a 30% return on equity. ( That is impressive)

- Most impressive is the company’s 90-cent quarterly dividend, which translates to a yield of 20.6%.

Fundamental Analysis

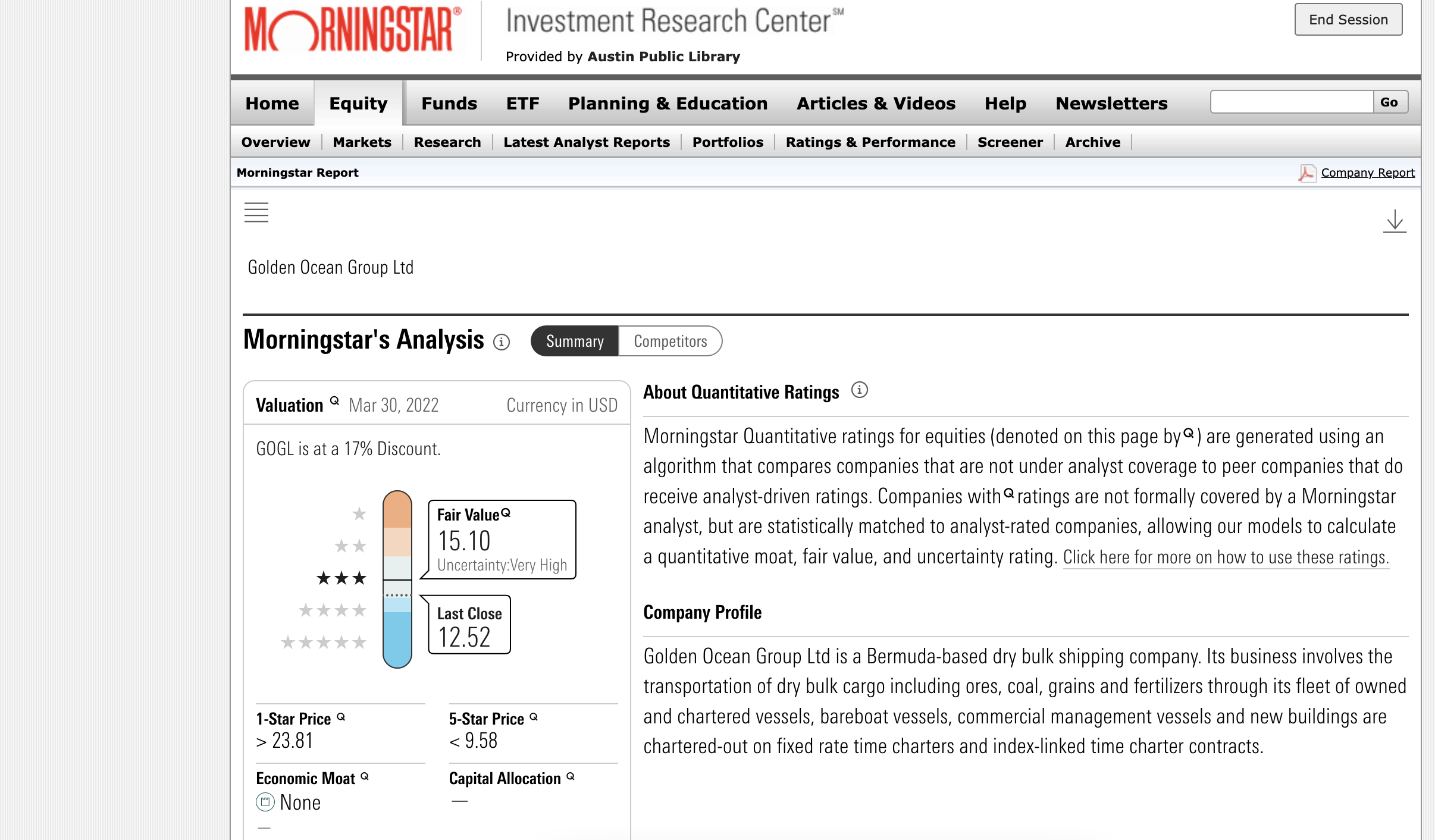

I ran the Stock in Morning Star and here is what came up. The fair valuation of this stock is around $15. I believe it should hit 15 in the next few months.

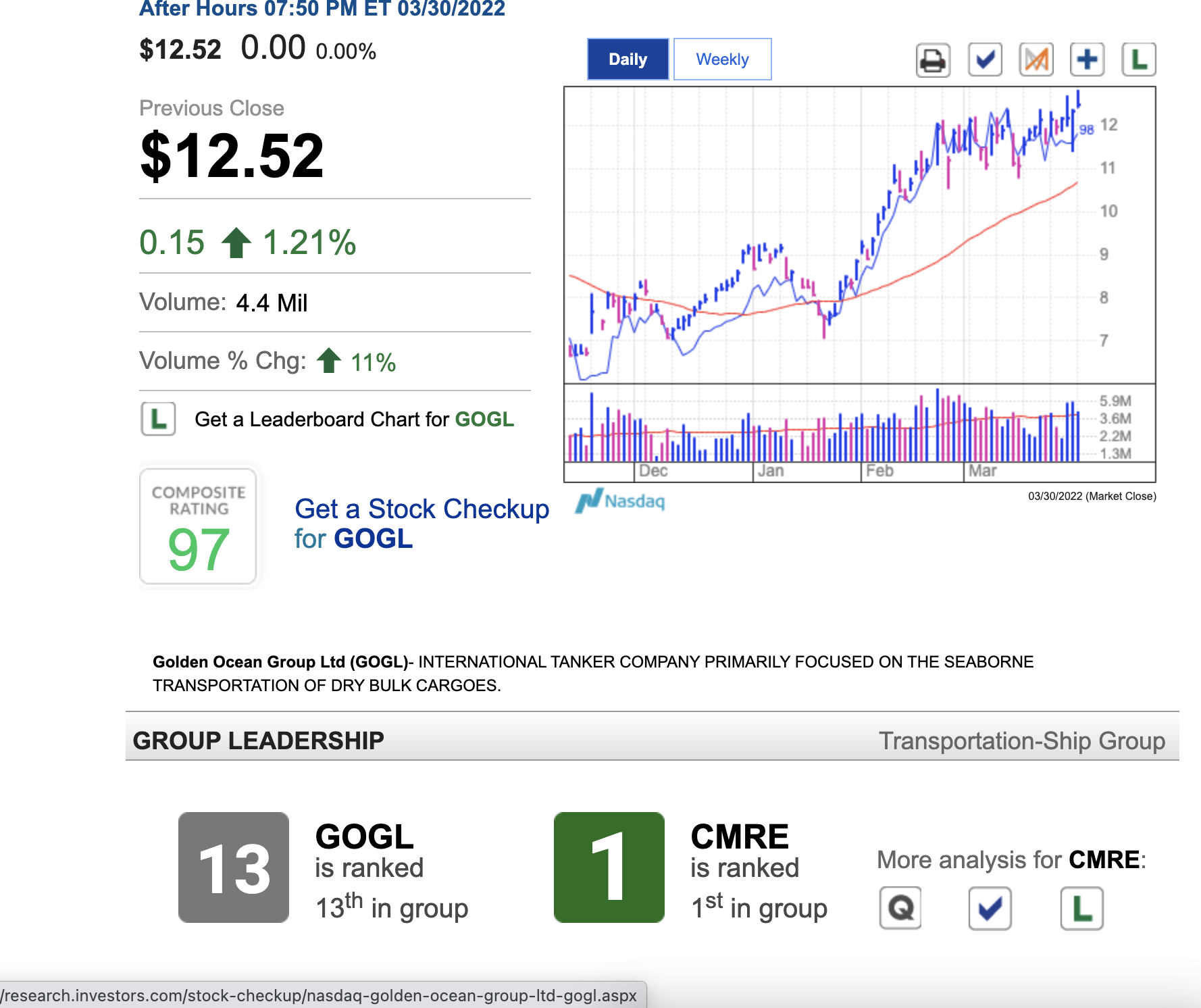

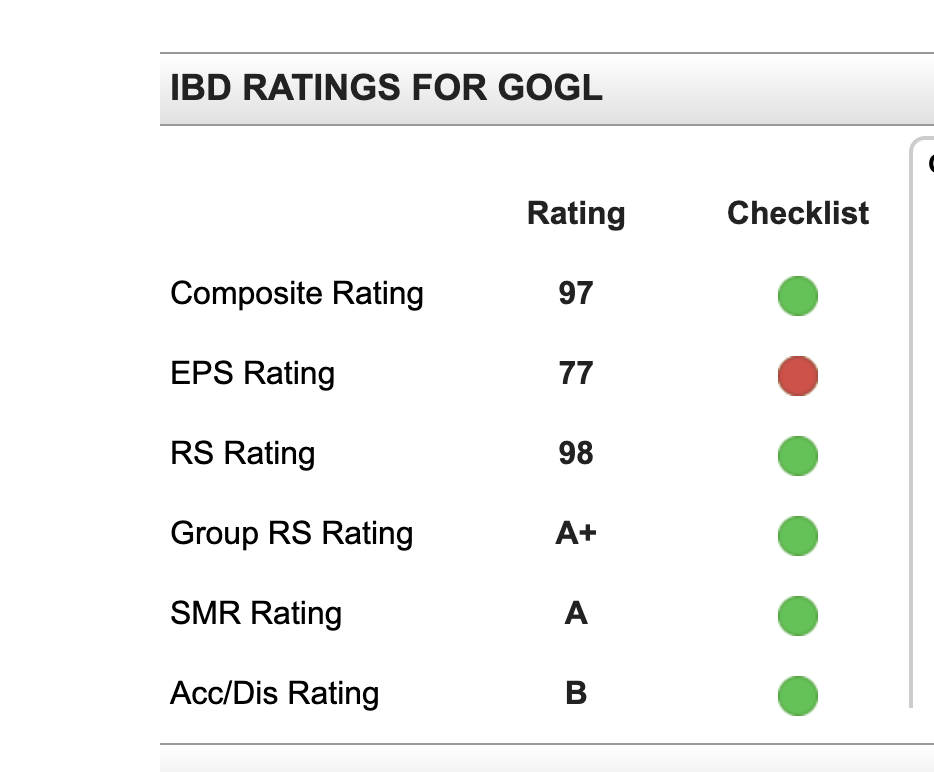

I ran the stock in IBD to check its Ratings. Currently, the stock is ranked number 13th in that specific industry group Check the Chart below. The composite rating is around 97 which is highly impressive.

Technical Analysis

I did a quick One Day chart analysis. The current Support is at $10.92. And the resistance has already broken out to $ 12.40.

I will be looking to ride the stock for at least 20% profits. And I might sell after that. But feel free to hold on to it

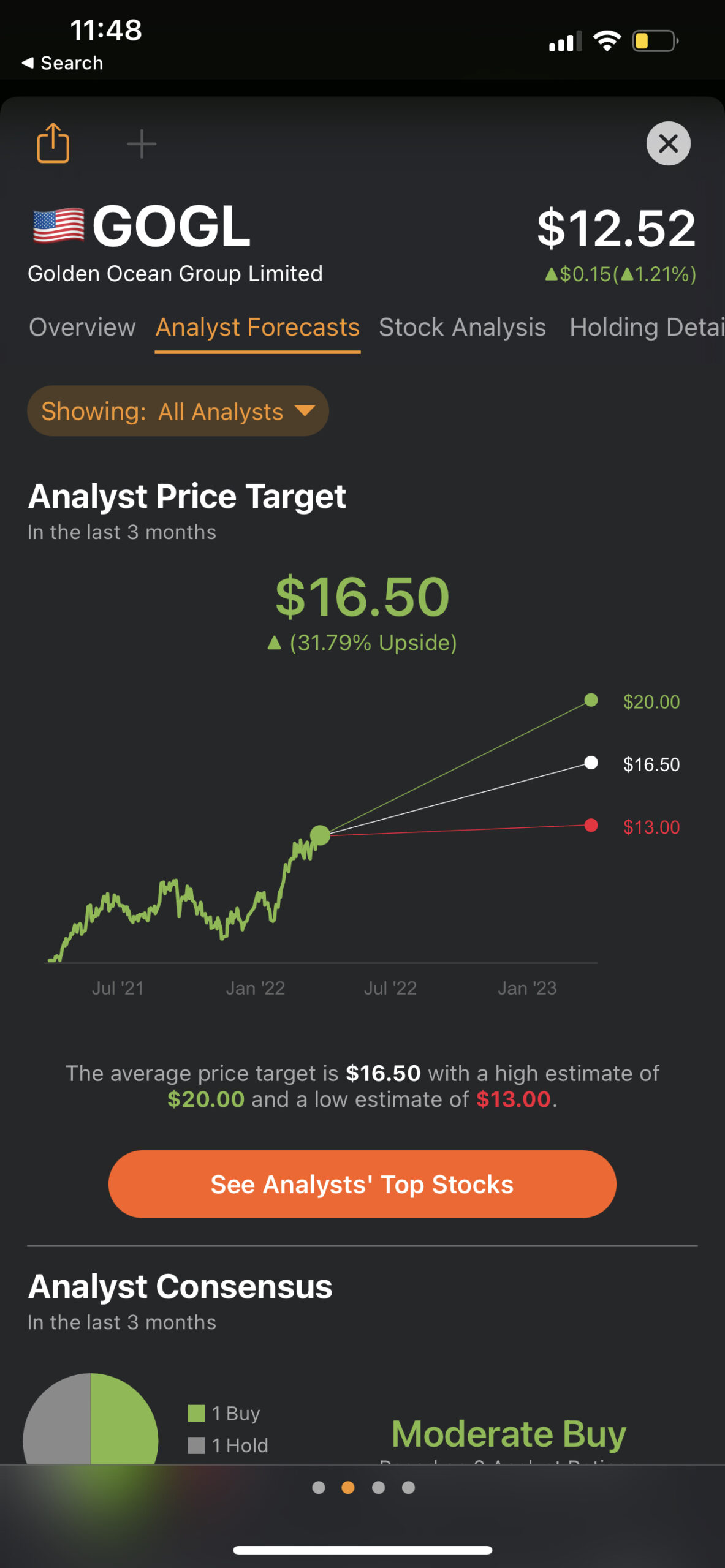

Analyst Rating :

Tip rank Rating :

I ran the stock on Tip RANKS. And the suggested pricing upside is around $16.50 with a high estimate of $20 and a low of $13.

Zacks Rating :

Zacks’s Rating currently has it as a strong buy.

Disclosure: At the time of writing I already hold a position in GOGL stock. I have no plans to initiate any new positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. I am not a financial adviser. Please do your own due diligence. I am not a financial advisor.