Hair Care

- I have not written an article in the last few months. Essentially because the market does not warrant being in long-term investments currently. Almost everybody’s portfolio is Red and there is a lot of uncertainty about how the market will react. Essentially we are in a Bear market and in my last article, I had written some key indicators on how to navigate through this market. Here is the link https://www.halalfinanceinvesting.com/bear-market-strategies/

I am still using my cash to find good swings to generate some income. I trade some key stocks which have better ATR.

Most of our picks from this website have generated us good profits الحمدلله even in this market.

The most recent I recommend was.

$EURN ➡️ $11.00 ➡️ $17.65 💸 60% gain! 📈

Last week I took a position in a few companies that I think could generate us at least 20% profits IA, when the rally starts.

One of them is

OLPX – Olaplex

Olaplex Holdings Inc is a science-enabled, technology-driven beauty company. It offers science-backed solutions that improve hair health. It identifies consumers’ most relevant haircare concerns in collaboration with the community of professional hairstylists and consumers and strives to address them through its proprietary technology and innovation capabilities. It offers products through a global omnichannel platform serving the professional, specialty retail, and DTC channels. The company derives its revenue through the sale of its specialty hair care products.

So why are we bullish on OLPX ?

-

In the U.S., Olaplex was number 4 by retail sales last year in the prestige hair category, according to Euromonitor.

-

Barclays analyst Lauren Lieberman estimates that international sales should account for 75% of next year’s sales growth. The company sells products in the United Kingdom, Europe, China, and other Southeast Asian countries.

- Olaplex reports third-quarter earnings in November, Wall Street is expecting a profit of 13 cents a share, about 20% above the year-earlier figure, on sales of $210 million, a 30% increase from the total in the same quarter of 2021.

- Olaplex’s profit margin. Earnings before interest, taxes, depreciation, and amortization, or Ebitda, margins clocked in at 68.3% in 2021. They are expected to dip to 63.6% in 2022, as Olaplex continues to drive sales in stores, where margins are lower than sales through hair salons.

Fundamental Analysis

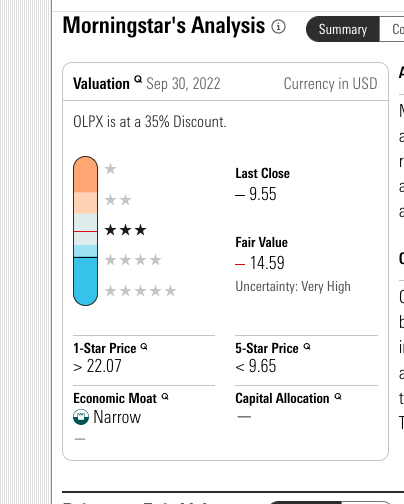

Morning Star Rating :

I ran the Stock in Morning Star and the Fair value evaluation came above the current price. Good Sign

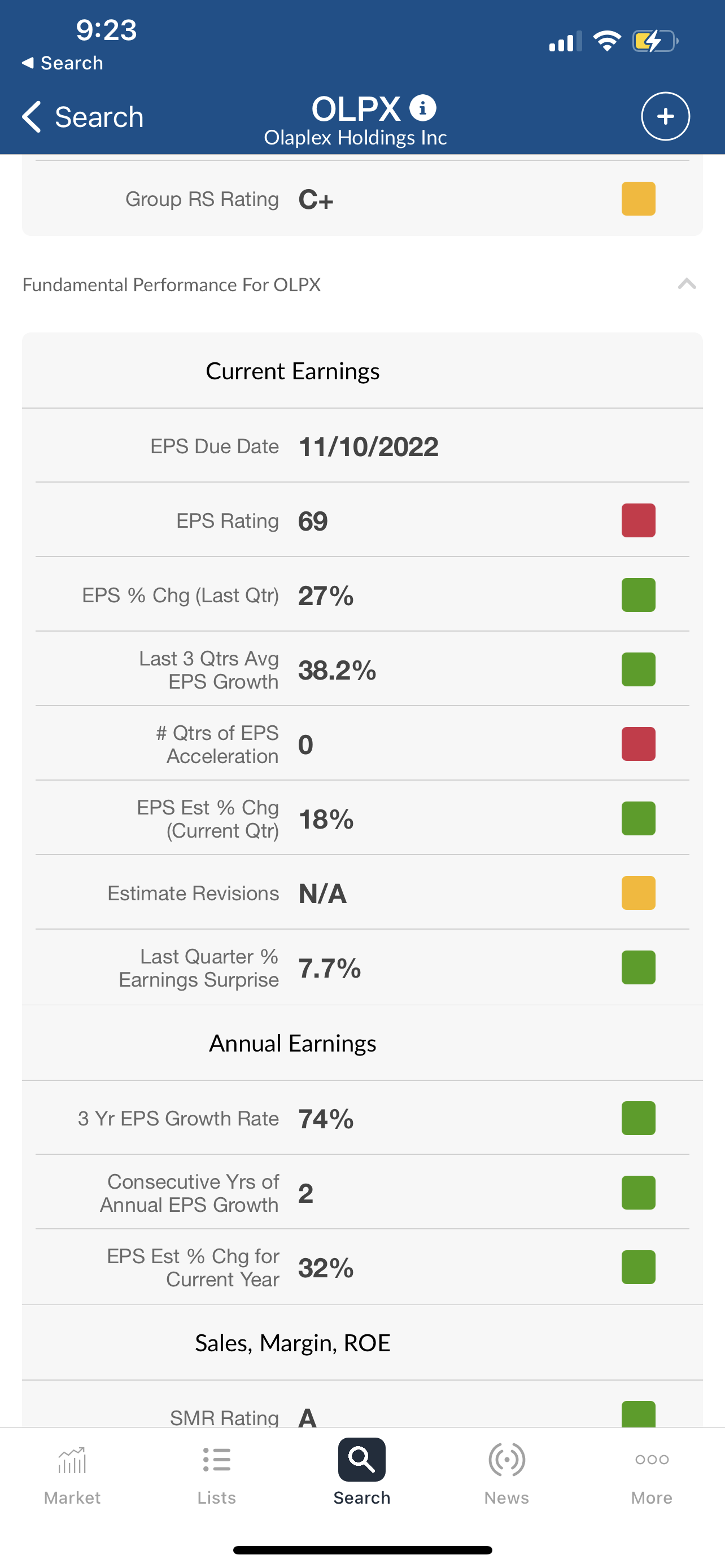

IBD Rating :

I ran the stock in IBD to check its Ratings.

EPS

EPS last quarter was 27%. Which is good.

Technical Analysis

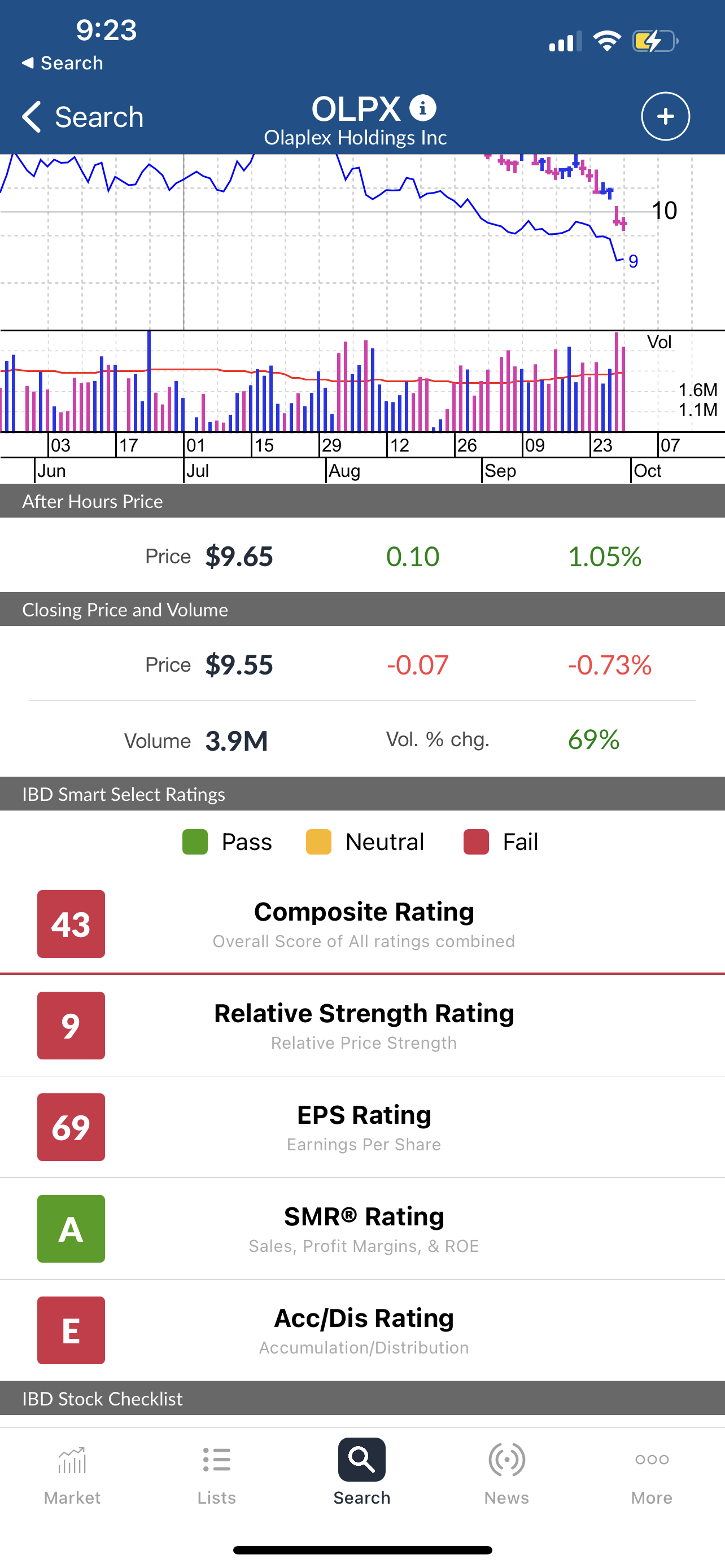

Current chart :

My chart Analysis

I did a quick One Day chart analysis.

A support zone ranges from $ 9.55. This is the lowest the stock has been since it debuted on the market on 10/24/2021.

- A resistance zone ranges from $17.58 to $ 18.42 is the supply zone Or Resistance. This zone is formed by a combination of multiple trend lines in the daily time frame. you can either buy it at the retest of these zones after the breakout.

My SL (Stop Loss) – I do not have a Hard Stop Loss for this stock. But If I lose 40 % on this. I will probably sell it.

As usual, my target is to get 10-15% profits on this swing. I will scale some when it breaches the $18. It might take a few months for this to happen.

Analyst Rating :

Tip Ranks Rating :

I ran the stock on Tip ranks and the suggested pricing upside is around $20.79 with about 117 % upside.

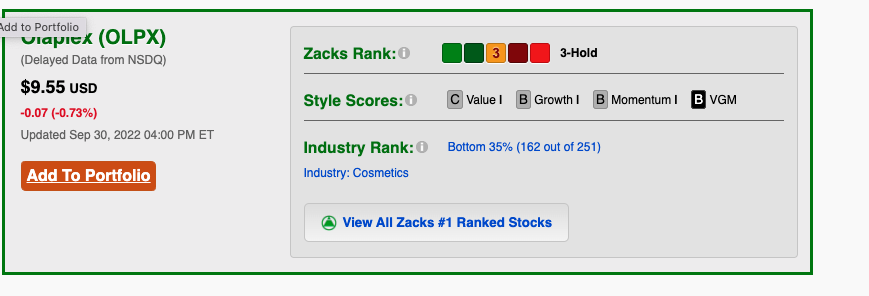

Zacks Rating :

Zacks’s Rating currently has a Hold rating.

Disclosure: At the time of writing I already have a position in OLPX stock. I do not have plans to initiate new positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. I am not a financial adviser. Please do your own due diligence. My articles are not recommendations to buy or sell any security.