Mid stream energy players are going to be the key to energy, and oil issues we have been encountering in the recent months.

What is a Midstream energy company?

- Midstream companies operate the pipeline and gathering or transmission facilities that move the gas from the well (upstream) to our homes and businesses (downstream). Midstream operations also treat the product, remove water or waste products, compress it and get it ready for various markets downstream.

The stock we will discuss today is a leading midstream player to derive stable fee-based revenues since the partnership is the operator of midstream energy infrastructure and logistics assets (revenues for their transportation and storage assets contracted by shippers for a long period of time). This company is also involved in services related to fuel distribution.

So I found a stock that can quickly give us a small return on our investments ( Remember I take profits for most of my stocks at 20% . That is my trading strategy )

MPLX – MPLX LP

MPLX LP owns and operates midstream energy infrastructure and logistics assets primarily in the United States. It operates in two segments, Logistics and Storage, and Gathering and Processing. The company is involved in the gathering, processing, and transportation of natural gas; gathering, transportation, fractionation, exchange, storage, and marketing of natural gas liquids; gathering, storage, transportation, and distribution of crude oil and refined products, as well as other hydrocarbon-based products; and sale of residue gas and condensate. It also engages in the inland marine businesses comprising transportation of light products, heavy oils, crude oil, renewable fuels, chemicals, and feedstocks in the Mid-Continent and Gulf Coast regions, as well as owns and operates boats and barges, including third-party chartered equipment, and a marine repair facility located on the Ohio River; and distribution of fuel, as well as operates refining logistics, terminals, rail facilities, and storage caverns. In addition, the company operates terminal facilities for the receipt, storage, blending, handling, and redelivery of refined petroleum products located through the pipeline, rail, marine, and over-the-road modes of transportation. MPLX GP LLC acts as the general partner of MPLX LP. The company was incorporated in 2012 and is headquartered in Findlay, Ohio. MPLX LP operates as a subsidiary of Marathon Petroleum Corporation.

Courtesy of yahoo finance.

- MPLX, with a Zacks Rank of 2, has a low-cost business culture and strict capital discipline. Over the past 30 days, MPLX LP has witnessed upward earnings estimate revisions for 2022.

- MPLX brought multiple projects into service last year, which enabled the partnership to produce a hefty 32% jump in revenues during the most recent quarter. These new projects should continue to pay dividends – literally – over the coming quarters.

Fundamental Analysis

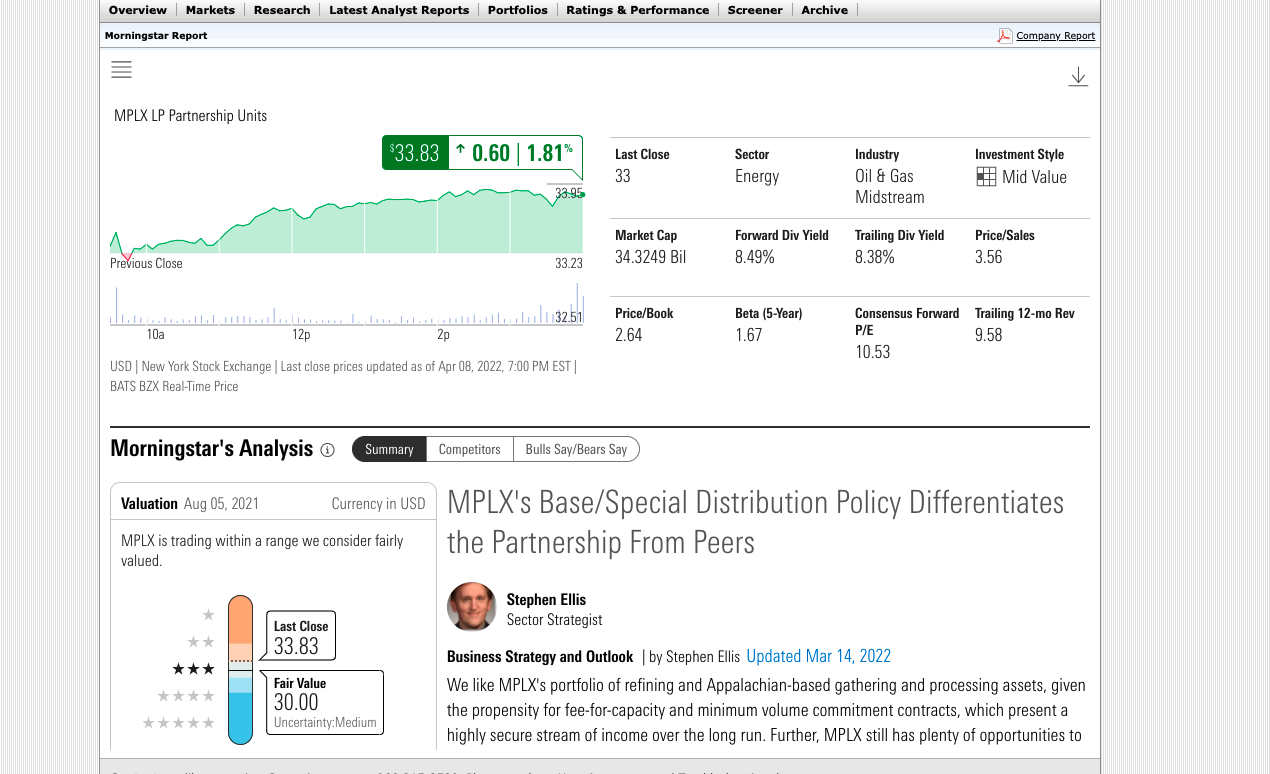

Morning Star Rating :

I ran the Stock in Morning Star and here is what came up. The fair valuation of this stock is around $23.82. But with OIL and Gas , War and Supply chain issues. I am targeting at least a 20% percent profit on my investment on this stock. ( I will wait for it to come down before I initiate the position)

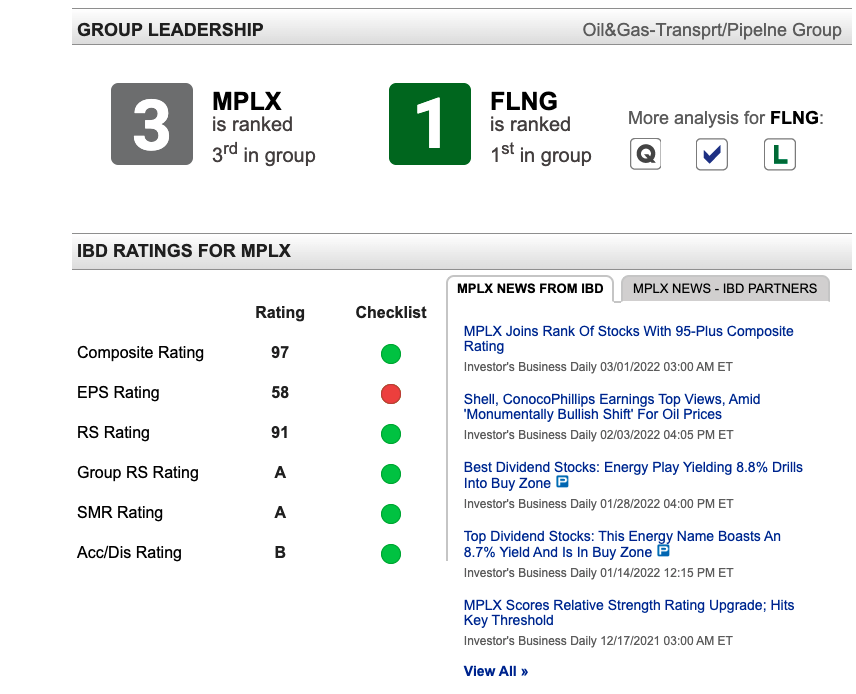

IBD Rating :

I ran the stock in IBD to check its Ratings. Currently, the stock is ranked number 1 in that specific industry group Check the Chart below. The composite rating is around 99 which is highly impressive.

Technical Analysis

I did a quick One Day chart analysis. The current Support is $30.10. And the resistance is at 34.64. My stop loss would be around $29.40

I will be looking to ride the stock for at least 20% profits. And I might sell after that. But feel free to hold on to it

Analyst Rating :

Tip rank Rating :

I ran the stock on Tip RANKS. And the suggested pricing upside is around $36.55 with a high estimate of $40 and a low of $33.

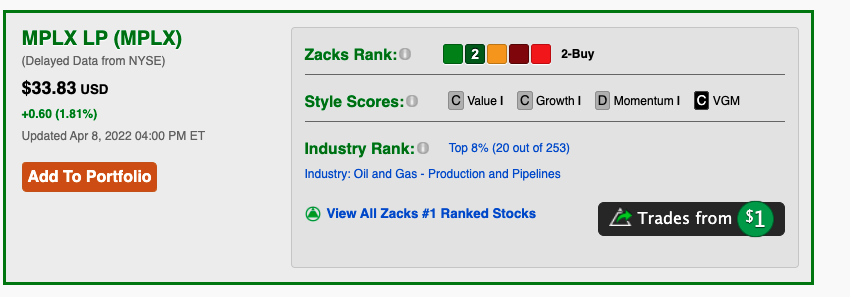

Zacks Rating :

Zacks’s Rating currently has it as a Buy.

Disclosure: At the time of writing I do not hold a position in MPLX stock. I have no plans to initiate any new positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. I am not a financial adviser. Please do your own due diligence. I am not a financial advisor.