Construction and manufacturing are in full swing in the current market. I was reading an article a few days ago new york times.

I noticed two things the supply chain issues will still remain for a few more months at the minimum and the war in Russia is going to increase gas prices which will impact the supply chain as well.

This company came into my Radar while I was looking for an alternate sector to Invest my Money in.

CMC stands for Commercial Metals Company is a steel and metal manufacturer based in Irving, Texas.

Steel is a required commodity in any construction business. This is a Chart of Steel

Currently, it is sitting at about 4831. And I believe that the prices will go up further up.

But that’s not the only reason why CMC caught my attention.

The fundamentals look very strong and the technicals are about to break out.

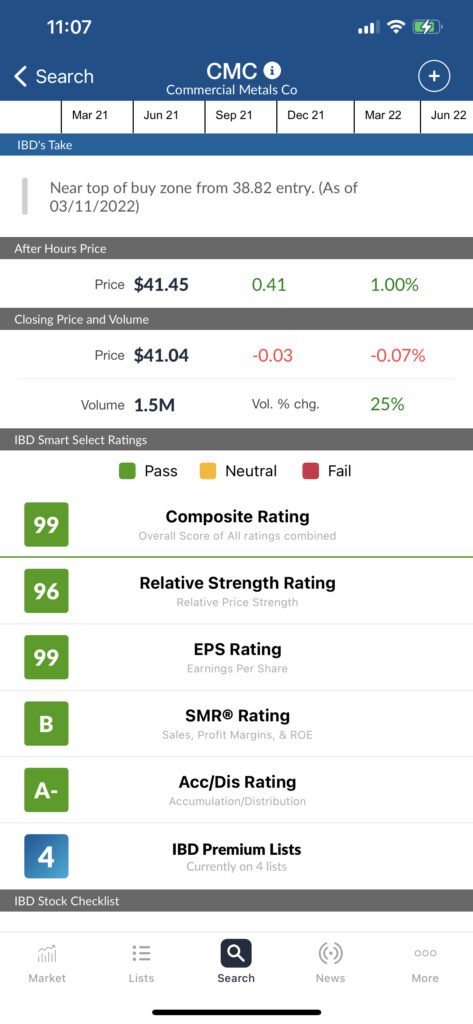

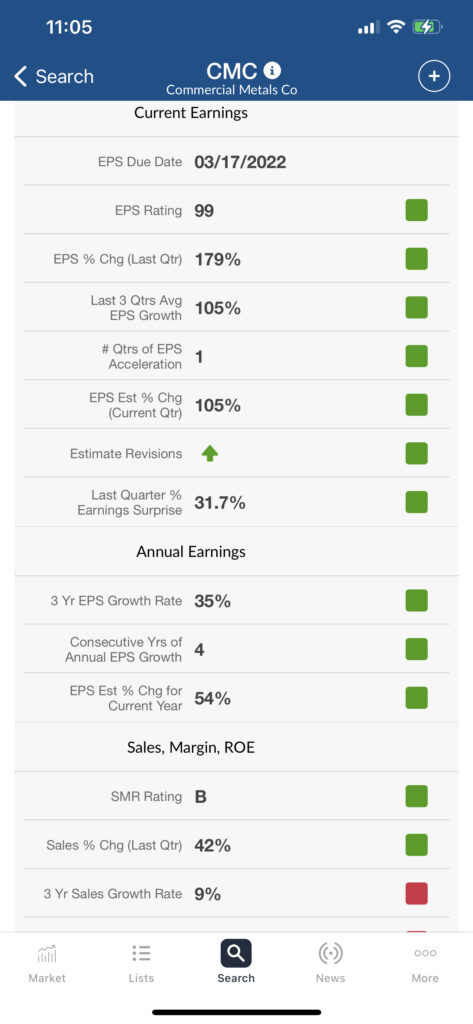

I just ran through CMC in Investors Business Daily and here is what I came up with

with a Composite Rating of 99 and a relative strength rating of 99. This stock is number 1 in the IBD stocks list for this sector.

Technical Analysis

The will to win, the desire to succeed, the urge to reach your full potential these are the keys that will unlock the door to personal excellence.

I was looking at the one-day chart of CMC and currently, the Support Line is at $39.97 and the resistance is at $41.00.I am adding a small portion here and waiting for it to break the resistance to add more.

Analyst rating:

I ran the stock on Tip Ranks. And the suggested pricing upside is around $47. But I am expecting it to reach at least $50 in a few weeks once consolidation happens.

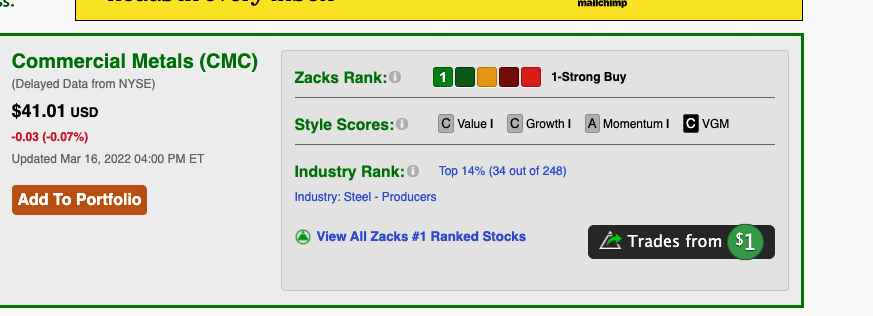

CMC also has a strong buy rating in Zacks

Disclaimer: I am not a financial advisor. Do not take anything on my website as financial advice, ever. Do your own research. Consult a professional investment advisor before making any investment decisions!