Semiconductors

I am a software programmer and I also have a small mining rig facility at my home. When I started crypto mining to put all of these together. ( It is a complex system with a Motherboard, CPU, fans, and its own GPUS). I needed Graphic cards to make this setup work. That is when I understood the demand for Graphic cards. It’s almost impossible to get 3080, 3090 Nvidia Graphics cards- Money is where the demand is). That is when I started investing in NVIDIA. This was late 2020. Every Graphic card will require Semiconductor chips. So will every EV car, Refrigerator, TV, Weather station, phone… The list is long

My portfolio is heavy with NVIDIA, AMD, and Intel ( It is currently bleeding but I am in this for a long haul)

But today I am not going to ask you to buy any of the above stocks. We are going to be buying a company that has a role to play in almost all semiconductors and chip production.

Trading is not only about finding good companies. It is also about finding solid suppliers for these good companies.

Example :

AAPL is a great stock to own ( I also have a major portion of my portfolio in AAPL). But there are suppliers of AAPL who have constantly generated profits. These are some major suppliers of AAPL. And all of them also cater to other tech giants.

- Intel (NASDAQ:INTC)

- Murata Manufacturing (OTCMKTS:MRAAY)

- Qualcomm (NASDAQ:QCOM)

- Hon Hai Precision Industry (OTCMKTS:HNHPF)

- Skyworks Solutions (NASDAQ:SWKS)

- Texas Instruments (NASDAQ:TXN)

- Samsung Electronics (OTCMKTS:SSNLF)

So some of these stocks are cheap For Example HNHPF is trading at $6 as I write this. This is despite consistent performance over the last five years and a net profit of $3.6 billion in 2021. This stock has room to grow.

So today we will take about a 7 Dollars stock that is going to play a critical role in helping large chips companies.

-

What you need to understand is what this company does.

Any semiconductor chip is generally created using silicon, germanium, or other pure elements. Semiconductors are created by adding impurities to the element.

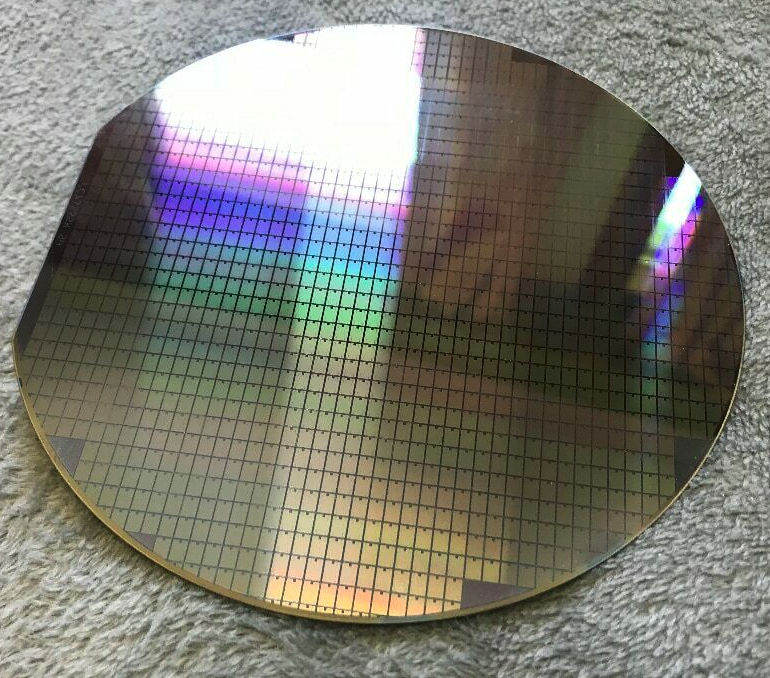

silicon is purified, melted, and cooled to form an ingot, which is then sliced into discs called wafers. Chips are built simultaneously in a grid formation on the wafer surface in a fabrication facility or “fab.

The wafer looks something like this

The chip is made on this wafer and complex computer software is loaded on each chip.

So the company we are going to be discussing today is one of the leading manufacturers of these Wafers.

UMC – United Microelectronics Corporation (UMC)

United Microelectronics Corporation operates as a semiconductor wafer foundry in Taiwan, Singapore, China, Hong Kong, Japan, the United States, Europe, and internationally. It operates through Wafer Fabrication and New Business segments. The company provides circuit design, mask tooling, wafer fabrication, and assembly and testing services. It serves fabless design companies and integrated device manufacturers. United Microelectronics Corporation was incorporated in 1980 and is headquartered in Hsinchu City, Taiwan.

So why are we bullish on UMC? ( Everything is in Taiwan Dollars)

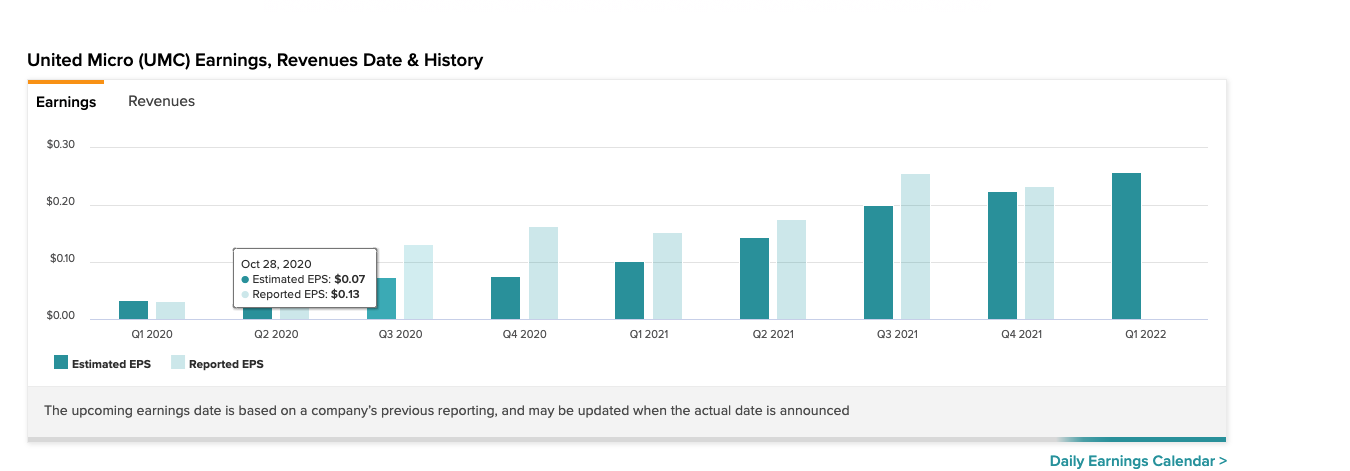

- The net income is about NT$20 billion, compared to NT$15 billion in the previous quarter, which is about 25% quarter-over-quarter growth and the EPS is NT$1.61 a share.

- Revenue in the earnings calls was 63.42B. In terms of year-over-year comparison, revenue grew up by 35% year-over-year, operating margins grew nearly two times to NT$22.3 billion and EPS also almost doubled compared to the same period of last year.

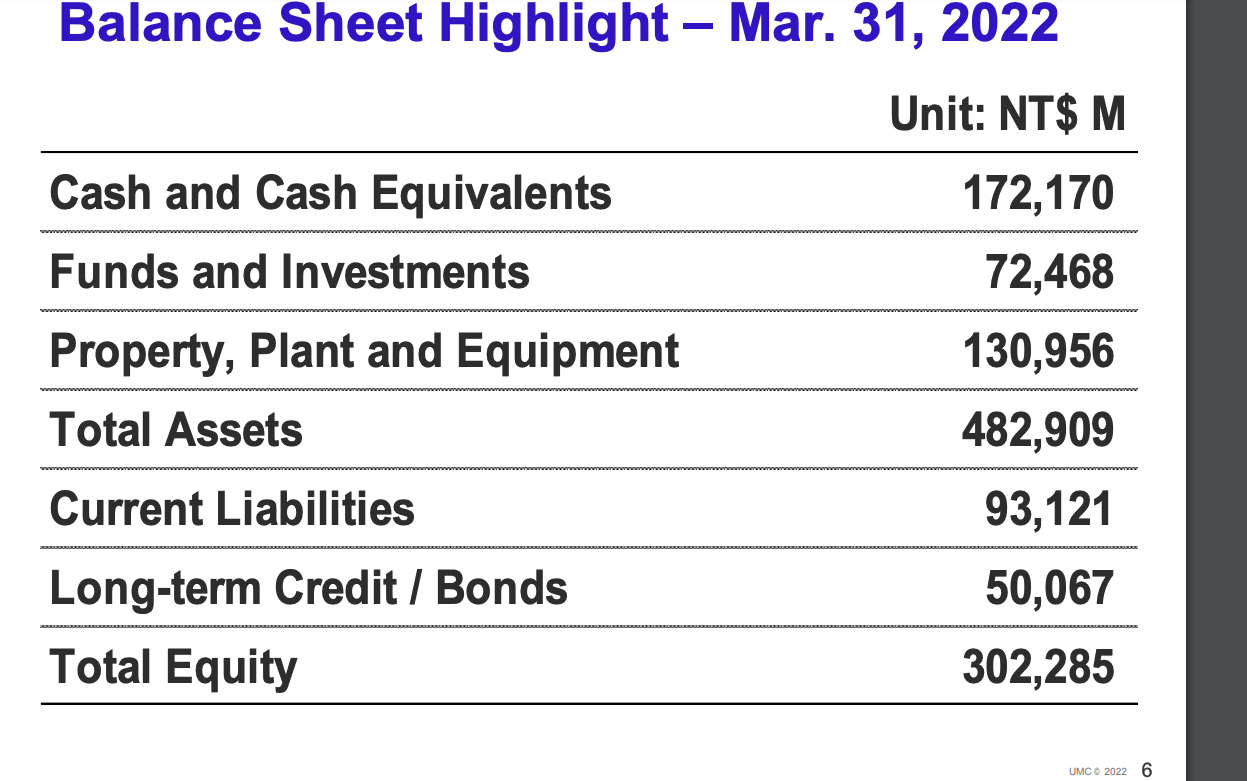

- In terms of our balance sheet revenue, cash remained strong at NT$172 billion and the total equity is about NT$300 billion.

In addition to all these strong factors. here is the Key takeaway from their earnings call.

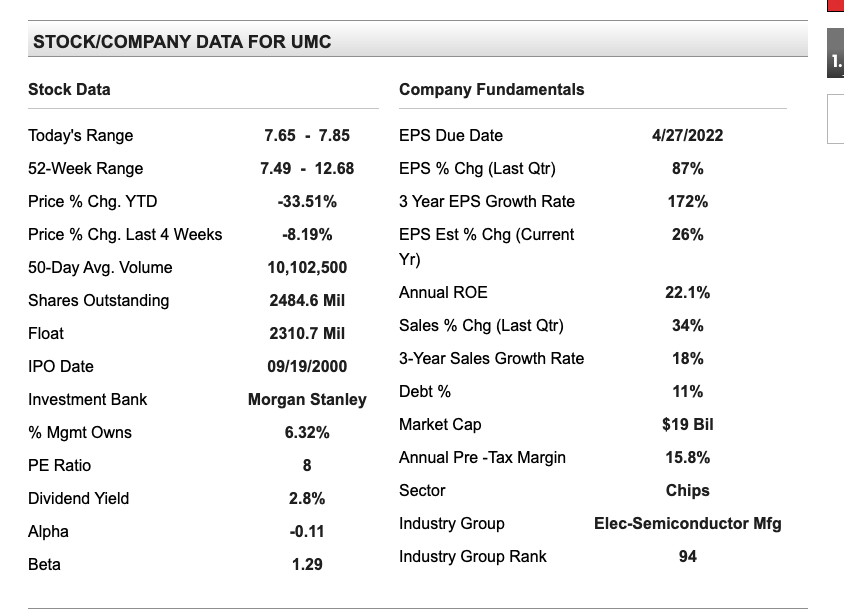

Fundamental Analysis

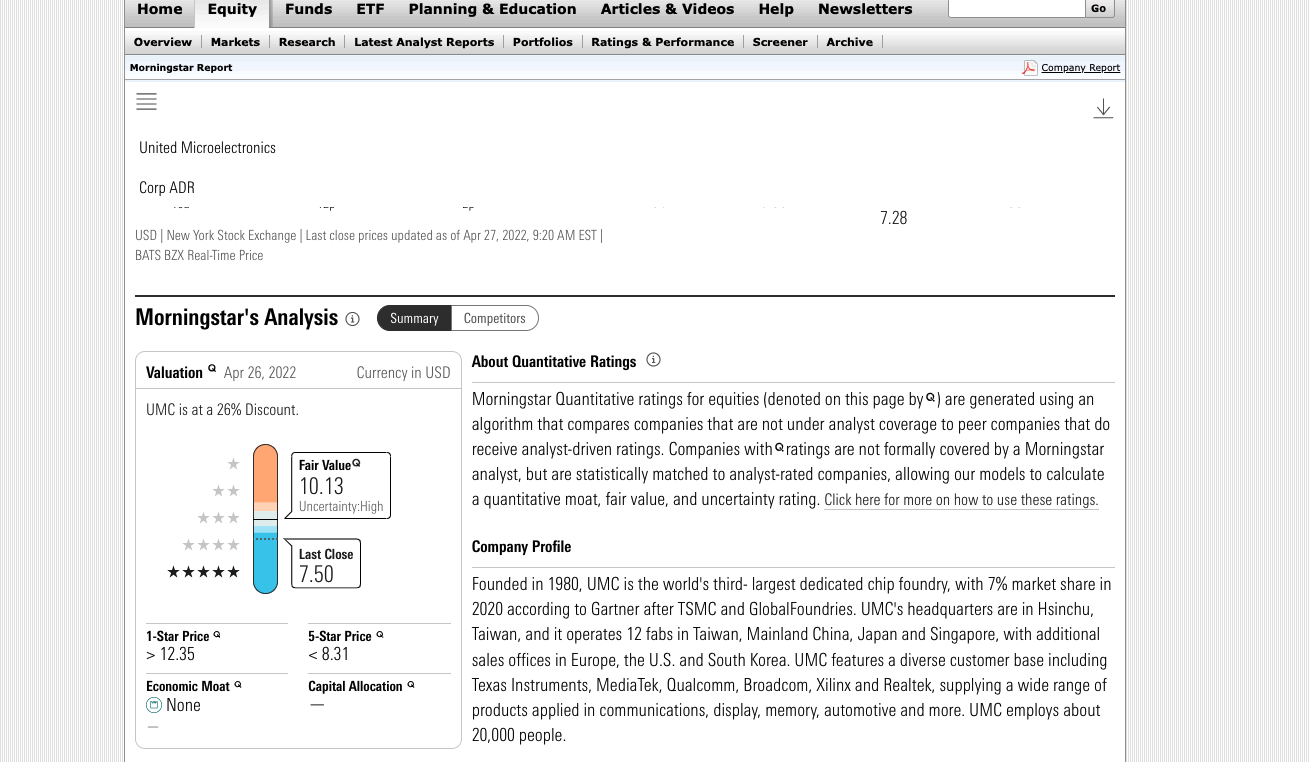

Morning Star Rating :

I ran the Stock in Morning Star, The Fair value evaluation came up lesser than the current price.

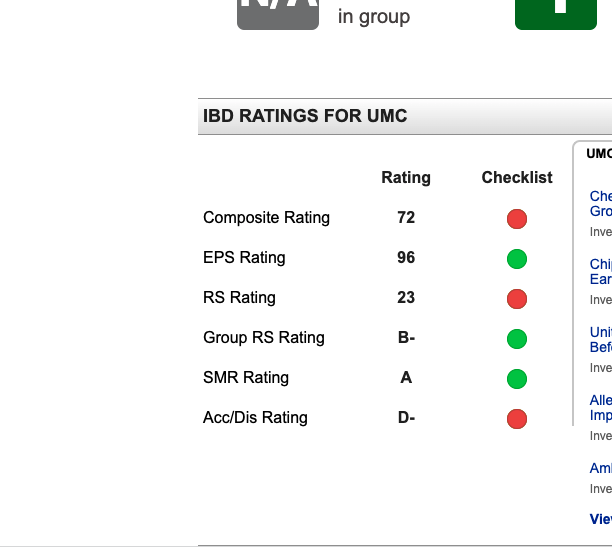

IBD Rating :

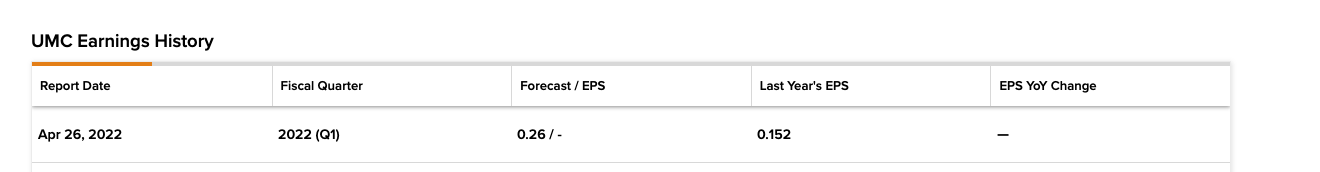

I ran the stock in IBD to check its Ratings. Currently, the stock is not ranked in that specific industry group Check the Chart below. The composite rating is around 72 which is not that impressive but they did miss earnings last month by a small margin. But their EPS is still solid.

Technical Analysis

I did a quick One Day chart analysis.

- Support @7.78 from a trend line in the daily time frame.

- Resistance is @8.44 from a trend line in the daily time frame.

- Resistance is also @9.21 and @9.63 and @11.98 ( This is when I sold them last year)

- My stop Loss will be @7.25

Note: They just had an earnings call today. I am holding this stock for at least 6 months. I used to own these stocks last year and sold them for profits. This is my second purchase.

I am looking to hold this stock for a few months. Do not put large money into this position. Remember capital preservation is key for trading.

I am looking to hold this stock for a few months. Do not put large money into this position. Remember capital preservation is key for trading.

Analyst Rating :

Tip rank Rating :

I ran the stock on Tip RANKS. No Data came up

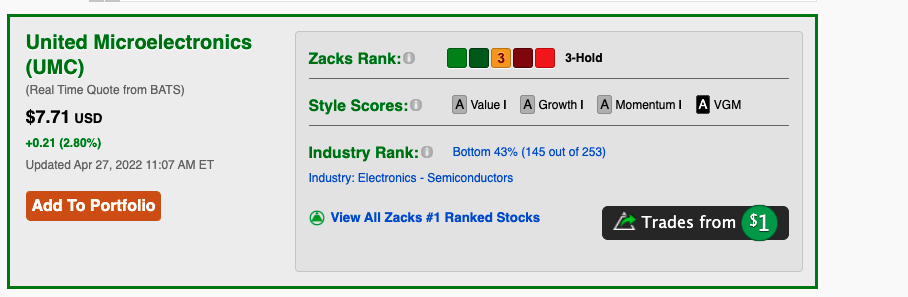

Zacks Rating :

Zacks’s Rating currently has a Hold rating.

Disclosure: At the time of writing I hold a position in UMC stock. I have no plans to initiate any new positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. I am not a financial adviser. Please do your own due diligence.