EV Batteries

AMZN, INTEL , AAPL reported earnings today. I was not surprised by AMZN earnings considering that they had almost 1 billion invested in RIVIAN. The stock took a beating. Another heavy weight TSLA reported earnings a few days ago. I played the Earnings call and quickly netted 1k in less than 3 hours of trading. الحمدلله . Sometimes Earnings could lead to quick profits. (I do not recommend this for New traders).

Coming back to TSLA. We all know that it is a EV giant and their cars are class apart. I have seen videos of NIO , XPENG and some other EV cars. They all look good. The world will eventually move to EV whether we like it or not.

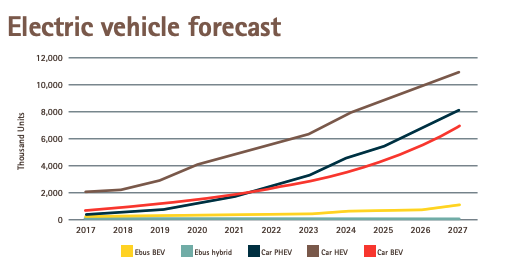

The demand for electric vehicles is expected to see major growth over the next ten years, driven by technology improvements, increased affordability and the deployment of more electric chargers. Please see the chart below.

But remember my philosophy Trading is just not about buying good companies, It is also about finding hidden gems. The Suppliers for these good companies.

What is the most primary requirement for all EVS ?

- Batteries.

What is the core requirement for all batteries required by EVs ?

- Copper and Lithium

All types of EV require a substantial amount of copper. It is used in batteries, windings and copper rotors used in electric motors, wiring, busbars and charging infrastructure.

-

How much copper is really used for EV ?

- Internal combustion engine: 23 kg of copper.

- Hybrid electric vehicle (HEV): 40 kg of copper.

- Plug-in hybrid electric vehicle (PHEV): 60 kg of copper.

- Battery electric vehicle (BEV): 83 kg of copper.

- Hybrid electric bus (Ebus HEV): 89 kg of copper.

- Battery-powered electric bus (Ebus BEV): 224–369 kg of copper (depending on the size of the battery).

So I decided to reenter a stock today that I had made good profits on early this year.

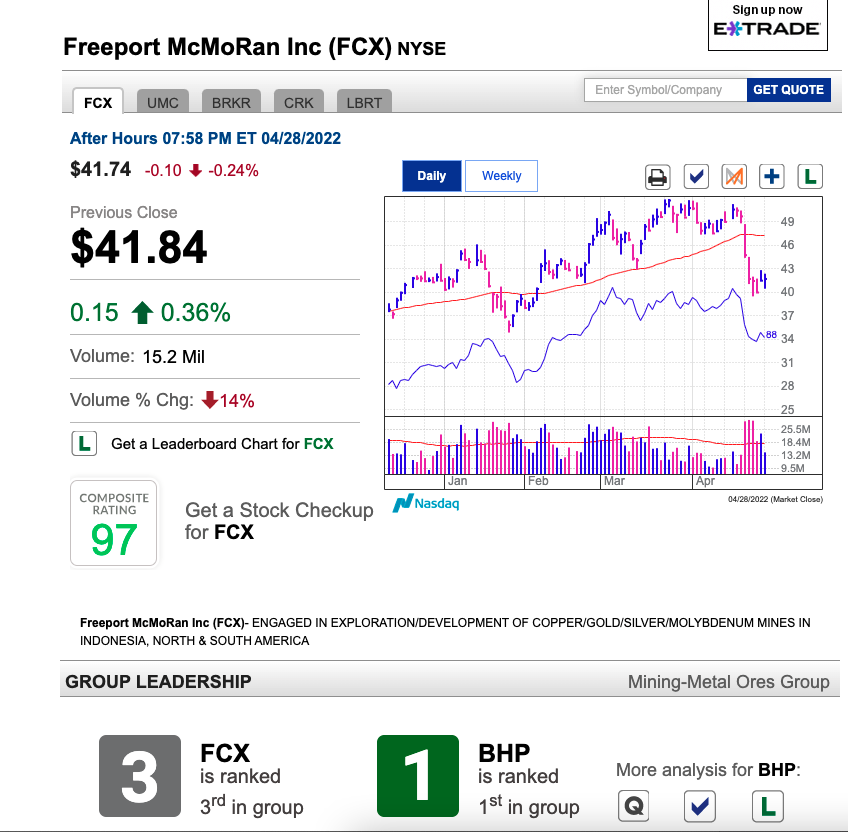

FCX – Freeport-McMoRan Inc

Freeport-McMoRan Inc is an international mining company. It operates geographically diverse assets with proven and probable mineral reserves of copper, gold and molybdenum. The company’s portfolio of assets includes the Grasberg minerals district in Indonesia; and mining operations in North America and South America, including the large-scale Morenci minerals district in Arizona and the Cerro Verde operation in Peru. It derives key revenue from the sale of Copper.

So why are we bullish on FCX ?

- Freeport-McMoRan posted a quarterly profit of $1,527 million or $1.04 per share, beating analysts’ expectations.

- Consolidated production totaled 1.009 billion pounds of copper, 415 thousand ounces of gold, and 21 million pounds of molybdenum in the first quarter of 2022.

- Revenues climbed 36.1% year over year to $6,603 million.

- The case for copper as a commodity is strong.

Fundamental Analysis

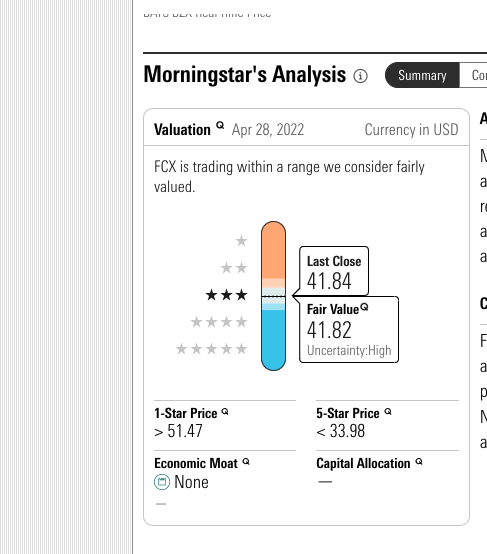

Morning Star Rating :

I ran the Stock in Morning Star, The Fair value evaluation came up lesser than the current price.

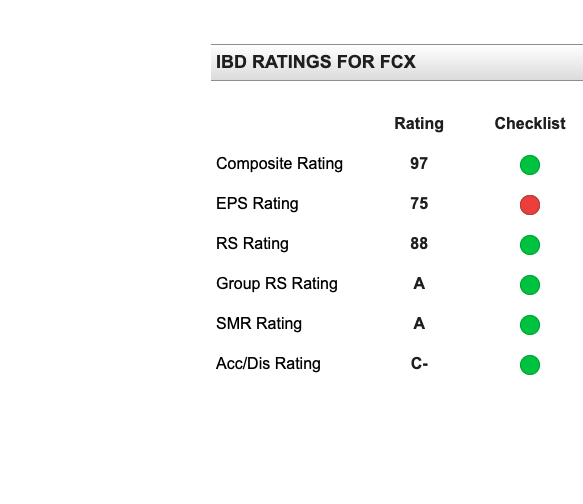

IBD Rating :

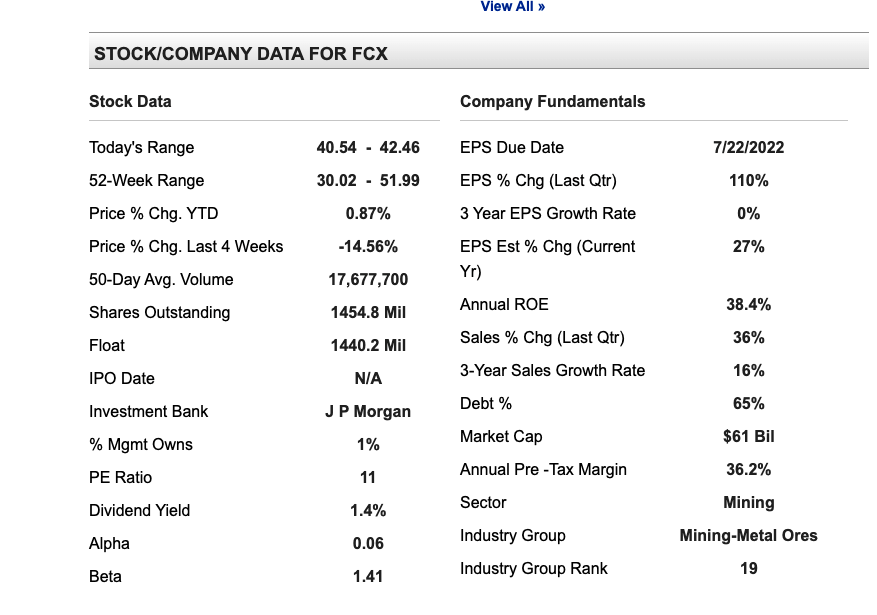

I ran the stock in IBD to check its Ratings. Currently, the stock is ranked Number 3 in that specific industry group Check the Chart below. The composite rating is around 97 which is highly impressive. The EPS has grown 110% in the last quarter. This stock has a potentials to grow atleast 40-50% in the next one year.

Technical Analysis

Current Chart

Support and resistance

I did a quick One Day chart analysis.

- Support @40.54 from a trend line in the daily time frame.

- Resistance is @42.90 and 42.66 from a trend line in the daily time frame.

- I sold the stock at about $47.56 a few months ago. I can see it getting back to that zone in the next few months.

I am looking to hold this stock for a few months. I will still follow strict Stop Loss on them.

Analyst Rating :

Tip rank Rating :

I ran the stock on Tip RANKS. The most conservative upside is at $ 49.93 at 19% return on investment. The long term upside is at $65.

Zacks Rating :

Zacks Rating :

Zacks’s Rating currently has a Hold rating.

Disclosure: At the time of writing I hold a position in FCX stock. I have no plans to initiate any new positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. I am not a financial adviser. Please do your own due diligence.