Bear Official

–

‘‘History never looks like history when you are living through it. It always looks confusing and messy, and it always feels uncomfortable.’’

How to recognize a bear market?

Any Bull market cannot be sustained if the economy is faltering. So when the market is closely watching everything the FED is deciding know that the market is bracing for a Bear market downtrend.

- When FED increases the Interest rate to Curb inflation

- Consumer and Investor confidence numbers are keenly watched and the market suddenly drops when those numbers come out.

- Gold: Interest in Gold and silver stocks picks up.

- Stock market action: When the volume of Large caps goes up but the prices don’t Change Much.

- The sharp rise in Debt: What can I say about US Debt !!

All indicators above point that we are going to see a sharp bear market in the coming months. You can click all the points above to give you an indicator that we are officially in a bear market.

What is the average Bear market percentage decline?

There has been a bear market every 4 years on average. The percentage of decline in bear markets ranges from as little as 13.9% up to 90%. The last one was in 2020 and it lasted for 90 days.

On average, a Bear market lasts about 289 trading days.

Only This time I think the Fed will let the economy goes into recession to tackle inflation, There is no other way around it IMHO.

The S&P 500 has dropped 21% from its early January all-time high. One of the most powerful drivers of that has been high inflation.

Quick note: If you still have not sold your stocks here is some advice

“It’s too late to sell and too early to buy.”

Even though the bear market is just getting started. The selling has even not started yet. We should start seeing heavy selling in the next few weeks.

All major news channels, Fed meetings, and economic health do point to a bear market. So in this article, I want to explore the steps to be profitable in a bear market. ( Yes we can )

- Don’t be an optimist, Neither a pessimist, Be a realist.

Do not take trades in hope that the company is a good investment. I agree that large companies are a good place to invest and most groups and analysts will ask you to buy Microsoft, Apple, TSLA, CVS Etc. No doubt these companies will always have a comeback. But some comebacks can take years.

Example: MSFT dropped to around 15 in November 2008 for it to come back to its original price of 31. It took it close to 1.5 years.

Nov 2008 – Jan 2010.

Another example is that of Cisco which never recovered after that shock.

- When to Buy is more important than what you buy in a bear market.

TSLA in my opinion is a great stock to own. ( I have them الحمدلله ) . But during the 2020 market crash. I bought the stocks at around 400 USD. ( Sure I doubled my account in less than 6 months ) But The stock during 2020 went way below 400 and was trading at $84 Dollars. If I had just waited a few more days. I could have picked up a lot more of TSLA.

So be a realist and pick the stocks when they are bottoming out and don’t catch the falling knife. ( chart pattern)

- Understand sectors that are least affected by inflation. ( since this is a recession based on inflation

Companies that operate mostly in the Digital/ Software development space will lead the upward trend because they have little exposure to inflationary pressures that affect both raw materials and inventory. They are also not affected by Supply chain issues. Staples, utilities, master limited partnerships, or healthcare are better positioned to make a quicker recovery than other stocks.

-

Beware of Secondary reactions :

Watch for Dead cat bounce or DECEPTIVE RALLIES :

You will see small rallies or stocks trying to make a comeback for a day or 2 to just sizzle back. Be careful to confuse this as the end of a bear market. You can make quick money playing short swings. Never enter stocks in hopes of sharp rises.

How to trade in a bear market :

- Fundamental Analysis is of little use during bear markets

As you know that on our website we believe that stocks that have good fundamentals are safe investments and we enter based on technical analysis on what is the best time to enter and what is the right exit. For a bear market, this theory needs to be set aside.

- Rely on Technical Analysis

Technical analysis: The charts do not lie. It relies on reading charts and price data action and not on inside information. The price is a price. We just follow the money.

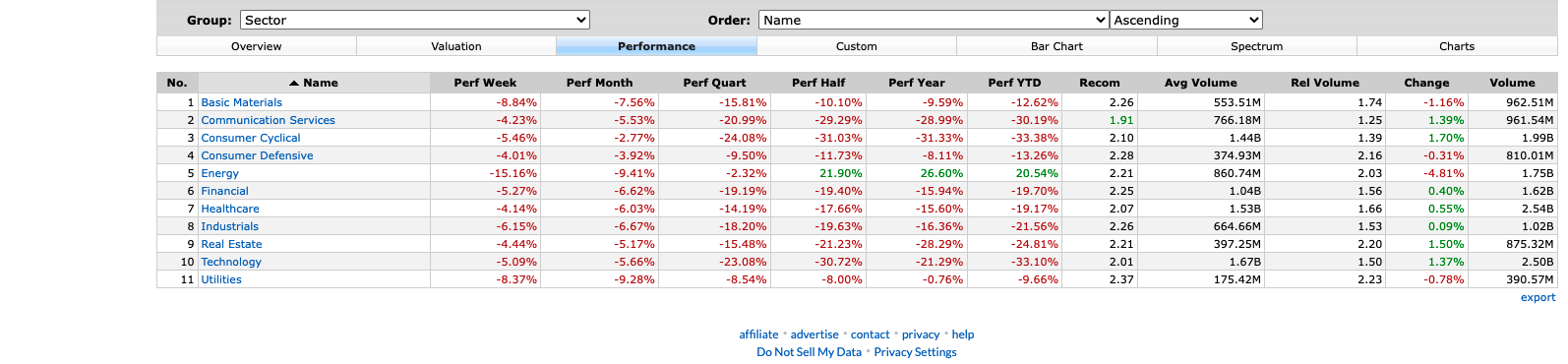

Quick note: Every day make it an exercise to look at finviz to see the charts of major sectors to see where the money is flowing and where it is going out.

- DAILY NEW HIGHS AND LOWS

In bear markets, one watches the daily new highs and lows differently. If the highs can remain superior on a new down leg in a bear market, there is a chance you are seeing a reversal, from bear to bull.

Every Bear market has legs

Initial phase :

How can we make money in the bear market in the initial phase of the bear market:

Note: This is for Traders only if you are an investor which means you can buy and hold for years. (High volatility ) Then just buy and not look at the price action. My primary purpose is to grow my account and I use swing and day trading. For the long term, I have a section called black box on this site. I haven’t added anything new there.

- Preserve your capital during the bear market: The most fundamental approach to trading in bear markets is to preserve capital. The opportunities present themselves quickly and you need to have the capital to grab them with both hands.

- Trade short swings or Day Trading: Trade based on Earnings, dividends, and squeeze out small profits of 5-10 % and maintain a Stop loss of 5 % on each of the positions.

- Trade less number of stocks: Buy a few stocks that look bullish on their charts as perhaps 10 to 25% of total stocks may, if it is not too far along in the intermediate term, up-move (i.e., the secondary reaction in a bear market). Thus, you’ll get a nice play for several points of profit, assuming you have done your chart reading properly. You should pick stocks that have little apparent downside risk and good support levels: ( IBM, NVDA, CVS, Energy stocks ) stocks that are in a new uptrend and enjoy increased volume, and perhaps have something fundamentally bright. ( This can be optional).

- The attack is the best defense: We all need to learn to trade like guerrilla soldiers. Get in, take profits and get out. Buy and Hold does not always work in the bear market especially if it is during the initial leg of the Bear market.

- Keep emotions aside: During the Initial days of my trading. I followed every book I read, course, and technical indicator to make money. I kept losing it only to realize that the problem was not with the course or technical indicators. The problem was ME. I just did not know how to control my emotions during trading.

This one realization led to making some ground rules.

a) Get rid of all weak investments – I was holding a lot of Penny stocks, and OTC markets, and seeing them red every day just made it worse. So I took the bullet and got rid of them.

b) I held on to my strongest stocks no matter what the outcome was because I believed in those companies. I still hold NVDA, FB, TSLA, AAPL, and some others.

6) Trade without pride or Ego: I cannot count the number of times my Ego came in between me and my trades to just ruin my positions

Ex: Back when I was a confused trader ( I bought NKLA at 85 dollars once because I thought it was the best investment and can soon reach 1000 just like TSLA). When others were selling I held on to it. I just did not want to believe that I could make a mistake with this stock pick. A year later I sold it for 17 dollars. Pride or Ego is a good thing but not in trading, you have to accept that you made a mistake and close your losers early and move on to the next. Not everybody has a 100% track record. Our job is to minimize these errors and find ways to park our capital in stocks that can quickly generate 5-10 % profits.

7) Move to shorter swings or DayTrades and buy stocks based on Momentum and price action along with technicals. Only Trade a handful of stocks to squeeze money from the market. IBM, TSLA, CVS, AAPL. All of these stocks give at least 3-4 opportunities every day to make 2-4% on their positions. ( I will do a summary of how to Day Trade and when to enter and when to exit soon)

End Phase :

-

How to identify if the bear market is ending :

I have experienced 3 bear markets. As a novice trader in 2008 ( I got annihilated and lost almost all of my position ) back then I thought that I would never enter stocks again. I reentered stocks again in 2015 to make moderate gains to lose them again. But in 2020 I was well prepared. I doubled my portfolio in 2020 because I was conservative in my approach and held onto capital to buy stocks that were a mix of growth and value.

By default, no one can accurately predict the end of a bear market but there are some indicators.

- Unemployment slightly decreasing, and CPI (Consumer Price Index ) numbers showing slight improvements.

- Latent buying power: It means that the people will have large holdings in bonds, Gold mining, and cash-related investments. This lack of Money flowing into the market is actually what gives stamina to the Bull market.

- Volume increase of major ETF ( SPY, QQQ), Options tape showing higher bid-ask prices.

- Zero confidence from experts: Most news channels like Bloomberg and market watch will put a pessimistic forecast for the markets and the business. The market rises when it is least expected. (Check the History).

- Government bonds: Buying off the Government bonds is increasing but the yield is going down.

- Things we can do to make money in the bear market in the last phase of the bear market :

- Buy mid-size companies’ stocks that have a rising Relative strength. (RSI indicator) on the chart is a good indicator. Check IBD for fundamentals.

- Trade only fewer stocks. Try medium-quality stocks. ( PLTR, NIO, LCID, AMBA AGL,ALB,CHWY, GWRE, PEAK, LYFT, OKTA, PEGA, PNR, RNG, ROK) Etc.

- Pick up some airline stocks, Cruise stocks, and healthcare stocks.

Just don’t buy any stock that looks healthy; you pick those that traditionally (not certainly, mind you) rise fastest in the first phase of a bull market. This usually means low-priced or middle-priced stocks. Blue chips normally come much later. (Check History again)

If you have learned anything from this article. Please share with your friends.