بسم الله الرحمن الرحيم

PS : I am a computer science engineer who loves numbers. I am no Mufti and I trade any stock that does not deal with

- Riba

- Porn

- Gambling

- Alcohol

- Pork

Please do your due diligence for the investments.

Here are some of the Stocks that I have traded and recommended on this site.

$CVE ➡️ $18.12 ➡️ $24.20 💸 33% gain! 📈

$MNRL ➡️ $26.43 ➡️ $32.58 💸 23% gain! 📈

$MPLX ➡️ $33.83 ➡️ $35.58 💸 5% gain! 📈

$MTDR ➡️ $54.99 ➡️ $64.17 💸 16.69% gain! 📈

$NFE ➡️ $41.96 ➡️ $49.60 💸 18.21% gain! 📈

$GOGL ➡️ $12.52 ➡️ $16.43 💸 31.23% gain! 📈

$SSRM ➡️ $20.21 ➡️ $23.67 💸 17% gain! 📈

$EQT ➡️ $43.52 ➡️ $ 48.43 💸 11.28% gain! 📈. ( Alerted on Whatsup App)

$SBLK ➡️ $29.99 ➡️ $33.84💸 12.84% gain! 📈 ( Alerted on Whatsup App)

$AMR ➡️ $147.49 ➡️ $181.62 💸 23% gain! 📈 ( Alerted on Whatsup App)

$RBLX ➡️ $29.72 ➡️ $33.95 💸 14.23% gain! 📈 ( Alerted on Whatsup App)

$MRK ➡️ $89. 42 ➡️ $94.78 💸 5.99% gain! 📈 ( Alerted on Whatsup App)

Most Recently here are how some of recommendations have turned out.

NVDA ➡️ $270 ➡️ $1100 ( Before Split) 💸 307 % gain 📈

$IOT ➡️ $39 ➡️ $47.33 💸 21.35% gain 📈 ( Alerted on Instagram and whatsUp) – https://www.instagram.com/p/C4beB1EqKcA/

CLRX ➡️ $129.40 ➡️ $167.75 💸 29.64 % gain 📈

GEHC ➡️ $78.82 ➡️ $88.53 💸 12.31 % gain 📈

ONON ➡️ $39.90 ➡️ $49.15 💸 23.17 % gain 📈

FCX ➡️ $43.63 ➡️ $41.81 💸 -4.17 % Loss 📈 ( Holding)

CELH ➡️ $40.60 ➡️ $33.00 💸 -18 % Loss 📈 ( Holding)

QUICK ➡️ $11.65 ➡️ $ 7.52 💸 -35 % Loss 📈 ( Holding) Should have sold it when it came to breakeven

But overall I am happy with the progress الحمدلله.

I only recommend Swing trading ideas on my website. I also day trade a separate list of liquid stocks. (That is for some other day)

Coming back to our new swing stock.

The Critical Role of Lithium in Modern Technology and Why This Stock May Be a Good Investment

Lithium, a soft, silvery-white alkali metal, has become an indispensable component in modern technology. Its unique properties make it an ideal material for various applications, particularly in the production of rechargeable batteries. The widespread adoption of electric vehicles (EVs) and renewable energy systems has significantly increased the demand for lithium, driving its market value to unprecedented heights. However, recent market trends have seen a decline in lithium prices due to oversupply, prompting major producers like CATL to adjust their production strategies. This adjustment could signal a shift towards a more balanced market, making lithium-related investments more attractive.

The Importance of Lithium

Lithium is a key element in the production of lithium-ion batteries, which power a vast array of devices, from smartphones and laptops to electric vehicles and renewable energy systems. The increasing global focus on reducing carbon emissions and transitioning to cleaner energy sources has led to a surge in demand for lithium-ion batteries. As the world moves towards a more sustainable future, the importance of lithium cannot be overstated.

Market Trends and Adjustments

The lithium market has experienced a significant downturn in recent times, with prices plummeting from a peak of $78,000 per metric ton in November 2022 to $10,500 per metric ton. This oversupply has led many lithium producers to slow or pause their supply expansion plans or announce supply cuts. The recent news of CATL’s plan to adjust lithium production at its lepidolite-based mines in China marks one of the first major supply cuts in 2024. This move is expected to bring the lithium market closer to balance, which could have a positive impact on lithium-related investments.

Fundamentals of the Company

The company in question has demonstrated resilience and adaptability in the face of market fluctuations. With a strong focus on sustainable mining practices and a commitment to reducing its environmental footprint, it has positioned itself as a responsible player in the industry. The company’s diversified operations and strategic partnerships have allowed it to maintain a stable financial position, even in the face of declining lithium prices.

Why This Stock May Be a Good Investment

Given the critical role lithium plays in modern technology and the recent market adjustments, this stock presents an attractive investment opportunity. The company’s commitment to sustainability and its diversified operations make it well-positioned to capitalize on the expected market balance. As the demand for lithium-ion batteries continues to grow, companies like this one, which are focused on responsible and efficient production, are likely to benefit from the increasing demand.

The Stock: A Good Investment for the Future

The company in question is Lithium Americas Corp. (LAAC), a company that has demonstrated its ability to navigate the complexities of the lithium market while maintaining a focus on sustainability. With the expected market balance and the continued growth in demand for lithium-ion batteries, this stock offers a promising investment opportunity for those looking to capitalize on the future of clean energy and technology.

Lithium Americas (Argentina) Corp., or LAAC, is a company involved in the mining and production of lithium, a key component in electric vehicle batteries and other clean energy technologies. The company’s primary focus is on its Thacker Pass project in Nevada, which is expected to be one of the largest known lithium resources in the United States. LAAC also has interests in the Pastos Grandes project in Argentina, which is a significant brine operation.

Regarding their mining operations, LAAC’s Thacker Pass project is designed to produce 40,000 tons per annum (tpa) of lithium carbonate, with potential expansion to 60,000 tpa by 2025. The project’s high-grade ore allows for efficient leaching in stirred reactors, minimizing sulfuric acid consumption. The resulting lithium-bearing solution undergoes pH-neutralization before further processing.

In terms of locations, LAAC’s main projects are:

- Thacker Pass, Nevada, USA: This is LAAC’s flagship project, which hosts the largest known Measured and Indicated lithium resource in the United States. The project is expected to have a 40-year mine life.

- Pastos Grandes, Argentina: This is a significant brine operation that LAAC has an interest in, with a potential to produce 40,000 tpa of lithium carbonate.

What does Morning star say ?

Morning star says the stock is at 87% discount.

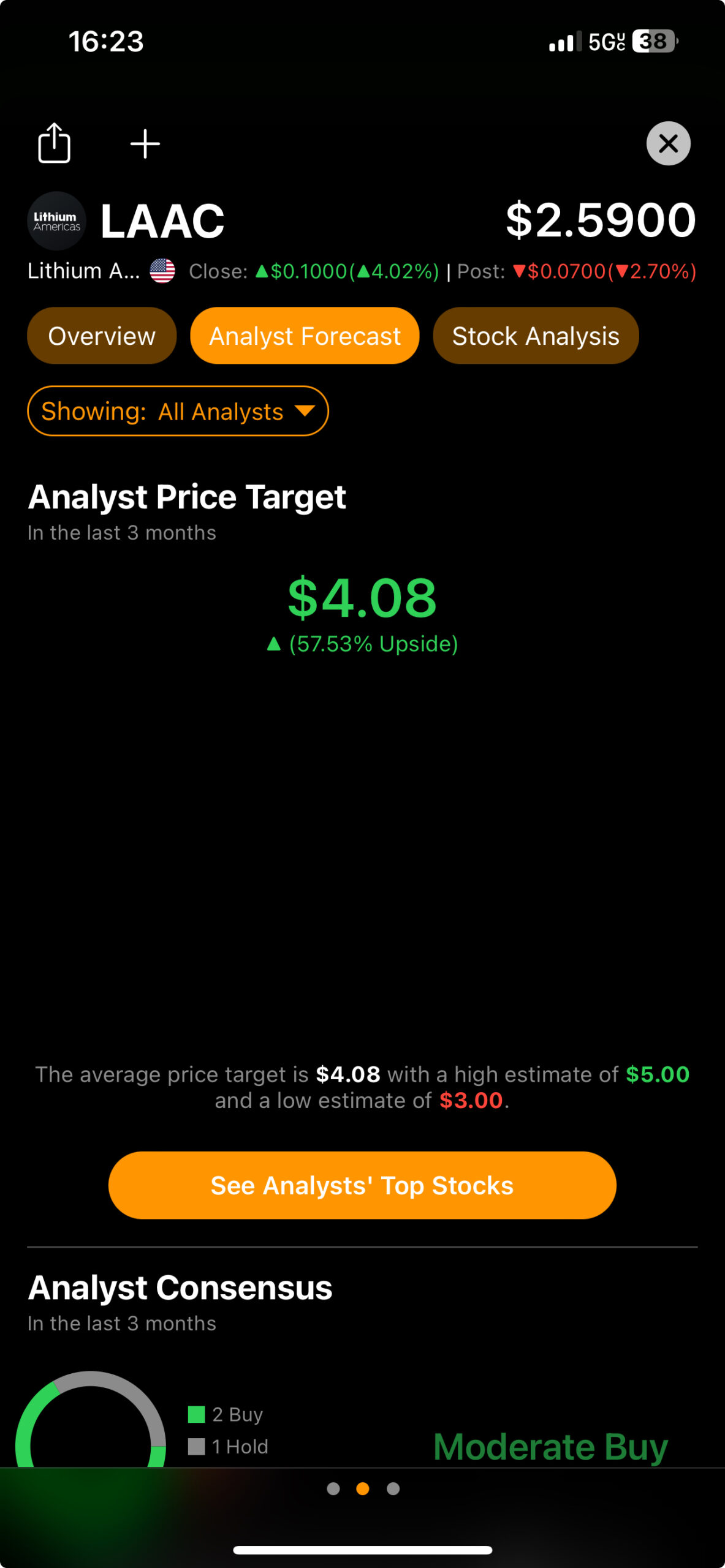

Tip Ranks :

Tip ranks thinks it was a 57 % upside

Please note :

This is a risky investment.

The information provided in this article is for general informational purposes only and should not be considered as investment advice. The author and the publisher are not financial advisors, and the content is not intended to be a recommendation to buy or sell any securities. It is essential to do your own research and consult with a financial advisor or a registered investment advisor before making any investment decisions. The author and the publisher are not responsible for any losses or gains resulting from the information provided. The content is based on the author’s opinions and should not be considered as personalized investment advice. It is recommended that you seek professional advice from a qualified financial advisor and conduct your own research before making any investment decisions.