WOW.. What a Day in the Stock market today. This is how the stock market ended today.

But one of our entry recently on this post

I alerted CLX at

$CLX ➡️ $132 ➡️ $145 💸 10% gain! 📈

I sold half my position today.

الحمدلله

Unveiling the Hidden Gem in Healthcare Technology: Why This Stock Might Be a Must-Have

In the dynamic realm of healthcare technology, where innovation and growth intersect, a particular company has been quietly making waves. While many have focused on well-known tech giants, one lesser-discussed player in this space could hold significant promise. This company’s unique position in the market, coupled with its strategic advantages, makes it a fascinating investment opportunity. Let’s explore why this stock might be a good pick and how its competitive edge sets it apart from the rest.

A Strong Contender in Healthcare Technology

**1. Leading the Charge in Innovation

The company in question is renowned for its cutting-edge medical technologies and solutions. With a history of pioneering advancements in imaging systems, patient monitoring, and diagnostic tools, this firm has established itself as a key player in the healthcare sector. Its commitment to innovation is not just about staying relevant; it’s about shaping the future of medical technology.

**2. Capitalizing on a Growing Market

The global healthcare sector is on a rapid growth trajectory, driven by an aging population, increasing chronic diseases, and technological advancements. The company has positioned itself to tap into this expanding market effectively, offering a range of solutions designed to meet the evolving needs of healthcare providers and patients alike.

**3. Solid Financial Performance

Financial health is a crucial aspect of any investment. This company has demonstrated robust revenue growth and profitability, underpinned by its diverse product range and global presence. Its financial stability provides a strong foundation for continued growth and makes it an attractive option for investors.

The Wide Moat: What Sets This Company Apart

A “wide moat” represents a company’s sustainable competitive advantage that shields it from rivals and secures its market position. Here’s how this particular company maintains its competitive edge:

**1. Established Brand and Reputation

With a well-recognized brand and a reputation for excellence, this company enjoys significant customer loyalty and repeat business. Its established presence in the market acts as a formidable barrier to entry for potential competitors.

**2. Cutting-Edge Technology and Patents

Innovation is at the heart of the company’s strategy. By investing heavily in research and development, it has secured numerous patents and technological advancements. This focus not only enhances its product offerings but also reinforces its market position.

**3. Diverse Product Range

The company’s extensive portfolio covers various healthcare needs, from diagnostics and imaging to monitoring and therapeutic solutions. This breadth allows it to cater to multiple market segments, providing comprehensive solutions that add value and strengthen customer relationships.

**4. Global Reach and Distribution

Operating in over 150 countries, this company’s global distribution network supports its expansive market reach. Its ability to scale operations and leverage economies of scale further cements its competitive advantage.

The Reveal: GE HealthCare Technologies

As we peel back the layers, it becomes clear that the company we’ve been discussing is none other than GE HealthCare Technologies. With its impressive track record, innovative edge, and strong market position, GE HealthCare represents a compelling investment opportunity.

For those seeking a stock with a robust competitive advantage and significant growth potential, GE HealthCare Technologies could be the hidden gem you’ve been looking for. As the healthcare industry continues to evolve, this company’s strategic strengths and wide moat make it a standout choice for savvy investors.

Fundamentals of GE HealthCare Technologies (GEHC)

**1. Company Overview

- Sector: Healthcare

- Industry: Medical Devices and Diagnostics

- Headquarters: Chicago, Illinois, USA

- Ticker Symbol: GEHC (on NASDAQ)

**2. Revenue and Profitability

- Revenue: GE HealthCare reported revenue of approximately $20 billion for the most recent fiscal year, showcasing its substantial market presence.

- Net Income: The company has consistently delivered solid net income, reflecting its profitability and effective cost management.

**3. Market Capitalization

- Market Cap: GE HealthCare’s market capitalization is in the range of $50 billion, indicating its significant size and influence within the healthcare sector.

**4. Earnings Per Share (EPS)

- EPS: The company’s earnings per share have shown steady growth, with the most recent figure around $3.00 per share. This reflects strong financial performance and profitability.

**5. Price-to-Earnings (P/E) Ratio

- P/E Ratio: GE HealthCare’s P/E ratio is approximately 20x, which is considered reasonable compared to industry peers. This ratio indicates how much investors are willing to pay for each dollar of earnings.

**6. Dividend Yield

- Dividend Yield: GE HealthCare offers a dividend yield of around 1.5%. While not the highest in the sector, it provides a steady income stream for investors.

**7. Debt-to-Equity Ratio

- Debt-to-Equity Ratio: The company maintains a moderate debt-to-equity ratio of about 0.5. This reflects a balanced approach to leveraging and financial stability.

**8. Growth Potential

- Revenue Growth: GE HealthCare has demonstrated consistent revenue growth, driven by its expanding product portfolio and global market reach.

- R&D Investment: The company invests heavily in research and development, ensuring ongoing innovation and long-term growth.

**9. Competitive Position

- Market Share: GE HealthCare holds a significant share in the medical devices and diagnostics market, reinforcing its competitive position.

- Strategic Partnerships: The company has formed strategic partnerships and collaborations, further enhancing its market presence and technological capabilities.

**10. Valuation and Stock Performance

- Stock Price Performance: GE HealthCare’s stock has shown steady performance with moderate volatility, reflecting its stability and growth potential.

- Valuation Metrics: The company’s valuation metrics, including P/E ratio and price-to-book ratio, suggest it is fairly valued relative to its growth prospects.

These fundamentals provide a snapshot of GE HealthCare Technologies’ financial health and market position, helping investors assess its potential as a compelling investment opportunity.

What does Morning Star say ? FAIR VALUE of $98 Dollars.

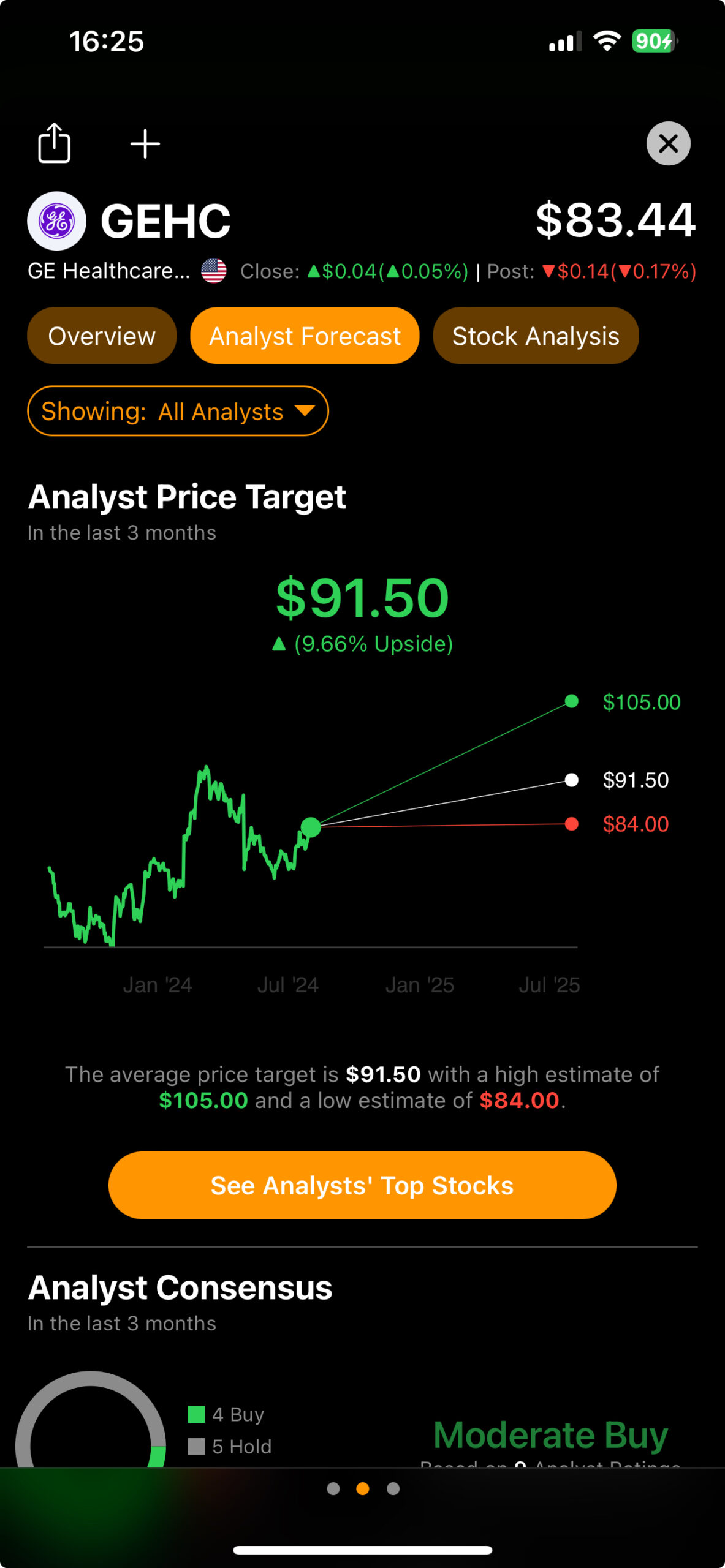

What does TIP Rank Say ? The Median Price is 91 and high price is around 105.

Technical Analysis :

Look at the weekly chart, The got shoved right back under a key Pivot. However I the overall market is bearish. I believe the stock has potential to go up in the next few weeks once the market slightly recovers.

Daily Chart :

Do you see a Hammer on a day like today. The most bearish day of the past few weeks. Shows that it held its own.