HealthCare Again

–

I wrote a summary in my previous article about health care costs in America and their impact on financial systems. Today while still remaining focussed on health care we will look into a mix of technology with health care. There are a lot of companies who have benefited from integrating health care with technology in recent years some went on to become Multi billion-dollar enterprises. Zocdoc for example.

The world today is moving at a rapid pace. 5g, Meta, Blockchain, Machine learning, and Artificial intelligence will all play a big role in how Health care providers will use technology in treating patients. With all the use of new technology, the insurance companies will keep raising their profit barometers. The company we discuss today is using technology for payments and controlling health care costs, especially for Medicaid and medicare

I found a company that I think might benefit a lot in the next few years if we purchase this stock.

Note: I only alert articles on the companies that I am interested in buying or I have already bought. I trade them and I have a certain profit percentage in mind. I sell them when that profit hits. I am a Swing trader and my target is to grow my investment capital. All the stocks I recommend can also be used for long-term investments. (I only recommend companies that are fundamentally strong and have growing revenue and EPS ), Provided you keep a close eye on your Stop Loss and cut the losers early.

Evolent (EVH)

Evolent Health Inc is engaged in healthcare delivery and payment. The company supports health systems and physician organizations in their migration toward value-based care and population health management. The company’s reportable segments are Service segment which includes value-based care services, specialty care management services, and comprehensive health plan administration services. and True Health segment consists of a commercial health plan it operates in New Mexico that focuses on small and large businesses. It generates a majority of its revenue from the Service segment.

So why are we bullish on EVH?

-

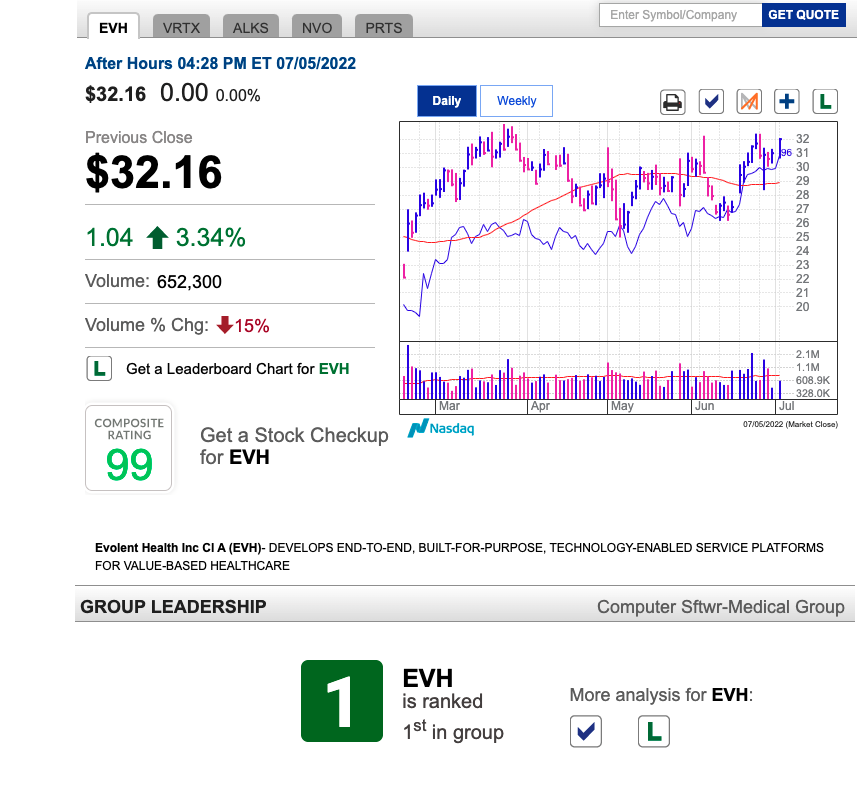

It is currently ranked 1 in the Computer Software-Medical industry group stocks in IBD.

- Evolent works with Medicaid, Medicare, and private health plans to analyze cost and payment structures. Which is going to be the key in controlling health care costs.

-

EVH is part of the Health Care Technology industry. There are 53 other stocks in this industry. EVH outperforms 96% of them.

-

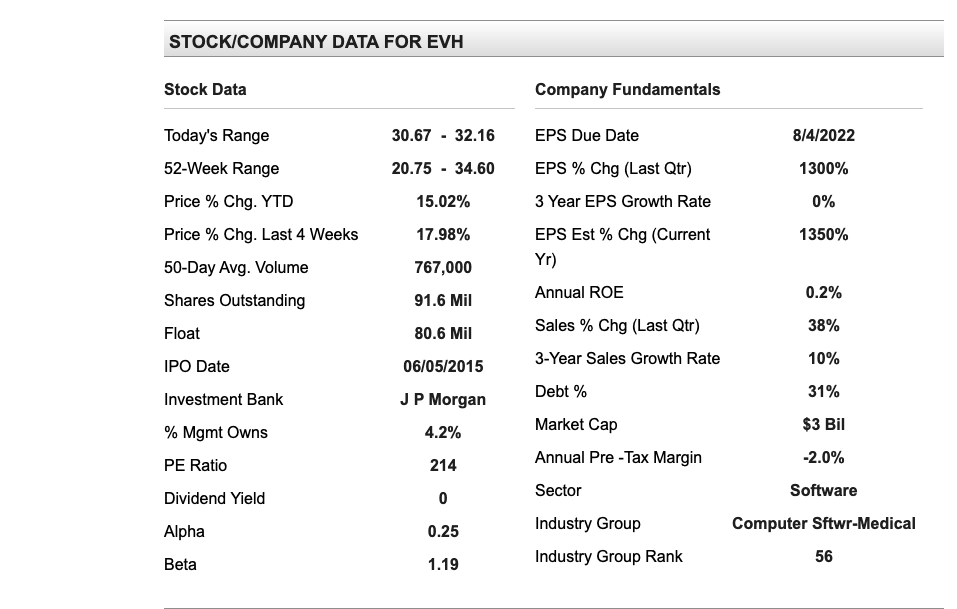

The company grew its revenue by 38% in the first quarter to $297 million. EPS swung from a year-ago loss of 1 cent to a profit of 12 cents in the first quarter. EVH’s full-year guidance for 2022 sees revenue of $1.16 billion to $1.21 billion. Adjusted EBITDA is expected to be in the range of $85 million to $95 million.

- Volume is considerably higher in the last couple of days, which is what you like to see during a strong move-up.

- Recently Evolent agreed to acquire IPG, a provider of surgical management technology for musculoskeletal conditions. Which would grow its revenue.

Fundamental Analysis

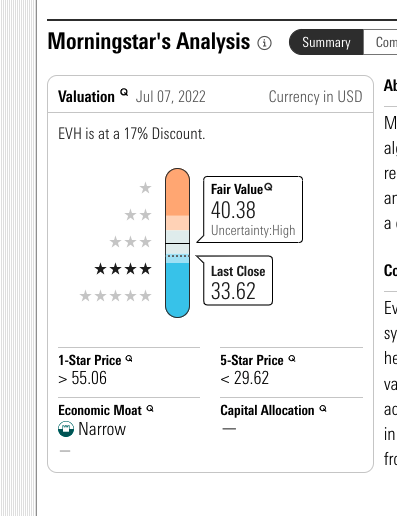

Morning Star Rating :

I ran the Stock in Morning Star and the Fair value evaluation came abovethe current price. Good Sign

IBD Rating :

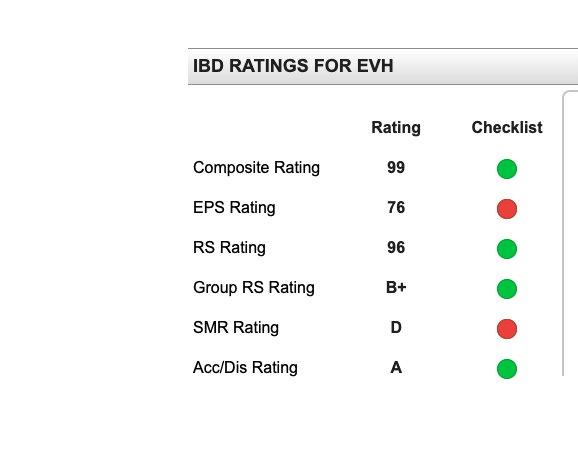

I ran the stock in IBD to check its Ratings. Currently, it is ranked Number one in that specific group. The composite rating is 99. Highly impressive.

EPS

EPS last quarter was 1300%. This is super impressive

Technical Analysis

Current chart :

My chart Analysis

A support zone ranges from $28.38

- A resistance zone ranges from $35.07. I will look to enter it when it breaks resistance.

My SL (Stop Loss) is around $ 28.38. I will maintain the Strict SL for most of my stocks. Especially Health care Stocks

As usual, my target is to get 10-15% profits on this swing. You can hold it if you want.

Analyst Rating :

Tip Ranks Rating :

I ran the stock on Tip ranks and the suggested pricing upside is around $50 with about 45 % upside.

Zacks Rating :

Zacks’s Rating currently has a Hold rating.

Disclosure: At the time of writing I do not have a position in EVH stock. I have plans to initiate new positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. I am not a financial adviser. Please do your own due diligence.