Car and AutoParts

–

Have you tried buying a car recently? I drive a Honda Insight hybrid 2015 model. It’s a great car for current circumstances but it does a small issue with Emission. The engine light comes off and on and I tried taking a quote for replacing the catalytic converter sometime 1 year ago. My cost for replacing it was about $ 2,400, and Labor is around 600. The total cost I paid for the car ( I purchased it from an old couple a few years back was around $6,000 USD). I thought it was not worth it to get it replaced.

I took a quote again a couple of weeks back,( I had to get a state inspection ). The cost now was $2700 and the labor is around $700.

When I asked the dealership about the increase in the cost. Here is the response I received “The car parts are hard to come by”, The cost has gone up and so it the labor.

Rightly so, The supply chain issues along with higher Oil costs have increased prices for most commodities. That gave me an idea to research companies that deal exclusively with Car parts and have good fundamentals because irrespective of what happens with the economy. People won’t stop driving their cars.

Quick update: I recently alerted tickers for SWN, CHK, and AMR, ( Reentry again). Most of them have generated an upside of about 4-7 %. Another one I alerted.STNG now sits on a 52-week high, I alerted it around Jun 2 when it was $34, Currently, it is at $37. I sold it early but still made profits الحمدلله. All these alerts were on a free private what’s app group. You can send an email to halalfinanceinvesting@gmail.com to get added to this group.

Back to Car Parts :

Here is the company I found.

PRTS – Car Parts

CarParts.com Inc is an online provider of automotive aftermarket parts and repair information. The company principally sells its products to individual consumers through its network of websites and online marketplaces. The company’s products consist of collision parts serving the body repair market, engine parts to serve the replacement parts market, and performance parts and accessories.

So why are we bullish on PRTS?

-

PRTS is currently trading at 0.68 times its sales. In other words, investors need to pay only 68 cents for each dollar of sales.

-

PRTS appears to have plenty of room to run, and that too at a fast pace and it is a high momentum stock.

- PRTS has a Momentum Score of B on Zack which indicates that this is the right time to enter the stock to take advantage of the momentum with the highest probability of success.

Fundamental Analysis

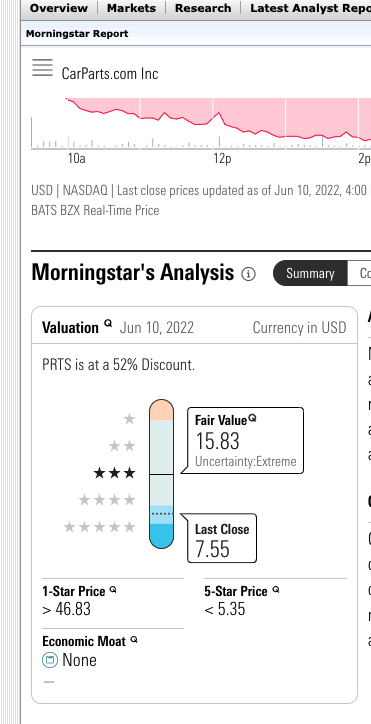

Morning Star Rating :

I ran the Stock in Morning Star and the Fair value evaluation came above the current price.Good Sign

IBD Rating :

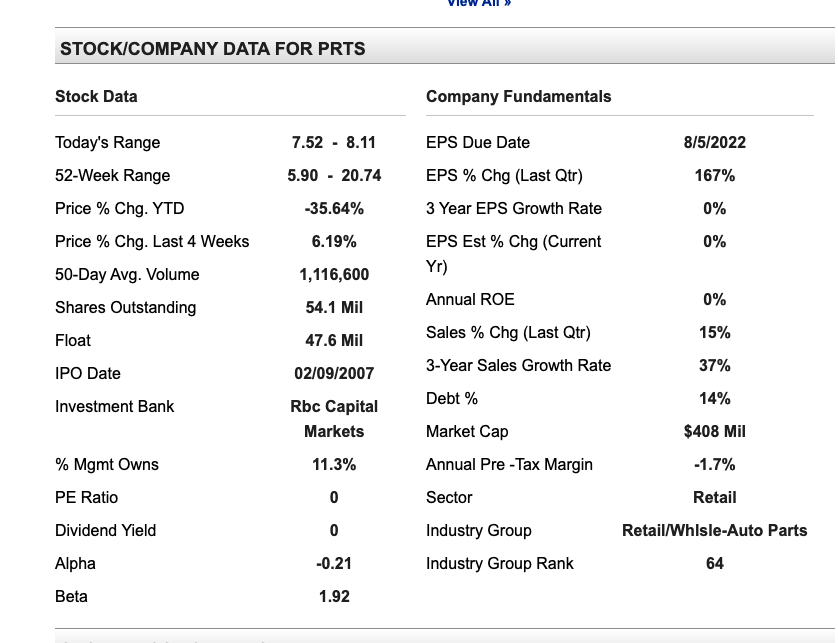

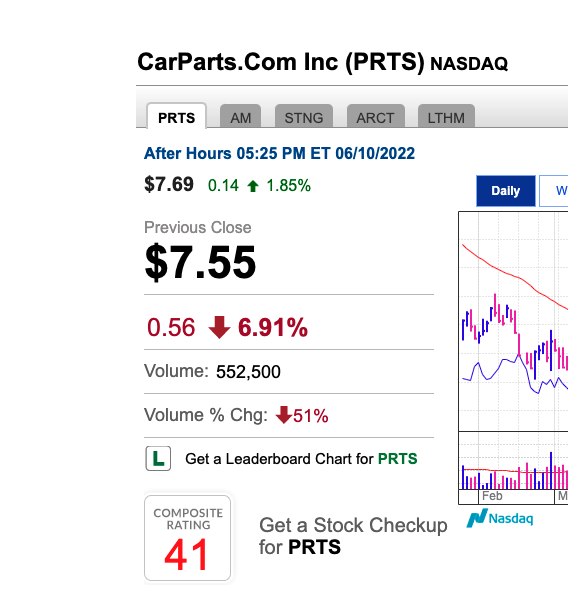

I ran the stock in IBD to check its Ratings. PRTS has no ranking. And the Ranking is around 41. As part of my rule, I try to avoid anything that has less than 81 composite ranking in IBD. I am making an exception for this stock based on the industry and sector.

EPS

EPS last quarter was 167%. Which is highly impressive.

Technical Analysis

Current chart :

My chart Analysis

I did a quick One Day chart analysis.

A support zone ranges from $ 6.46

- A resistance zone ranges from $8.42 to $ 8.99. This zone is formed by a combination of multiple trend lines in the daily time frame.

My SL (Stop Loss) is around $ 6.40. I will maintain the Strict SL for most of my stocks.

As usual, my target is to get 10-15% profits on this swing. I will sell it when it hits between 9-11 depending upon how they hold the Moving averages. You can hold it if you want.

Analyst Rating :

Tip Ranks Rating :

I ran the stock on Tip ranks and the suggested pricing upside is around $13.50 with about 78 % upside.

Zacks Rating :

Zacks’s Rating currently has a Strong Buy rating.

Disclosure: At the time of writing I do not have a position in PRTS stock. I have plans to initiate new positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. I am not a financial adviser. Please do your own due diligence.