B

io pharma is one industry that is constantly generating profits through new products. I know some traders who primarily trade for Biopharmaceutical companies. The return on investment for these stocks is immense. So is the downside. Any new news of FDA approvals will send the stock price to the moon. Any rejections, Lawsuits, or Phase 3 failures will send it right back to earth.

Just to give you an example I hold stocks of TNXP. The stock is trading currently at 0.19 cents. During its peak about 5 years ago this same stock was trading at USD 2800. Do you see the risk?

But today we are not going to be talking about such a risky company. Remember our goal is to make a consistent income by picking companies that are fundamentally strong and by looking at technical indicators to see if it is the right time to enter.

This company recently got approved for infertility treatment by FDA and is a key player in generic products for injectables and inhalers.

AMPH – Amphastar Pharmaceutcls

Amphastar Pharmaceuticals Inc is a biopharmaceutical company that focuses primarily on developing, manufacturing, marketing, and selling technically-challenging generic and proprietary injectable, inhalation, and intranasal products. Additionally, the company sells insulin API products. The company’s finished products are used in hospital or urgent care clinical settings and are contracted and distributed through group purchasing organizations and drug wholesalers. The company has two reportable segments finished pharmaceutical products and API products. Geographically the business presence of the firm is seen in the United States, China, and France of which the U.S. accounts for the majority of the revenue.

So why are we bullish on AMPH?

- Recently the Food and Drug Administration approved Amphastar’s shot called Ganirelix Acetate Injection which helps control the timing of ovulation in women undergoing infertility treatment.

- Based on research branded and generic versions of the infertility drug generate a collective $89 million in sales.

- Amphastar focuses on generic products so their products are less expensive than their competitors Ex: Organon’s treatment.

- The FDA is currently reviewing four of its applications for generic drugs one of them is for Diabetes treatment. Roughly if those four applications all get approved the drugs will have a market size of $3.9 Billion.

Note: Biotech Stocks are risky. So I would hold on to these stocks for at least a few years. I maintain strict stop losses on these too.

Fundamental Analysis

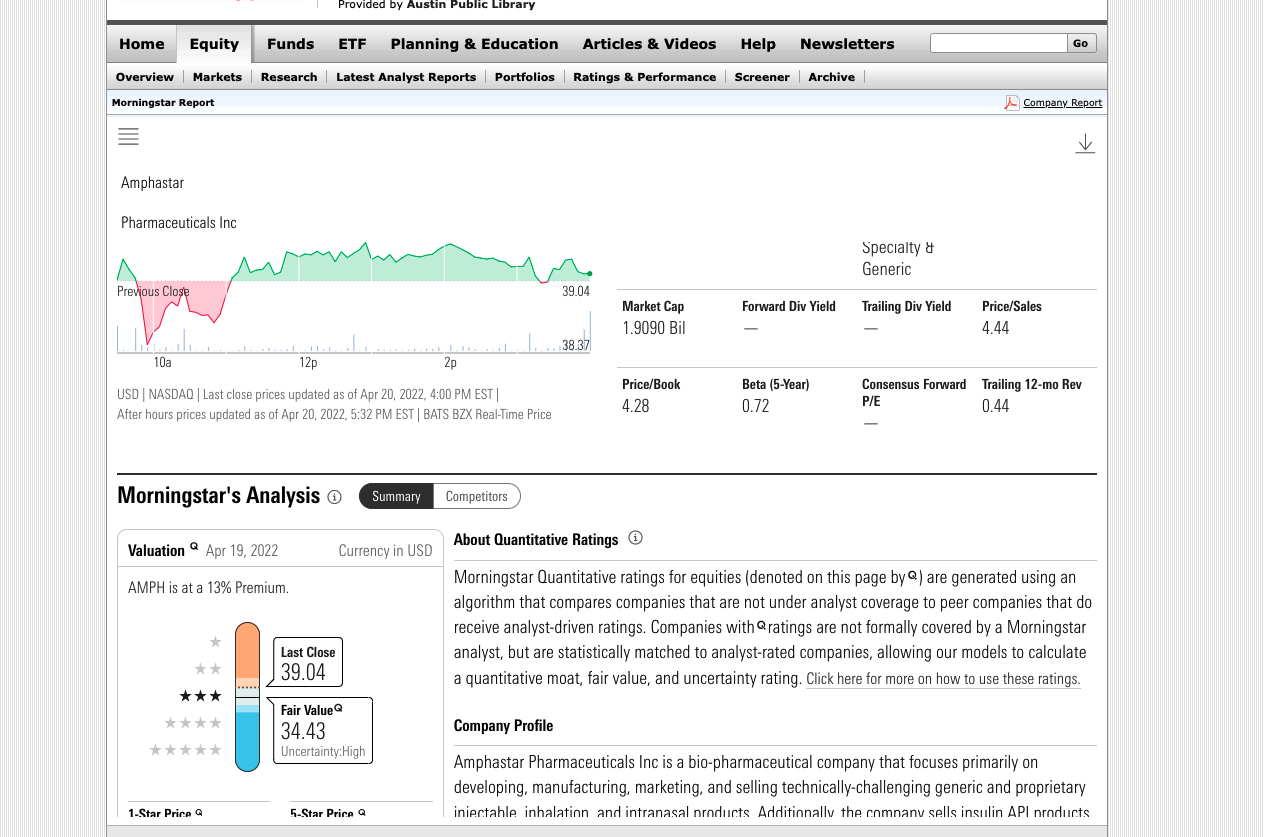

Morning Star Rating :

I ran the Stock in Morning Star, The Fair value evaluation came up lesser than the current price.

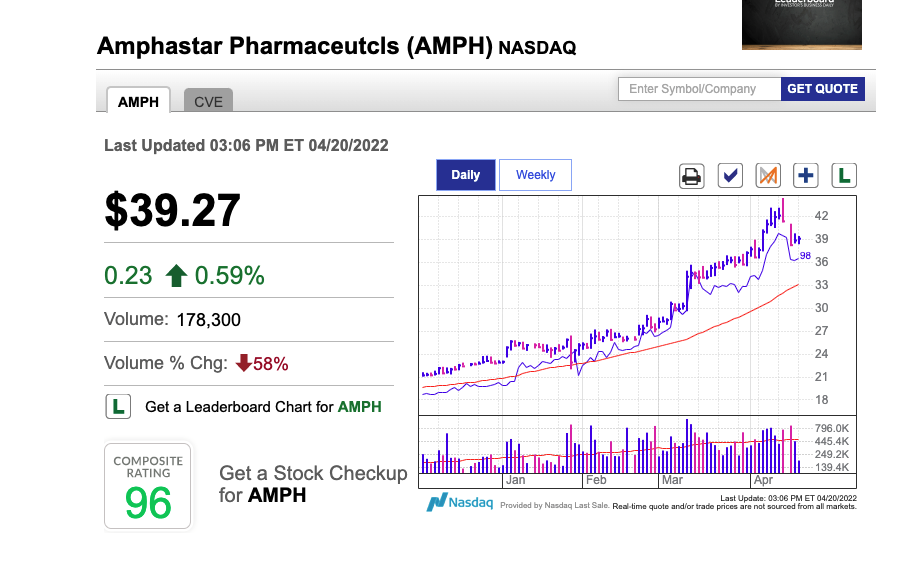

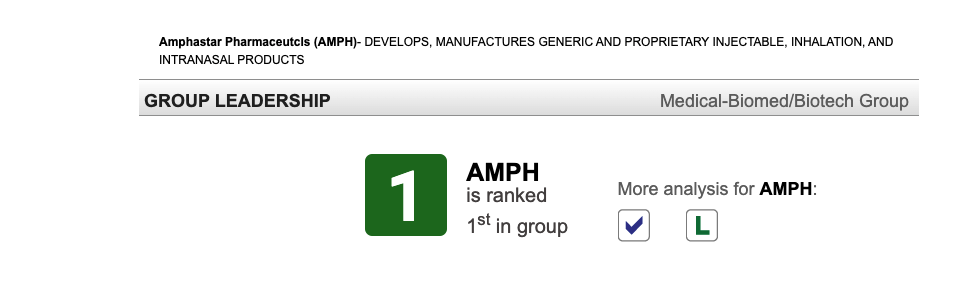

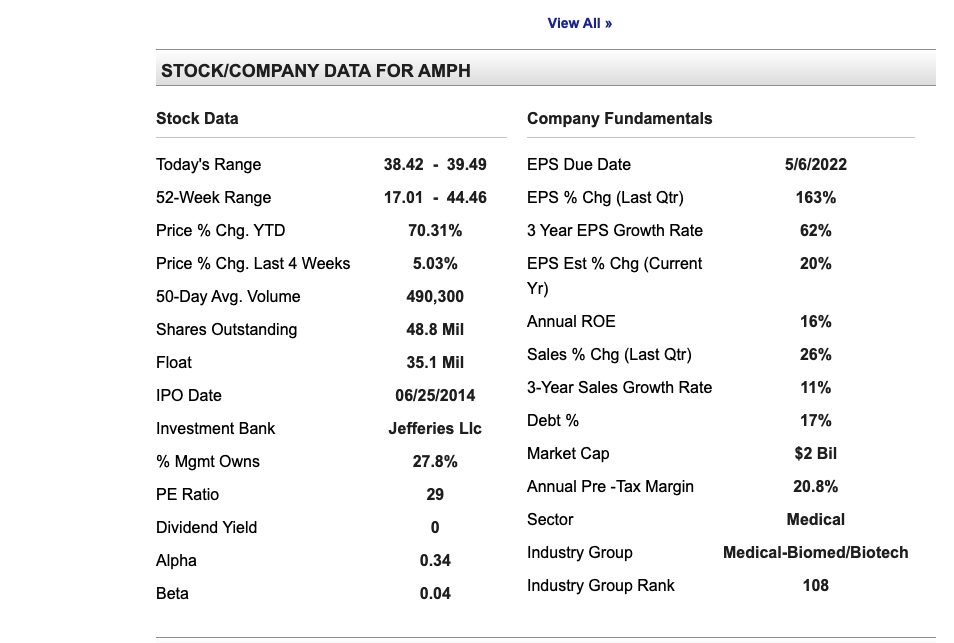

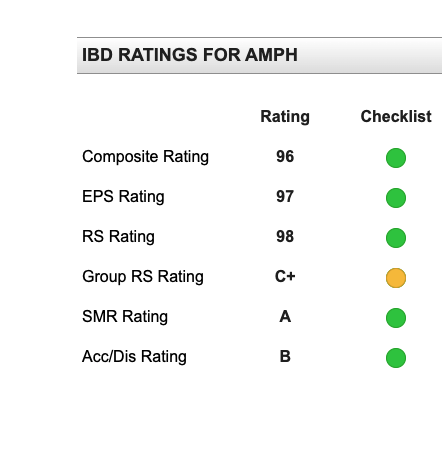

IBD Rating :

I ran the stock in IBD to check its Ratings. Currently, the stock is ranked number 1 in that specific industry group Check the Chart below. The composite rating is around 96 which is highly impressive and the EPS change last quarter was 163 %.

Technical Analysis

I did a quick One Day chart analysis.

- Support @27.79 from a trend line in the daily time frame.

- Resistance is @44.55 from a trend line in the daily time frame.

- My stop Loss is will be @27.71

You can play this stock when it breaks resistance and bounces back.

Note: They have Earnings in May and we expect it to consolidate until then.

I will be looking to ride the stock for at least 10-15 % profits. And I might sell after that. But feel free to hold on to it

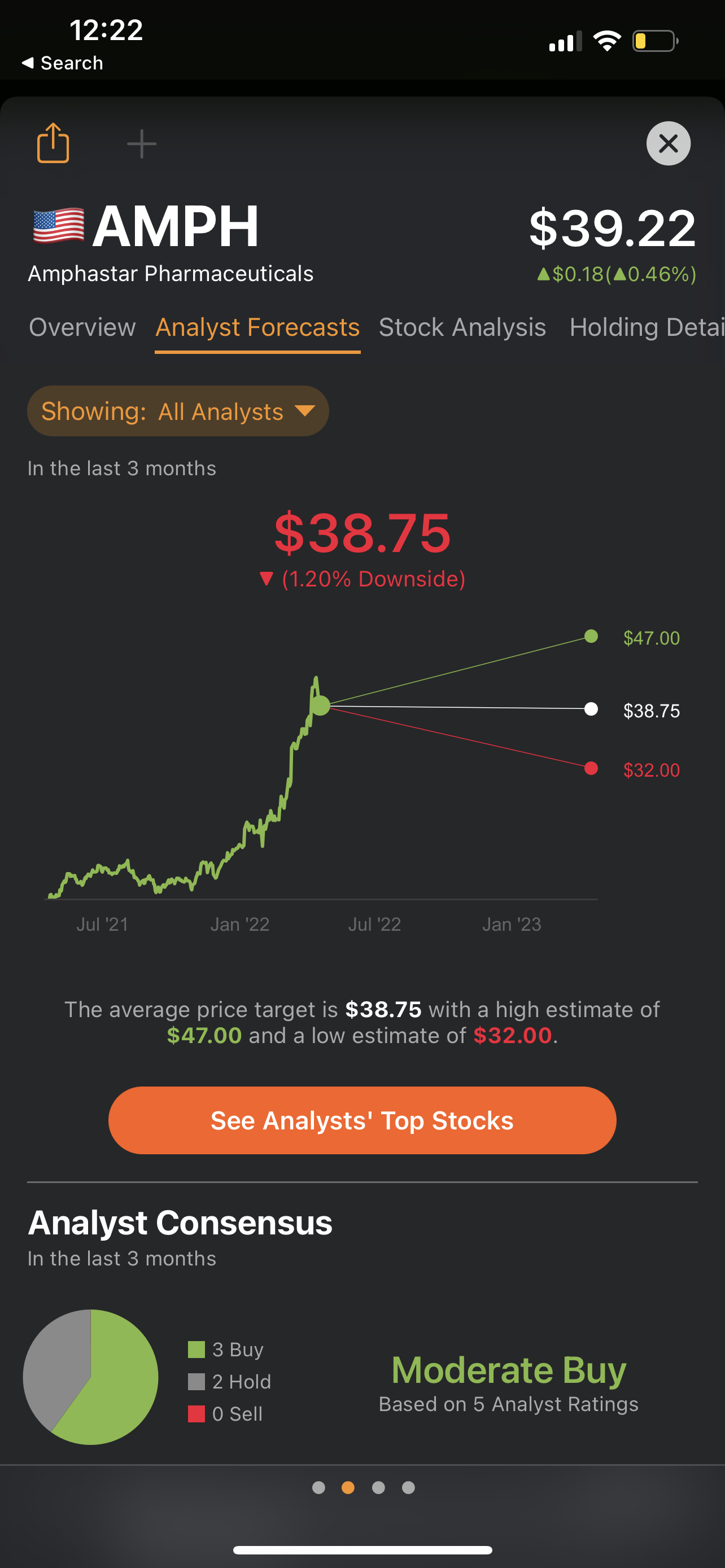

Analyst Rating :

Tip rank Rating :

I ran the stock on Tip RANKS. And the suggested pricing upside is around $47.0 with the low of $32.00

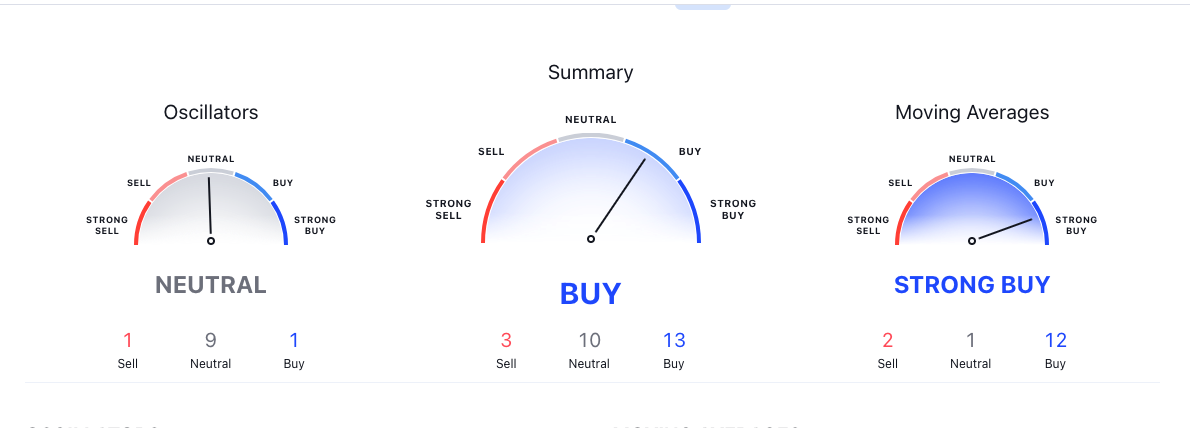

Zacks Rating :

Zacks Rating :

Zacks’s Rating currently has a Hold rating.

Disclosure: At the time of writing I still do not hold a position in AMPH stock. I have no plans to initiate any new positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. I am not a financial adviser. Please do your own due diligence.