O il and gas Sector is Hot. Russia could soon be forced to curtail crude oil production by 30%, subjecting the global economy to the biggest supply crisis in decades — that is, unless Saudi Arabia and other major energy exporters start pumping more.

The world’s second-largest crude oil exporter could be forced to limit output by 3 million barrels per day in April, the International Energy Agency warned on Wednesday, as major oil companies, trading houses, and shipping companies shun its exports and demand in Russia slumps.

Russia was pumping about 10 million barrels of crude per day, and exporting about half of that before it invaded Ukraine.

“The implications of a potential loss of Russian oil exports to global markets cannot be understated,” the IEA said in its monthly report.

And here is a good Stock to enter.

Matador Resources Company, MTDR an independent energy company, engages in the exploration, development, production, and acquisition of oil and natural gas resources in the United States. It operates through two segments, Exploration and Production; and Midstream. The company primarily holds interests in the Wolfcamp and Bone Spring plays in the Delaware Basin in Southeast New Mexico and West Texas. It also operates the Eagle Ford shale play in South Texas, and the Haynesville shale and Cotton Valley plays in Northwest Louisiana. In addition, the company conducts midstream operations in support of its exploration, development, and production operations; provides natural gas processing and oil transportation services; and offers oil, natural gas, and produced water gathering services, as well as produced water disposal services to third parties. As of December 31, 2021, its estimated total proved oil and natural gas reserves were 323.4 million barrels of oil equivalent, including 181.3 million stock tank barrels of oil and 852.5 billion cubic feet of natural gas. The company was formerly known as Matador Holdco, Inc. and changed its name to Matador Resources Company in August 2011. Matador Resources Company was founded in 2003 and is headquartered in Dallas, Texas.

Courtesy of Yahoo Finance.

Fundamental Analysis

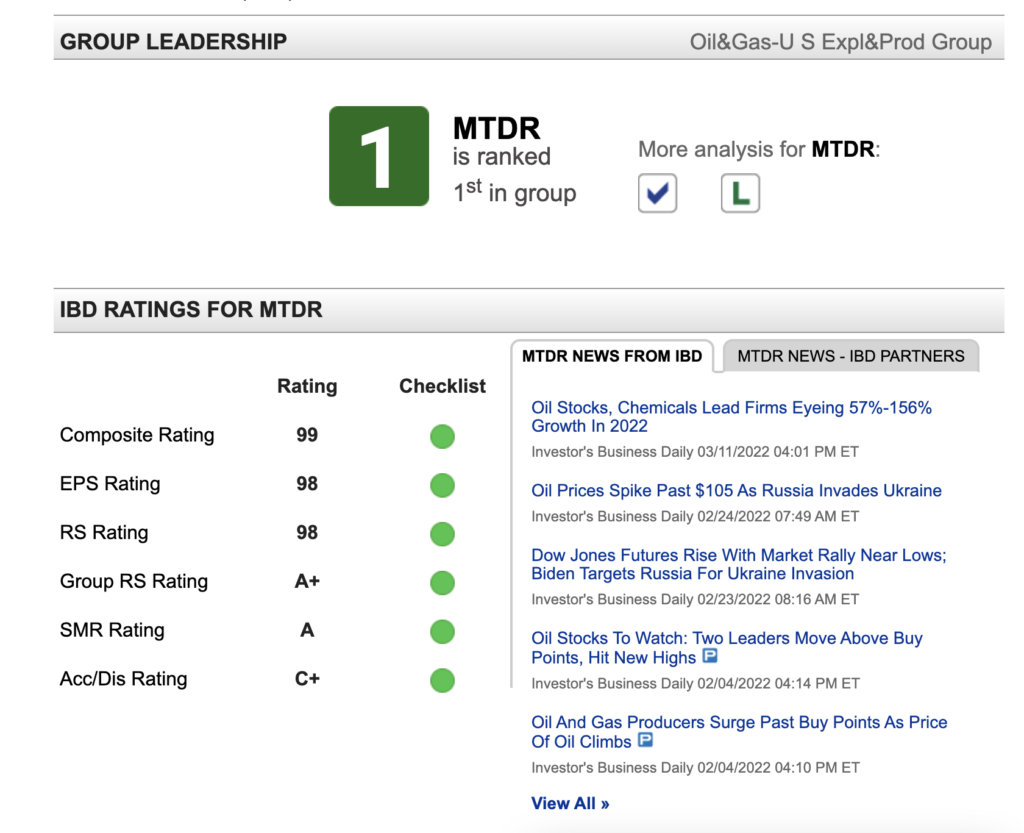

I ran the stock in IBD to check its Ratings. Currently, the stock is ranked number 1 on the Premium List. Check the Chart below.

Technical Analysis

Technical Analysis

My chart

Weekly chart the Resistance is at $ 57.11. I would wait for the resistance to break and volume to come in to enter the position.

Daily Chart :

The one-day chart of MTDR Currently has the Support Line is at 45.91 and the resistance is at $ 57.50. I am adding a small portion once it breaks resistance.The RSI is at 66.10 which says that is not as over bought. Anything above 70. I would wait for it to come down before I enter.

I normally take a 20 % profit on most of my stocks. Do your own research for entries and exits and manage your Risk to reward ratio.

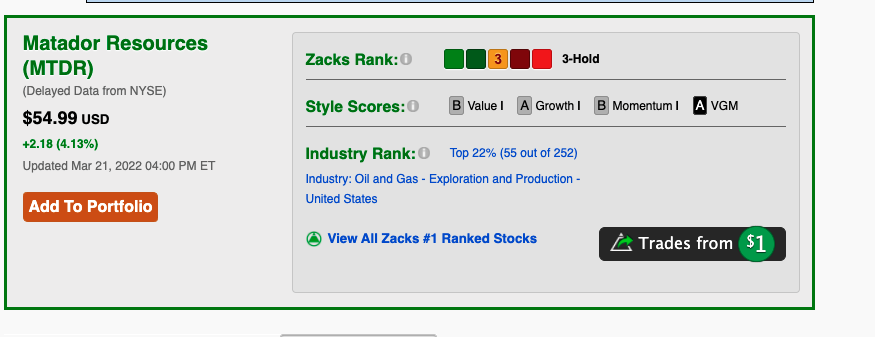

Analyst Rating :

I ran the stock on Tip RANKS. And the suggested pricing upside is around $78 But I am expecting it to reach at least $40 in a few weeks once consolidation happens.

MTDR also has a Hold rating in Zacks currently

Disclaimer: I am not a financial advisor. Do not take anything on my website as financial advice, ever. Do your own research. Consult a professional investment advisor before making any investment decisions!