S emiconductors are an essential component of electronic devices, enabling advances in communications, computing, healthcare, military systems, transportation, clean energy, and countless other applications.

From Driving your latest car to your refrigerator, Health care to Transportation everybody needs them. I thought I will discuss a great opportunity to enter a stock that is about to explode in the next year or so.

Alpha and Omega Semiconductor Limited designs develop and supply power semiconductor products for computing, consumer electronics, communication, and industrial applications in Hong Kong, China, South Korea, the United States, and internationally. It offers power discrete products, including metal-oxide-semiconductor field-effect transistors (MOSFET), SRFETs, XSFET, electrostatic discharge, protected MOSFETs, high and mid-voltage MOSFETs, and insulated gate bipolar transistors for use in smartphone chargers, battery packs, notebooks, desktop and servers, data centers, base stations, graphics card, game boxes, TVs, AC adapters, power supplies, motor control, power tools, e-vehicles, white goods and industrial motor drives, UPS systems, solar inverters, and industrial welding. The company also provides power ICs that deliver power, as well as control and regulate the power management variables, such as the flow of current and level of voltage. Its power ICs are used in flat panel displays, TVs, Notebooks, graphic cards, servers, DVD/Blu-Ray players, set-top boxes, and networking equipment. In addition, the company offers aMOS5 MOSFET for quick chargers, adapters, PC power, server, industrial power, telecom, and datacenter applications; and Transient Voltage Suppressors for laptops, televisions, and other electronic devices. Further, it provides EZBuck regulators; SOA MOSFET for hot-swap applications; RigidCSP for battery management; and Type-C power delivery protection switches. The company was incorporated in 2000 and is headquartered in Sunnyvale, California.

Courtesy of Yahoo Finance.

Semiconductor sales are here to stay and will this industry will see higher growths in the coming future.

Why we are buying AOSL?

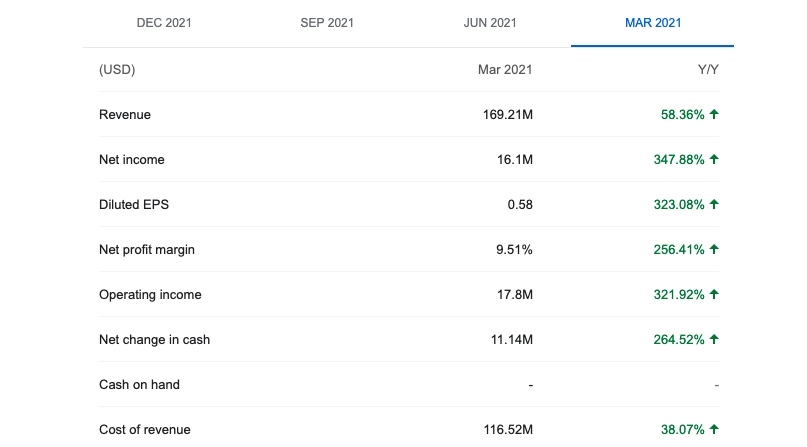

- The recent Earnings report gave us some insights into where it is headed.

- They have made significant investments to expand their capacity and further enhance our R&D capabilities at the Oregon facility.

- The semiconductor industry will likely continue to grow in 2022.

Analysis :

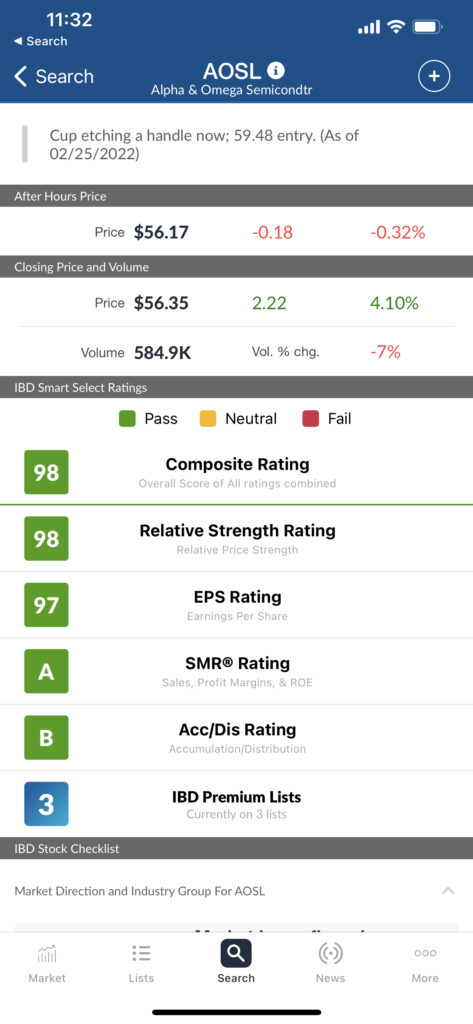

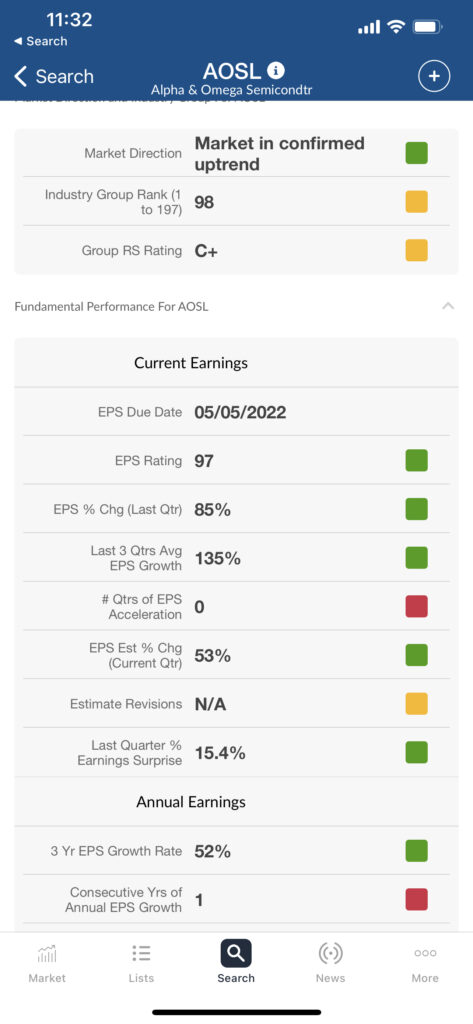

I ran the stock in IBD to check its Ratings. Currently, the stock is ranked number 3 in the Premium List. And the EPS has just grown year after year and I do not foresee it going down IMHO.

Technical Analysis

My chart

Currently, the Support is at $ 46.25 in the daily chart and the resistance is at $ 59.38

I was looking at the one-day chart of AOSL and currently, the Support Line is at 46.25 and the resistance is at $ 59.38. I am adding a small portion once it breaks resistance. ( Note: At the time of writing this article I already hold a portion of my portfolio )

I was looking at the one-day chart of AOSL and currently, the Support Line is at 46.25 and the resistance is at $ 59.38. I am adding a small portion once it breaks resistance. ( Note: At the time of writing this article I already hold a portion of my portfolio )

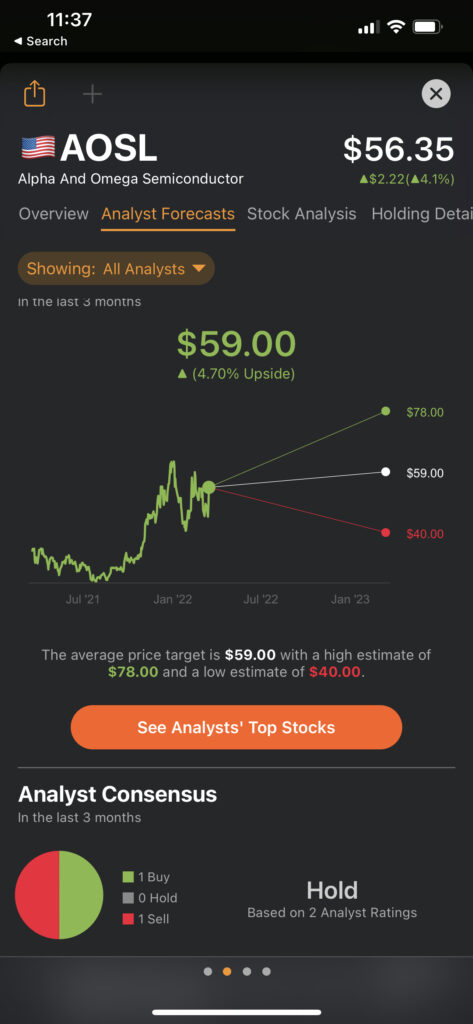

Analyst rating:

I ran the stock on Tip RANKS. And the suggested pricing upside is around $78 But I am expecting it to reach at least $40 in a few weeks once consolidation happens.

AOSL also has a Buy rating in Zacks

Disclaimer: I am not a financial advisor. Do not take any article on my website as financial advice, ever. Do your own research. Consult a professional investment advisor before making any investment decisions!